Auditing and Assurance Services (16th Edition)

16th Edition

ISBN: 9780134065823

Author: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 35DQP

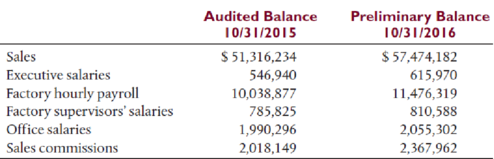

You are auditing payroll for the Morehead Technologies company for the year ended October 31, 2016. Included next are amounts from the client’s

You have obtained the following information to help you perform preliminary analytical procedures for the payroll account balances.

- 1. There has been a significant increase in the demand for Morehead’s products. The increase in sales was due to both an increase in the average selling price of four percent and an increase in units sold that resulted from the increased demand and an increased marketing effort.

- 2. Even though sales volume increased, there was no addition of executives, factory supervisors, or office personnel.

- 3. All employees including executives, but excluding commission salespeople, received a three percent salary increase starting November 1, 2015. Commission salespeople receive their increased compensation through the increase in sales.

- 4. The increased number of factory hourly employees was accomplished by recalling employees that had been laid off. They receive the same wage rate as existing employees. Morehead does not permit overtime.

- 5. Commission salespeople receive a five percent commission on all sales on which a commission is given. Approximately 75 percent of sales earn sales commission. The other 25 percent are “call-ins,” for which no commission is given. Commissions are paid in the month following the month they are earned.

Required

- a. Use the final balances for the prior year included above and the information in items 1 through 5 to develop an expected value for each account, except sales.

- b. Calculate the difference between your expectation and the client’s recorded amount as a percentage using the formula (expected value – recorded amount)/expected value.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial accounting question

answer plz

Provide accounting

Chapter 7 Solutions

Auditing and Assurance Services (16th Edition)

Ch. 7 - Prob. 1RQCh. 7 - Prob. 2RQCh. 7 - Prob. 3RQCh. 7 - Prob. 4RQCh. 7 - Prob. 5RQCh. 7 - Prob. 6RQCh. 7 - Prob. 7RQCh. 7 - Prob. 8RQCh. 7 - Prob. 9RQCh. 7 - Prob. 10RQ

Ch. 7 - Prob. 11RQCh. 7 - Prob. 12RQCh. 7 - Describe the liquidity activity ratios and explain...Ch. 7 - Prob. 14RQCh. 7 - Prob. 15RQCh. 7 - Prob. 16RQCh. 7 - Prob. 17RQCh. 7 - Prob. 18RQCh. 7 - Define what is meant by a tick mark. What is its...Ch. 7 - Prob. 20RQCh. 7 - Prob. 21.1MCQCh. 7 - Prob. 21.2MCQCh. 7 - Prob. 21.3MCQCh. 7 - Prob. 22.1MCQCh. 7 - Prob. 22.2MCQCh. 7 - Prob. 22.3MCQCh. 7 - Prob. 23.1MCQCh. 7 - Prob. 23.2MCQCh. 7 - Prob. 23.3MCQCh. 7 - Prob. 24.1MCQCh. 7 - Prob. 24.2MCQCh. 7 - Prob. 24.3MCQCh. 7 - Prob. 25DQPCh. 7 - Prob. 26DQPCh. 7 - Prob. 27DQPCh. 7 - Prob. 28DQPCh. 7 - Prob. 29DQPCh. 7 - Prob. 30DQPCh. 7 - Following are 10 audit procedures with words...Ch. 7 - Prob. 32DQPCh. 7 - Prob. 33DQPCh. 7 - Prob. 34DQPCh. 7 - You are auditing payroll for the Morehead...Ch. 7 - Prob. 36DQPCh. 7 - Prob. 38C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License