Aldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The division’s

Required:

- 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.)

- 2. The divisional manager has decided to increase the advertising budget by $250,000. This will increase sales revenues by $1 million. By how much will operating income increase or decrease as a result of this action?

- 3. Suppose sales revenues exceed the estimated amount on the income statement by $1,500,000. Without preparing a new income statement, by how much are profits underestimated?

- 4. Compute the margin of safety based on the original income statement.

- 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)

1.

Calculate contribution margin per unit, break-even point in units, contribution margin ratio and break-even sales revenue.

Answer to Problem 53P

Contribution margin per unit, break-even units, contribution margin ratio and break-even sales revenue are $30, 164,850 units, 0.4286 and $11,538,731 respectively.

Explanation of Solution

Contribution margin:

Contribution margin can be defined as the amount obtained after deducting the variable expense from sales revenue. It means the amount of sales left after covering the variable expenses.

Break-Even Point:

The point or situation where the amount of total cost is equivalent to total revenue is known as the break-even point. It is the point where there is no loss or no profit.

Contribution Margin Ratio:

The sales percentage remaining after covering the amount of total variable cost is known as the contribution margin ratio. It is the available sales dollar percentage which will be used to cover the total fixed cost.

Break-Even Sales Revenue:

Break-even sales revenue can be evaluated by dividing the total amount of fixed cost by the contribution margin ratio.

Use the following formula to calculate contribution margin:

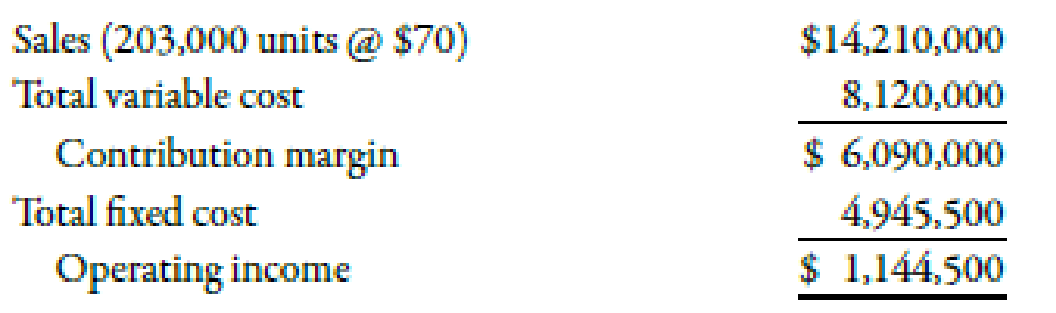

Substitute $6,090,000 for contribution margin and 203,000 for units sold in the above formula.

Therefore, the contribution margin per unit is $30.

Use the following formula to calculate break-even units:

Substitute $4,945,500 for total fixed cost and $30 for contribution margin per unit in the above formula.

Therefore, break-even units are 164,850 units.

Use the following formula to calculate contribution margin ratio:

Substitute $30 for contribution margin per unit and $70 for selling price per unit in the above formula.

Therefore, the contribution margin ratio is 0.4286.

Use the following formula to calculate break-even sales revenue:

Substitute $4,945,500 for the total fixed cost and 0.4286 for contribution margin ratio in the above formula.

Therefore, the break-even point in sales dollars is $11,538,731.

2.

Calculate the effect of increase of in advertising budget and sales revenues on the operating income.

Answer to Problem 53P

Operating income increases by $178,600.

Explanation of Solution

Use the following formula to calculate change in operating income:

Substitute $428,6001 for increase in contribution margin and $250,000 for increase in advertising expense in the above formula.

Therefore, the operating income increases by $178,600.

Working Note:

1. Calculation of change in contribution margin:

3.

Find out the amount of underestimated profit due to increase in estimated amount of sales.

Answer to Problem 53P

The profit is underestimated by $642,900.

Explanation of Solution

Use the following formula to calculate underestimated profit:

Substitute $1,500,000 for increase in sales and 0.4286 for contribution margin ratio in the above formula.

Therefore, the profit is underestimated by $642,900.

4.

Calculate margin of safety on the basis of original information.

Answer to Problem 53P

Margin of safety is $2,671,269.

Explanation of Solution

Margin of Safety:

The number of units sold or the income earned in excess of the break-even sales is known as margin of safety. It is calculated by deducting the break-even sales from the sales revenue.

Use the following formula to calculate the margin of safety:

Substitute $14,210,000 for sales and $11,538,731 for break-even sales revenue in the above formula.

Therefore, the margin of safety is $2,671,269.

5.

Calculate the degree of operating leverage on the basis of original information. Also calculate the percentage increase in operating income if there is increase of 8% in the expected sales revenues.

Answer to Problem 53P

Degree for operating leverage is 5.32 and percentage increase in operating income is 42.56%.

Explanation of Solution

Degree of Operating Leverage (DOL):

The degree of operating leverage can be evaluated by dividing the total contribution margin by the operating income of the company.

Use the following formula to calculate degree of operating leverage:

Substitute $6,090,000 for total contribution margin and $1,144,500 for operating income in the above formula.

Therefore, degree for operating leverage (DOL) is 5.32.

Use the following formula to calculate increase in operating income:

Substitute 0.08 for increase in sales and 5.32 for DOL in the above formula.

Therefore, the percentage increase in operating income is 42.56%.

Want to see more full solutions like this?

Chapter 7 Solutions

Managerial Accounting

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College