Fundamental Accounting Principles -Hardcover

22nd Edition

ISBN: 9780077862275

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 5QS

Controlling accounts and subsidiary ledgers

C3

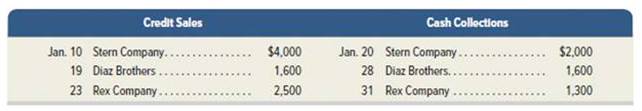

Following is information from Fredrickson Company for its initial month of business.

1. Identify the balances listed in the

2. Identify the Accounts Receivable balance listed in the general ledger at month’s end.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Do fast answer of this accounting questions

answer plz

If the net sales

Chapter 7 Solutions

Fundamental Accounting Principles -Hardcover

Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - What are the five fundamental principles of...Ch. 7 - Prob. 4DQCh. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 11DQCh. 7 - Prob. 12DQCh. 7 - APPLE Locate “Note 11" that reports Apple’s...Ch. 7 - Prob. 14DQCh. 7 - Prob. 15DQCh. 7 - Prob. 1QSCh. 7 - Prob. 2QSCh. 7 - Prob. 3QSCh. 7 - Prob. 4QSCh. 7 - Controlling accounts and subsidiary ledgers C3...Ch. 7 - Prob. 6QSCh. 7 - Prob. 7QSCh. 7 - OS 7-8

Accounts receivable ledger posting from...Ch. 7 - Prob. 9QSCh. 7 - Prob. 10QSCh. 7 - Prob. 1ECh. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Prob. 6ECh. 7 - Prob. 7ECh. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Prob. 1APSACh. 7 - Prob. 2APSACh. 7 - Problem 7-3A

Special journals, subsidiary ledgers,...Ch. 7 - Prob. 1BPSBCh. 7 - Prob. 2BPSBCh. 7 - Problem 7-3B

Special journals, subsidiary ledgers,...Ch. 7 - Prob. 1SPCh. 7 - Prob. 1CPCh. 7 - Prob. 1GLPCh. 7 - Prob. 1BTNCh. 7 - Prob. 2BTNCh. 7 - Prob. 3BTNCh. 7 - Prob. 4BTNCh. 7 - Prob. 5BTNCh. 7 - Prob. 6BTNCh. 7 - Prob. 7BTNCh. 7 - Prob. 8BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- financial accountingarrow_forwardNeed true option general Accountingarrow_forwardPam Pet Foods Co. reported net income of $52,000 for the year ended December 31, 2005. January 1 balances in accounts receivable and accounts payable were $30,000 and $28,000, respectively. Year-end balances in these accounts were $27,000 and $31,000, respectively. Assuming that all relevant information has been presented, Pam's cash flows from operating activities would be__.need helparrow_forward

- The following information relates to Westline Traders for a trading year. Calculate the overhead expenses as a percentage of the net sales. Details Sales Purchases Sales Returns Purchases Returns Amount $625,000 $410,000 $25,000 $30,000 Opening Stock Value $50,000 Closing Stock Value $55,000 Overhead Expenses $205,000arrow_forwardNeed help with this financial accounting question please answerarrow_forwardAnswerarrow_forward

- expert of general account answerarrow_forwardPam Pet Foods Co. reported net income of $52,000 for the year ended December 31, 2005. January 1 balances in accounts receivable and accounts payable were $30,000 and $28,000, respectively. Year-end balances in these accounts were $27,000 and $31,000, respectively. Assuming that all relevant information has been presented, Pam's cash flows from operating activities would be__.arrow_forwardcan you please solve thisarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License