Concept explainers

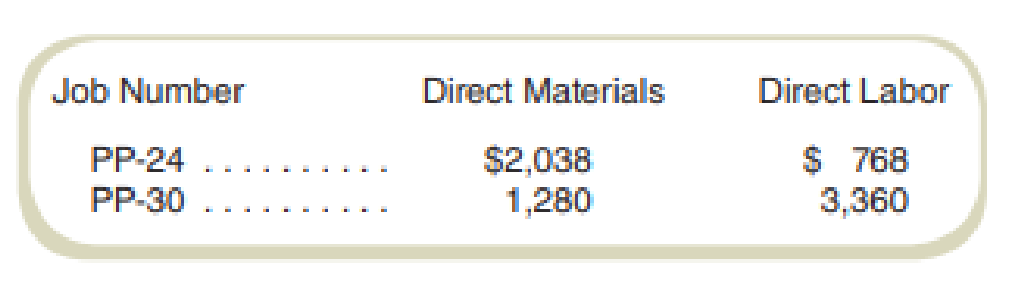

On September 1, two jobs were in process at Pete’s Patios. Details of the jobs follow:

Materials Inventory on September 1 totaled $11,040, and $1,392 worth of materials was purchased during the month. Indirect materials of $192 were withdrawn from materials inventory. On September 1, finished goods inventory consisted of two jobs, PP-12, costing $4,704, and PP-14, with a cost of $1,896. Costs for both jobs were transferred to Cost of Services Billed during the month.

Also during September, Jobs PP-24 and PP-30 were completed. Completing Job PP-24 required an additional $2,720 in direct labor. The completion costs for Job PP-30 included $1,296 in direct materials and $8,000 in direct labor.

Pete’s Patios used a total of $3,768 of direct materials (excluding the $192 indirect materials) during the period, and total direct labor costs during the month amounted to $16,320.

Required

Compute the costs of Jobs PP-24 and PP-30 and the balances in the September 30 inventory accounts.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Fundamentals Of Cost Accounting (6th Edition)

Additional Business Textbook Solutions

FUNDAMENTALS OF CORPORATE FINANCE

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Operations Management

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Foundations of Financial Management

- Please help with accountingarrow_forwardAccounting problem with solutionarrow_forwardHome Insert Draw Page Layout Formulas Data Review View Automate Developer Calibri (Body) 12 ✓ Α Αν Conditional Formatting ✓ ☑Insert v Σ Custom Paste B I U ✓ ✓ $ ✓ %9 0 .00 →0 Format as Table ✓ Cell Styles ▾ Delete ✓ Format ✓ C26 fx A B D E F G 1 Instruction: 2 1. Please complete the following budget plan using appropriate cell references format (the cells highlighted in grey) 3 2. Please use fill handler to complete the table. E.g. in cell C16, build one formula and generate other formulas to D16 and E16 with fill handler. 4 3. For "Cost of Goods Sold" section (before "COGS Subtotal"), build one formula in cell C19, and generate formulas until E21. Overhead (B21) is 20% (B10) of the labor cost (B20). 5 4. For "COGS Subtotal", build one formula in C22, and generate the formulas to E22. 6 5. Similar requirements for "Selling Expenses" and "Projected Earnings" section. 7 6. Please be noted, for all items under "Cost of Goods Sold", and "Selling Expenses" the cost is per ONE shoe, not per…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning