Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7.1DC

Reading 3M Company’s

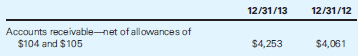

The following current asset appears on the balance sheet in 3M Company’s Form 10-K for the year ended December 31, 2013 (amounts in millions of dollars):

Required

- What is the balance in 3M Company’s Allowance for Doubtful Accounts at the end of 2013 and 2012?

- What is the net realizable value of 3M Company’s accounts receivable at the end of each of these two years?

- What caused increases in the allowance account during 2013? What caused decreases? Explain what a net decrease in the account for the year means.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Find the rate of return on this investment for donne

Ingram Enterprises has variable expenses equal to 65% of sales. At a $500,000 sales level, the degree of operating leverage is 4.5. If sales increase by $50,000, what will be the new degree of operating leverage? Need answer

General Accounting question

Chapter 7 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 7 - Allowance Method of Accounting for Bad...Ch. 7 - Notes Receivable On September 1, 2016, Dougherty...Ch. 7 - Prob. 7.19ECh. 7 - Prob. 7.19MCECh. 7 - Allowance Method for Accounting for Bad Debts At...Ch. 7 - Allowance Method for Accounting for Bad Debts At...Ch. 7 - Reading 3M Companys Balance Sheet: Accounts...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License