Concept explainers

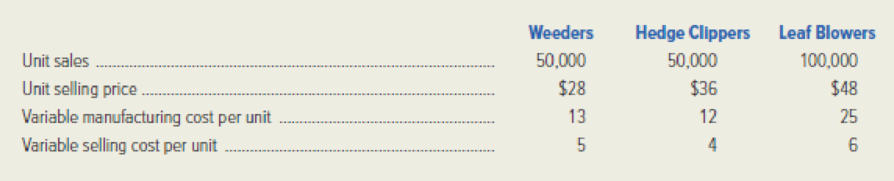

Cincinnati Tool Company (CTC) manufactures a line of electric garden tools that are sold in general hardware stores. The company’s controller, Will Fulton, has just received the sales

For 20x2, CTC’s fixed manufacturing

Required:

- 1. Determine CTC’s budgeted net income for 20x2.

- 2. Assuming the sales mix remains as budgeted, determine how many units of each product CTC must sell in order to break even in 20x2.

- 3. After preparing the original estimates, management determined that its variable

manufacturing cost of leaf blowers would increase by 20 percent, and the variable selling cost of hedge clippers could be expected to increase by $1.00 per unit. However, management has decided not to change the selling price of either product. In addition, management has learned that its leaf blower has been perceived as the best value on the market, and it can expect to sell three times as many leaf blowers as each of its other products. Under these circumstances, determine how many units of each product CTC would have to sell in order to break even in 20x2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Please give me true answer this financial accounting questionarrow_forwardEquipment was acquired at the beginning of the year at a cost of $957,500. The equipment was depreciated using the straight-line method based on an estimated useful life of 7 years and an estimated residual value of $46,400. What was the depreciation for the first year?arrow_forwardNew Corporation reported net sales of $4,500,000 for the year. The company’s beginning total assets were $1,900,000, and its asset turnover ratio was 3.0 times. Based on this information, what is the ending total asset balance? correct answerarrow_forward

- Lexington Corporation has the following transactions: $750,000 operating income; $580,000 operating expenses; $45,000 municipal bond interest; $120,000 long-term capital gain; and $85,000 short-term capital loss. Assume the same facts except that Lexington's long-term capital gain is $180,000 (instead of $120,000). Compute Lexington's taxable income for the year.arrow_forwardAnswer? ? General Accountingarrow_forwardAccounting 24arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning