COST ACCOUNTING

16th Edition

ISBN: 9781323694008

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 7.32E

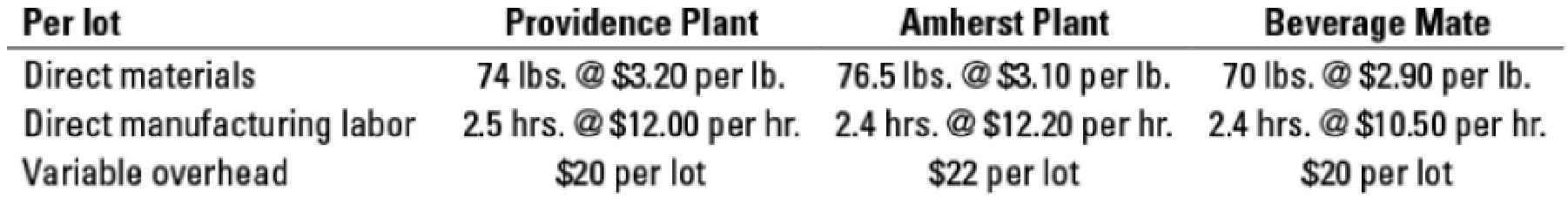

Price and efficiency variances, benchmarking. Nantucket Enterprises manufactures insulated cold beverage cups printed with college and corporate logos, which it distributes nationally in lots of 12 dozen cups. In June 2017, Nantucket produced 5,000 lots of its most popular line of cups, the 24-ounce lidded tumbler, at each of its two plants, which are located in Providence and Amherst. The production manager, Shannon Bryant, asks her assistant, Joel Hudson, to find out the precise per-unit budgeted variable costs at the two plants and the variable costs of a competitor, Beverage Mate, who offers similar-quality tumblers at cheaper prices. Hudson pulls together the following information for each lot:

- 1. What is the budgeted variable cost per lot at the Providence Plant, the Amherst Plant, and at Beverage Mate?

Required

- 2. Using the Beverage Mate data as the standard, calculate the direct materials and direct manufacturing labor price and efficiency variances for the Providence and Amherst plants.

- 3. What advantage does Nantucket get by using Beverage Mate’s benchmark data as standards in calculating its variances? Identify two issues that Bryant should keep in mind in using the Beverage Mate data as the standards.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Alpha Corporation applies overhead costs to jobs on the basis of direct labor costs. Job O, which was started and completed during the current period, shows charges of $6,850 for direct materials, $10,300 for direct labor, and $6,710 for overhead on its job cost sheet. Job O, which is still in process at year-end, shows charges of $3,500 for direct materials and $5,800 for direct labor. a. Should any overhead cost be applied to Job O at year-end? b. How much overhead cost should be applied to Job O? Correct Answer

Factory overhead was budgeted at 140000?

Need both general account answer

Chapter 7 Solutions

COST ACCOUNTING

Ch. 7 - What is the relationship between management by...Ch. 7 - What are two possible sources of information a...Ch. 7 - Distinguish between a favorable variance and an...Ch. 7 - What is the key difference between a static budget...Ch. 7 - Why might managers find a flexible-budget analysis...Ch. 7 - Describe the steps in developing a flexible...Ch. 7 - List four reasons for using standard costs.Ch. 7 - How might a manager gain insight into the causes...Ch. 7 - List three causes of a favorable direct materials...Ch. 7 - Describe three reasons for an unfavorable direct...

Ch. 7 - How does variance analysis help in continuous...Ch. 7 - Why might an analyst examining variances in the...Ch. 7 - Prob. 7.13QCh. 7 - When inputs are substitutable, how can the direct...Ch. 7 - Benchmarking against other companies enables a...Ch. 7 - Metal Shelf Companys standard cost for raw...Ch. 7 - All of the following statements regarding...Ch. 7 - Amalgamated Manipulation Manufacturings (AMM)...Ch. 7 - Atlantic Company has a manufacturing facility in...Ch. 7 - Basix Inc. calculates direct manufacturing labor...Ch. 7 - Flexible budget. Sweeney Enterprises manufactures...Ch. 7 - Flexible budget. Bryant Companys budgeted prices...Ch. 7 - Flexible-budget preparation and analysis. Bank...Ch. 7 - Flexible budget, working backward. The Clarkson...Ch. 7 - Flexible-budget and sales volume variances....Ch. 7 - Price and efficiency variances. Sunshine Foods...Ch. 7 - Materials and manufacturing labor variances....Ch. 7 - Direct materials and direct manufacturing labor...Ch. 7 - Price and efficiency variances, journal entries....Ch. 7 - Materials and manufacturing labor variances,...Ch. 7 - Journal entries and T-accounts (continuation of...Ch. 7 - Price and efficiency variances, benchmarking....Ch. 7 - Static and flexible budgets, service sector....Ch. 7 - Flexible budget, direct materials, and direct...Ch. 7 - Variance analysis, nonmanufacturing setting. Joyce...Ch. 7 - Comprehensive variance analysis review. Ellis...Ch. 7 - Possible causes for price and efficiency...Ch. 7 - Material-cost variances, use of variances for...Ch. 7 - Direct manufacturing labor and direct materials...Ch. 7 - Direct materials efficiency, mix, and yield...Ch. 7 - Direct materials and manufacturing labor...Ch. 7 - Direct materials and manufacturing labor...Ch. 7 - Use of materials and manufacturing labor variances...Ch. 7 - Direct manufacturing labor variances: price,...Ch. 7 - Direct-cost and selling price variances. MicroDisk...Ch. 7 - Variances in the service sector. Derek Wilson...Ch. 7 - Prob. 7.47P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide accountingarrow_forwardWhat is the total asset turnover rate for these financial accounting question?arrow_forwardThe ending inventory of Sienna Traders Ltd. is $52,000. If the beginning inventory was $78,000 and goods available for sale totaled $130,000, what is the cost of goods sold?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license