Evaluating the Income Statement and Income Tax Effects of Lower of Cost or Market

Smart Company prepared its annual financial statements dated December 31. The company used the FIFO inventory costing method, but it failed to apply LCM to the ending inventory. The preliminary income statement follows:

| Sales Revenue | $280,000 | |

| Cost of Goods Sold | ||

| Beginning Inventory | $30,000 | |

| Purchases | 182,000 | |

| Goods Available for Sale | 212,000 | |

| Ending Inventory (FIFO cost) | 44,000 | |

| Cost of Goods Sold | 168,000 | |

| Gross Profit | 112,000 | |

| Operating Expenses | 61,000 | |

| Income from Operations | 51,000 | |

| Income Tax Expense (30%) | 15,300 | |

| Net Income | $35,700 |

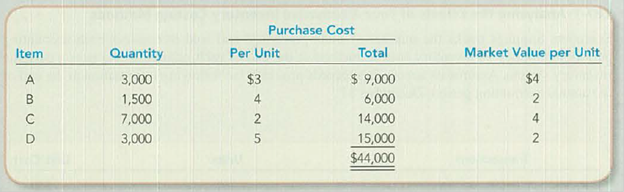

Assume that you have been asked to restate the financial statements to incorporate LCM. You have developed the following data relating to the ending inventory:

TIP: Inventory write-downs do not affect the cost of goods available for sale. Instead, the effect of the write-down is to reduce ending inventory, which increases Cost of Goods Sold and then affects other amounts reported lower in the income statement.

Required:

- 1. Restate the income statement to reflect LCM valuation of the ending inventory. Apply LCM on an item-by-item basis and show computations.

- 2. Compare and explain the LCM effect on each amount that was changed in requirement 1.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Fundamentals of Financial Accounting

- Noble Electronics reported annual sales revenue of $3,150,000. During the year, accounts receivable increased from a $65,000 beginning balance to a $85,000 ending balance. Accounts payable decreased from a $70,000 beginning balance to a $50,000 ending balance. How much is cash received from customers for the year? A. $3,130,000 B. $3,135,000 C. $3,165,000 D. $3,100,000arrow_forwardAt the end of Everest Manufacturing Ltd's first year of operations... Please answer the general accounting questionarrow_forwardAccurate answerarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,