Allocate payments and receipts to fixed asset accounts

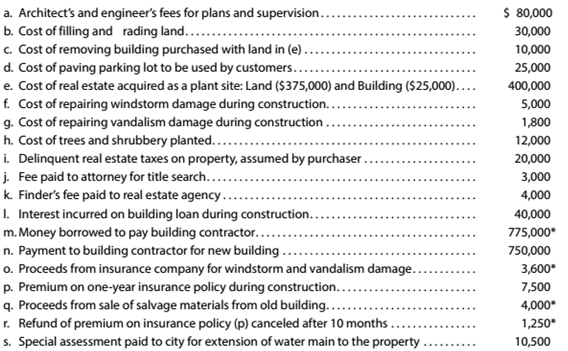

The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale apparel business. The receipts are identified by an asterisk.

Instructions

Determine the increases to Land, Lind Improvements. and Building.

Concept Introduction:

Capital Expenditures are that type of expenses which a company incurs on its tangible or fixed assets in regard to either its purchase or for its repairs or installation. These assets are those which are used for more than one year i.e. which are not held for sale. These expenditures are like purchase of land, building, equipment, repairs or improvement in the building or machinery, etc. These expenses are meant for capitalization in the balance sheet in the respective fixed assets.

The net increase in the value of land, land improvement, and building

Answer to Problem 7.1.2P

The increase in the value of land, land improvement, and building is

Explanation of Solution

| Transaction no. | Transaction | Land | Land improvements | Buildings | Other accounts |

| a. | Architect and engineer fees | | |||

| b. | Cost of filing and grading land | | |||

| c. | Cost of removing the building | | |||

| d. | Cost of paving parking lot | | |||

| e. | Cost of real estate acquired as plant site | | |||

| f. | Cost of repairing windstorm damage | | |||

| g. | Cost of repairing vandalism damage | | |||

| h. | Cost of trees and shrubbery | | |||

| i. | Delinquent real estate taxes on property | | |||

| j. | Fee paid to attorney for title | | |||

| k. | Finder's fee paid to real estate agency | | |||

| l. | Interest incurred on building loan | | |||

| m. | Money borrowed to pay building contractor | | |||

| n. | Payment to contractor for new building | | |||

| o. | Proceeds from insurance windstorm and vandalism | | |||

| p. | Premium on one-year insurance policy | | |||

| q. | Proceeds from sale of salvage materials | | |||

| r. | Refund of premium on insurance policy in | | |||

| s. | Special assessment paid to city for extension of water | | |||

| Total | | | | |

As per the assignment transactions, the net increase in the values of land, land improvement, and building are:

| Transaction no. | Transaction | Land | Land improvements | Buildings | Other accounts |

| Total | | | | |

Want to see more full solutions like this?

Chapter 7 Solutions

Survey of Accounting (Accounting I)

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning