ACCOUNTING F/GOV.+NON...(LL)

18th Edition

ISBN: 9781266785580

Author: RECK

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 22EP

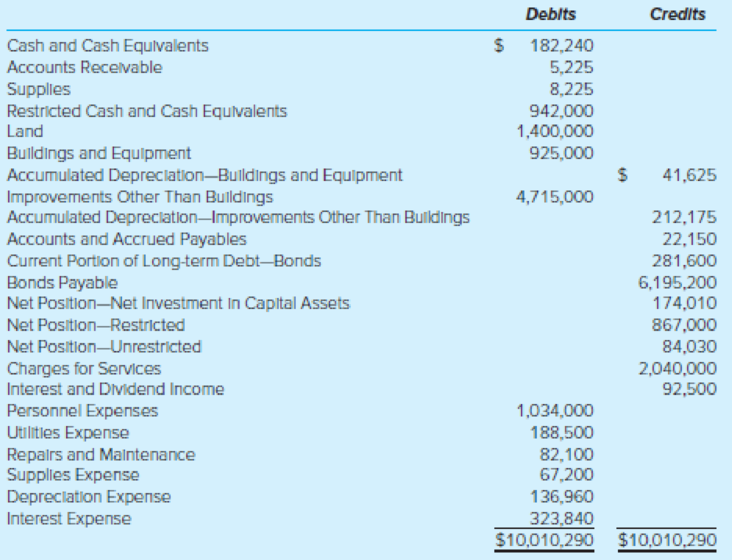

Tribute Aquatic Center Enterprise Fund. (LO7-5) The City of Saltwater Beach established an enterprise fund two years ago to construct and operate Tribute Aquatic Center, a public swimming pool. The pool was completed and began operations last year. All costs, including repayment of debt, are to be paid by user fees. The fund’s preclosing

Additional information concerning the Tribute Aquatic Center Fund follows.

- 1. All bonds payable were used to acquire property, plant, and equipment.

- 2. Each year a payment is required on January 1 to retire an equal portion of the bonds payable.

- 3. Equipment was sold for cash at its carrying value of $9,250.

- 4. Total cash received from customers was $2,038,355 and cash received for interest and dividends was $92,500; of this amount, $75,000 was restricted cash. There were no other changes to restricted cash during the year.

- 5. Cash payments included $1,038,800 for personnel expenses, $185,800 for utilities, $86,225 for repairs and maintenance, $323,840 for interest on bonds, and $65,900 for supplies.

- 6. The beginning balance in Cash was $99,300,

Accounts Receivable was $3,580, Supplies was $9,525, and Accounts and Accrued Payables was $28,375. Accrued Payables include personnel expenses, utilities, and repairs and maintenance. - 7. The net position categories shown on the preclosing trial balance have not been updated to reflect correct balances at year-end.

Required

- a. Prepare the statement of revenues, expenses, and changes in fund net position for the Tribute Aquatic Center for the year just ended.

- b. Prepare the statement of net position for the Tribute Aquatic Center at year-end.

- c. Prepare the statement of

cash flows for the Tribute Aquatic Center at year-end.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Provide correct answer general accounting question

what is company A's net income? account question

During the year, Company A had sales of $2,400,000.

The cost of goods sold, and depreciation expense were

$1,860,000 and $490,000 respectively. The company

had a net interest expense of $215,000 and a tax rate of

35%.

What is Company A's net income?

Chapter 7 Solutions

ACCOUNTING F/GOV.+NON...(LL)

Ch. 7 - Prob. 1QCh. 7 - Explain the reporting requirements for internal...Ch. 7 - A member of the city commission insists that the...Ch. 7 - Prob. 4QCh. 7 - What is the purpose of the Restricted Assets...Ch. 7 - Prob. 6QCh. 7 - Prob. 7QCh. 7 - When do GASB standards require interfund...Ch. 7 - Prob. 9QCh. 7 - What is meant by segment information for...

Ch. 7 - Prob. 11QCh. 7 - Internal Service Fund Reporting. (LO7-2) Financial...Ch. 7 - Proprietary Fund Operating Statement. (LO7-1)...Ch. 7 - Enterprise Fund Golf Course Management. (LO7-1)...Ch. 7 - Prob. 17.1EPCh. 7 - Which of the following would most likely be...Ch. 7 - Under GASB standards, the City of Parkview is...Ch. 7 - Prob. 17.4EPCh. 7 - Which of the following events would generally be...Ch. 7 - Proprietary funds a. Are permitted to integrate...Ch. 7 - Prob. 17.7EPCh. 7 - Prob. 17.8EPCh. 7 - Prob. 17.9EPCh. 7 - Prob. 17.10EPCh. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - Prob. 18EPCh. 7 - Prob. 19EPCh. 7 - Central Garage Internal Service Fund. (LO7-2) The...Ch. 7 - Internal Service Fund Statement of Cash Flows....Ch. 7 - Tribute Aquatic Center Enterprise Fund. (LO7-5)...Ch. 7 - Net Position Classifications. (LO7-5) During the...Ch. 7 - Central Station Enterprise Fund. (LO7-5) The Town...Ch. 7 - Enterprise Fund Journal Entries and Financial...Ch. 7 - Net Position Classifications. (LO7-5) The Village...Ch. 7 - Enterprise Fund Statement of Cash Flows. (LO7-5)...Ch. 7 - AppendixSolid Waste Enterprise Fund. (LO7-6) Brown...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ??arrow_forwarda. Determine the following variances for November. Note: Do not use negative signs with your answers. a. Total material price variance b. Total material usage (quantity) variance c. Labor rate variance d. Labor efficiency variance e. Variable overhead spending variance f. Variable overhead efficiency variance g. Fixed overhead spending variance h. Volume variance i. Budget variance cost accountingarrow_forwardThe absorption costing unit product cost is.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License