a.

Prepare journal entries to record the transactions of Water Utility Fund.

a.

Explanation of Solution

Enterprise funds: The enterprise funds record the activities that provide goods or service to the public. The enterprise funds are treated similar to that of business organizations.

Prepare

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Sales of water | 500,000 | |||

| Accrued utility revenues | 500,000 | |||

| (To record the reverse of accrued utility revenue account) |

Table (1)

Prepare journal entry to record the accrual of revenue from the sale of water:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accounts Receivable | 2,788,691 | |||

| Due from General fund | 193,866 | |||

| Sales of water | 2,982,557 | |||

| (To record the accrual of revenue from the sale of water) |

Table (2)

Prepare journal entry to record the interest income received and accrued:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 260,000 | |||

| Interest Income | 178,000 | |||

| Interest Receivable | 82,000 | |||

| (To record the interest income received and accrued) |

Table (3)

Prepare journal entry to record the accrual of expenses:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Management and administrative expense | 360,408 | |||

| Maintenance and Distribution | 689,103 | |||

| Treatment Plant Expense | 695,237 | |||

| Accounts Payable | 1,744,748 | |||

| (To record the accrual of expenses) |

Table (4)

Prepare journal entry to record the cash receipt for customer deposits:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash (restricted) | 2,427 | |||

| Customer deposits | 2,427 | |||

| (To record the cash receipts for customer deposits) |

Table (5)

Prepare journal entry to record the cash collected on customer account and general fund:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 2,943,401 | |||

| Accounts Receivable | 2,733,870 | |||

| Due from General Fund | 209,531 | |||

| (To record the cash collected on customer account and general fund) |

Table (6)

Prepare journal entry to record the payment of expenses and return of customer deposit:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accounts Payable | 1,462,596 | |||

| Interest expense | 264,145 | |||

| Interest Payable | 131,772 | |||

| Current portion of long-term debt | 400,000 | |||

| Machinery and equipment | 583,425 | |||

| Customer deposits | 912 | |||

| Cash ($2,943,401-$209,531) | 2,841,938 | |||

| Cash (restricted) | 912 | |||

| (To record the payment of expenses and return of customer deposits) |

Table (7)

Prepare journal entry to record the receipt of state grant:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 475,000 | |||

| Contribution(capital grant) | 475,000 | |||

| (To record the receipt of grant from the state) |

Table (8)

Prepare journal entry to write off the uncollectible accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Allowance for uncollectible account | 10,013 | |||

| Accounts receivable | 10,013 | |||

| (To record the write off the uncollectible account) |

Table (9)

Prepare the journal entry to record the inter-fund fund transfer:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interfund transfer- General fund | 800,000 | |||

| Cash | 800,000 | |||

| (To record the receipt of funds from general fund) |

Table (10)

Prepare journal entry to record the

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense - Building | 240,053 | |||

| Allowance for depreciation - Building | 240,053 | |||

| (To record the depreciation expense on building) |

Table (11)

Prepare journal entry to record the depreciation expense on machinery and equipment:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Machinery and equipment | 360,079 | |||

| Allowance for depreciation - Machinery and equipment | 360,079 | |||

| (To record the depreciation expense on machinery and equipment) |

Table (12)

Prepare journal entry to create provision for uncollectible accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Provision for uncollectible account | 14,913 | |||

| Allowance for uncollectible account | 14,913 | |||

| (To record the increase in uncollectible account) |

Table (13)

Prepare journal entry to record the accrual of utility revenues:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accrued Utility Revenue | 700,000 | |||

| Sales of Water | 700,000 | |||

| (To record the increase in uncollectible account) |

Table (14)

Prepare journal entry to record the accrual of interest income:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interest Receivable | 15,849 | |||

| Interest Income | 15,849 | |||

| (To record the accrual of interest income) |

Table (15)

Prepare journal entry to record the accrual of interest expense:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interest Expense | 61,406 | |||

| Interest Payable | 61,406 | |||

| (To record the accrual of interest expense) |

Table (16)

Prepare journal entry to adjust the revenue bond payable and record the current portion of long-term debt:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Revenue bonds payable | 400,000 | |||

| Current portion of long-term debt | 400,000 | |||

| (To record the current portion of long-term debt) |

Table (17)

Prepare journal entry to close all the nominal accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Sales of water | 3,182,557 | |||

| Interest income | 193,849 | |||

| Contribution (capital grant) | 475,000 | |||

| Management and administrative expense | 360,408 | |||

| Maintenance and distribution | 689,103 | |||

| Treatment plant expense | 695,237 | |||

| Interfund transfer- general fund | 800,000 | |||

| Interest Expense | 325,551 | |||

| Depreciation expense-building | 240,053 | |||

| Depreciation expense- machinery and equipment | 360,079 | |||

| Uncollectible account | 14,913 | |||

| Net position-unrestricted (balancing figure) | 366,062 | |||

| (To record closing of nominal accounts) |

Table (18)

Prepare journal entry to allocate the increase in “net investment in capital assets” to the “unrestricted net position”:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Net position -Unrestricted | 383,293 | |||

| Net position-net investment in capital assets | 383,293 | |||

| (To record the increase in “net investment in capital assets” to the “unrestricted net position) |

Table (19)

Notes to the above table: Determine the amount of increase in the “net investments in capital assets”.

Step 1: Calculate the ending balance of “net investments in capital assets”.

Step 2: Calculate the amount of increase in the “net investments in capital assets”.

b.

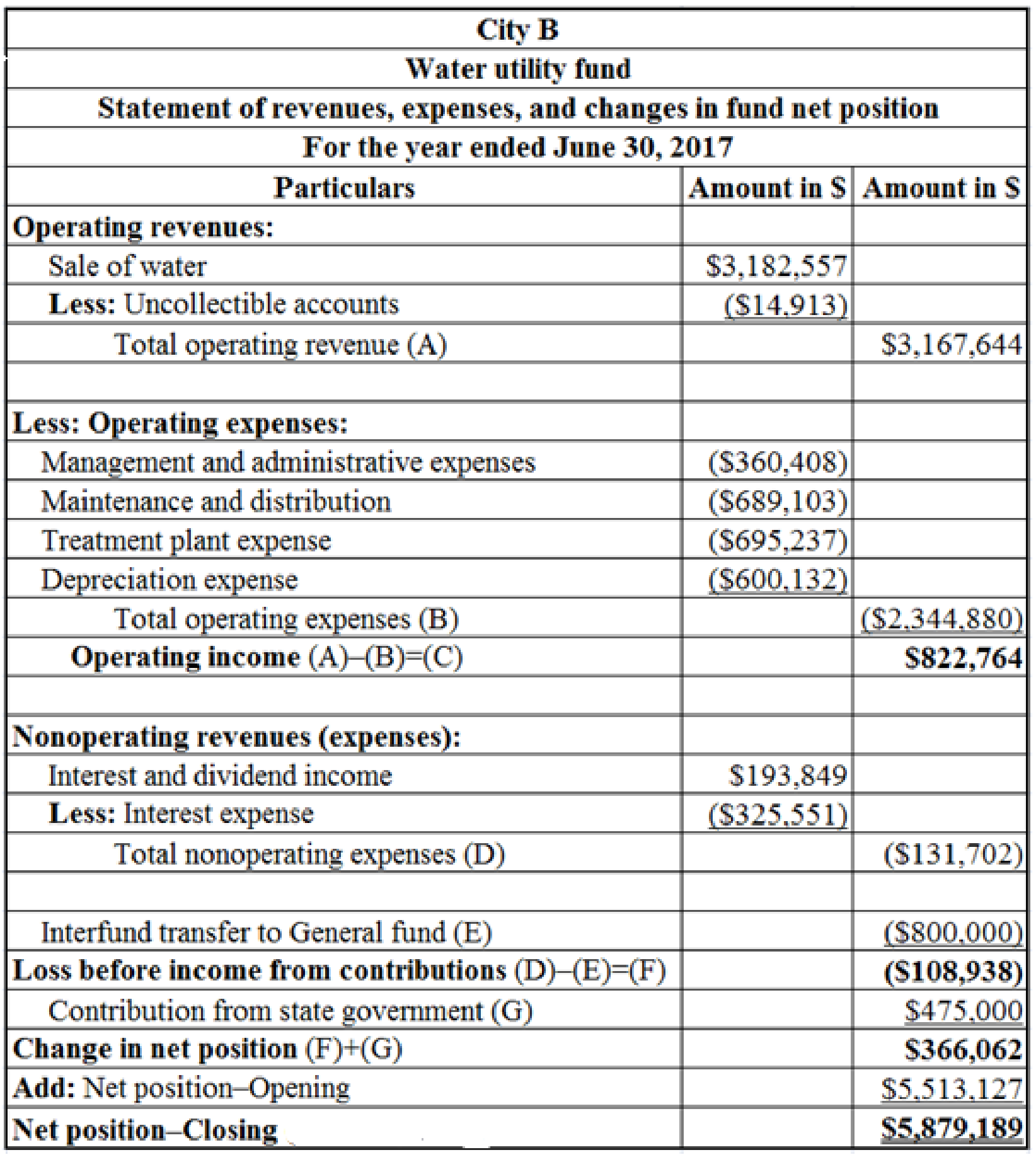

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Station Fund.

b.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Water utility fund:

Table (20)

Notes to the above table:

Determine the amount of net position-opening.

Before the fiscal year adjustment, the amount of unrestricted net position is $2,029,380 and the net position of “net investment is capital assets” calculated above is $3,483,747. Hence, the total net position-Opening is $5,513,127

(c)

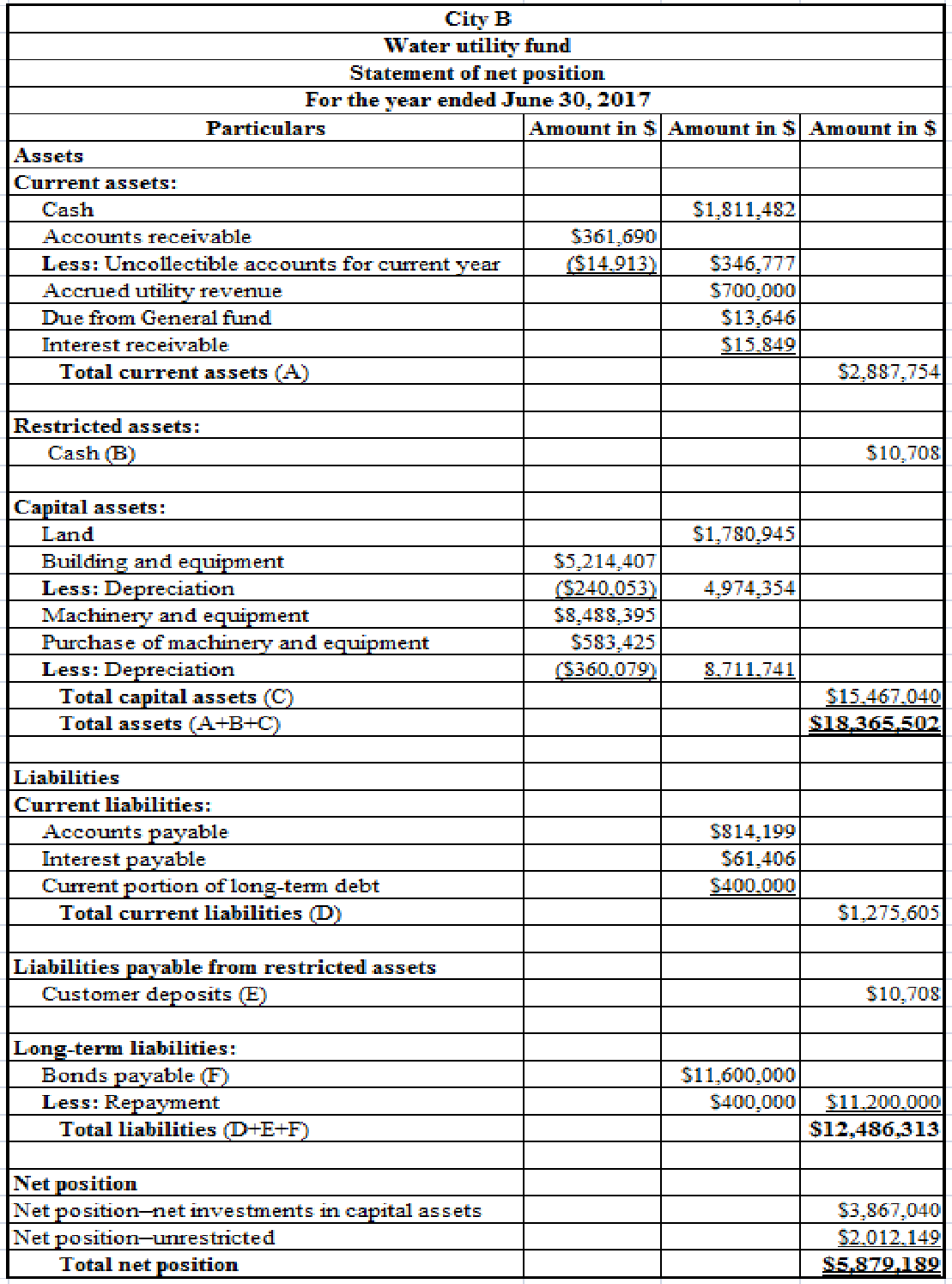

Prepare a “statement of net position” for Water Utility Fund.

(c)

Explanation of Solution

Statement of net position:

Prepare a “statement of net position” for Water Utility Fund.

Table (21)

Notes to the above table:

- Determine the closing balance of cash account.

Table (22)

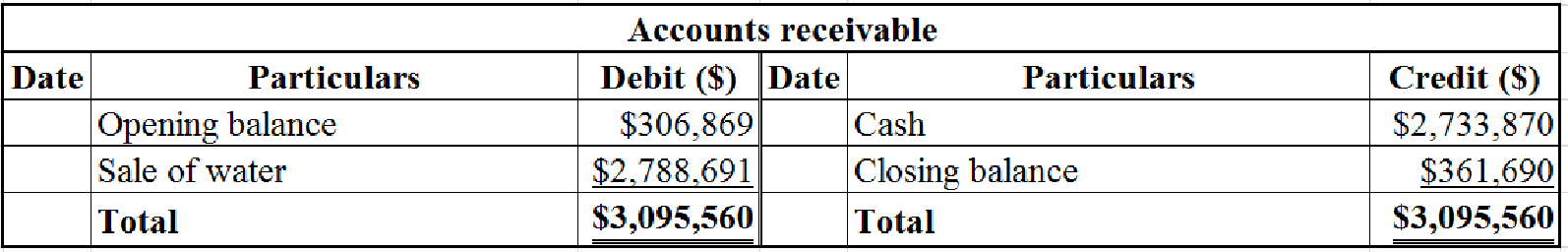

- Determine the closing balance of accounts receivable.

Table (23)

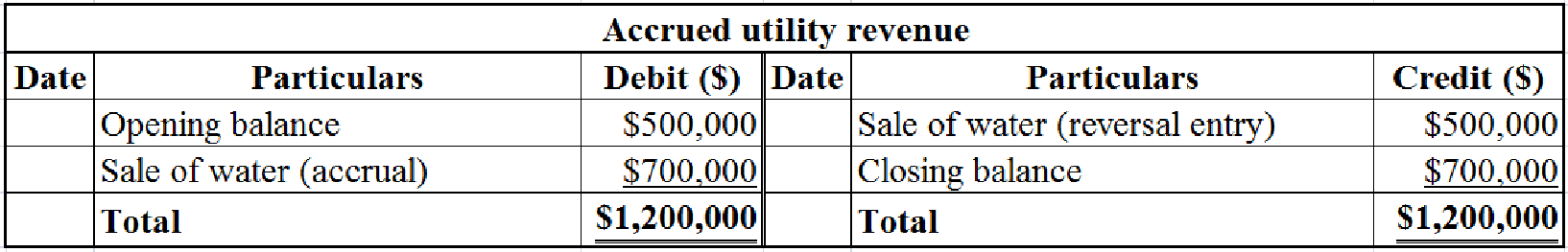

- Determine the closing balance of accrued utility revenue.

Table (24)

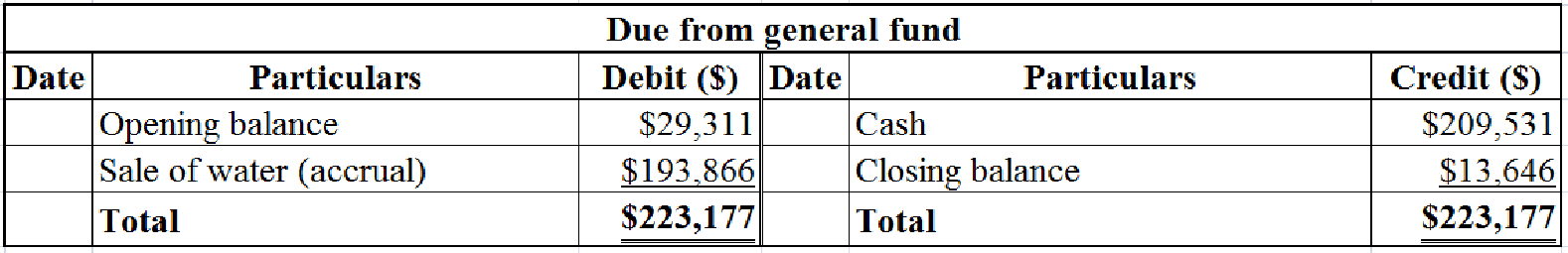

- Determine the closing balance of “due from general fund”.

Table (25)

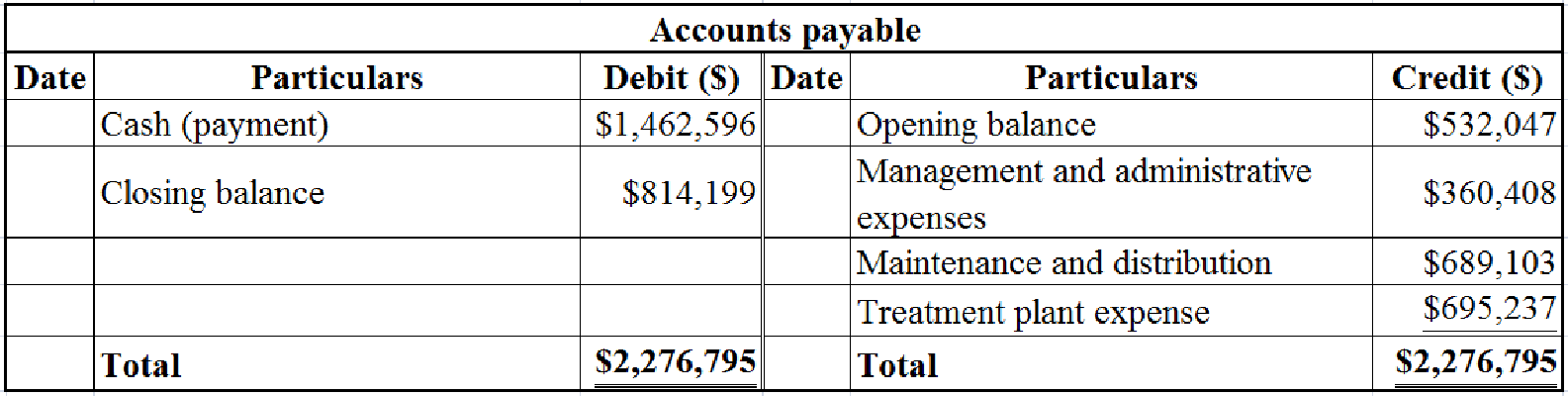

- Determine the closing balance of accounts payable.

Table (26)

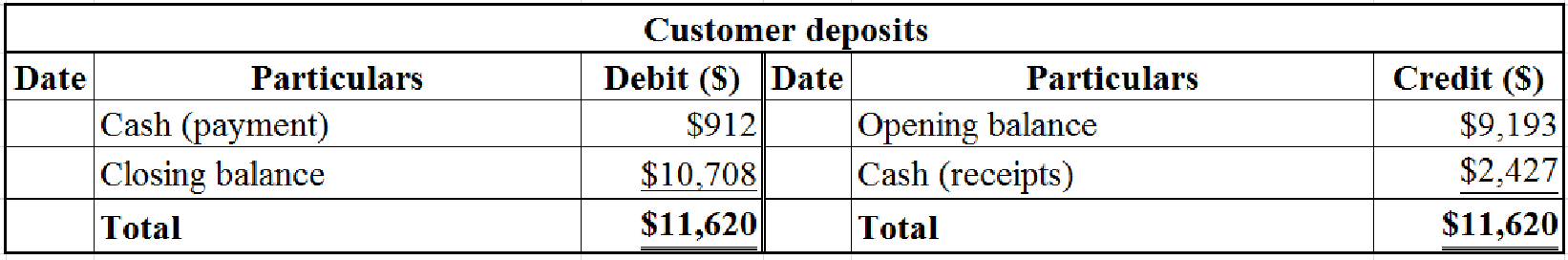

- Determine the closing balance of customer deposits.

Table (27)

- Determine the net position of unrestricted assets as on June 30, 2020.

(d)

Prepare “a statement of

(d)

Explanation of Solution

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

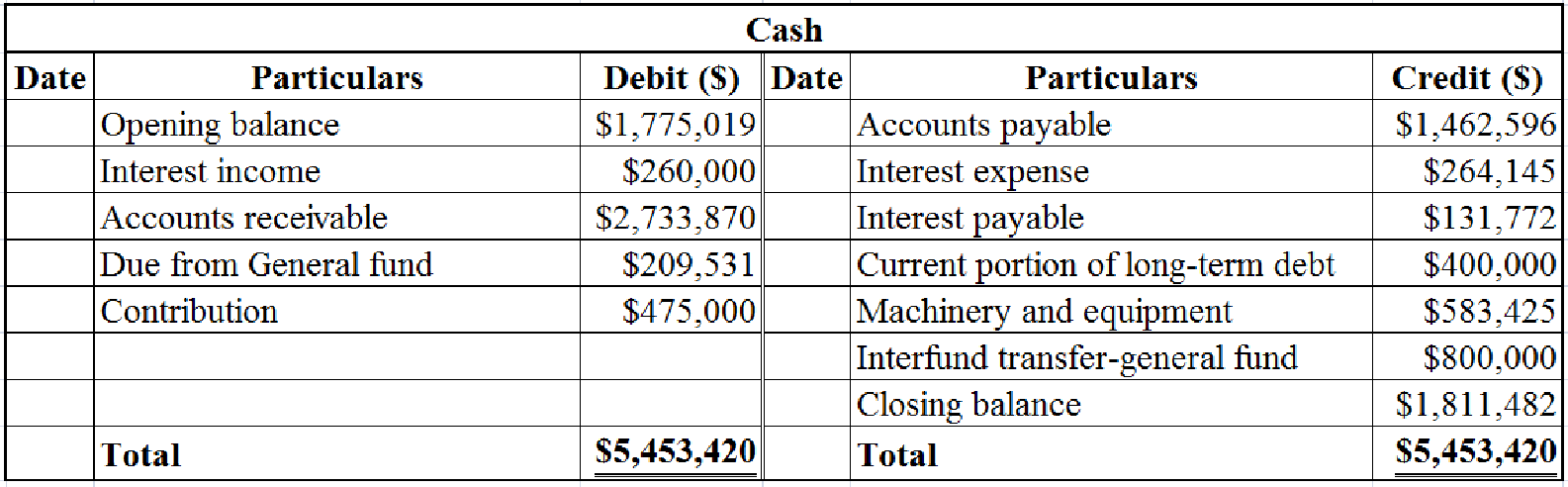

Prepare “a statement of cash flows” for water Utility Fund.

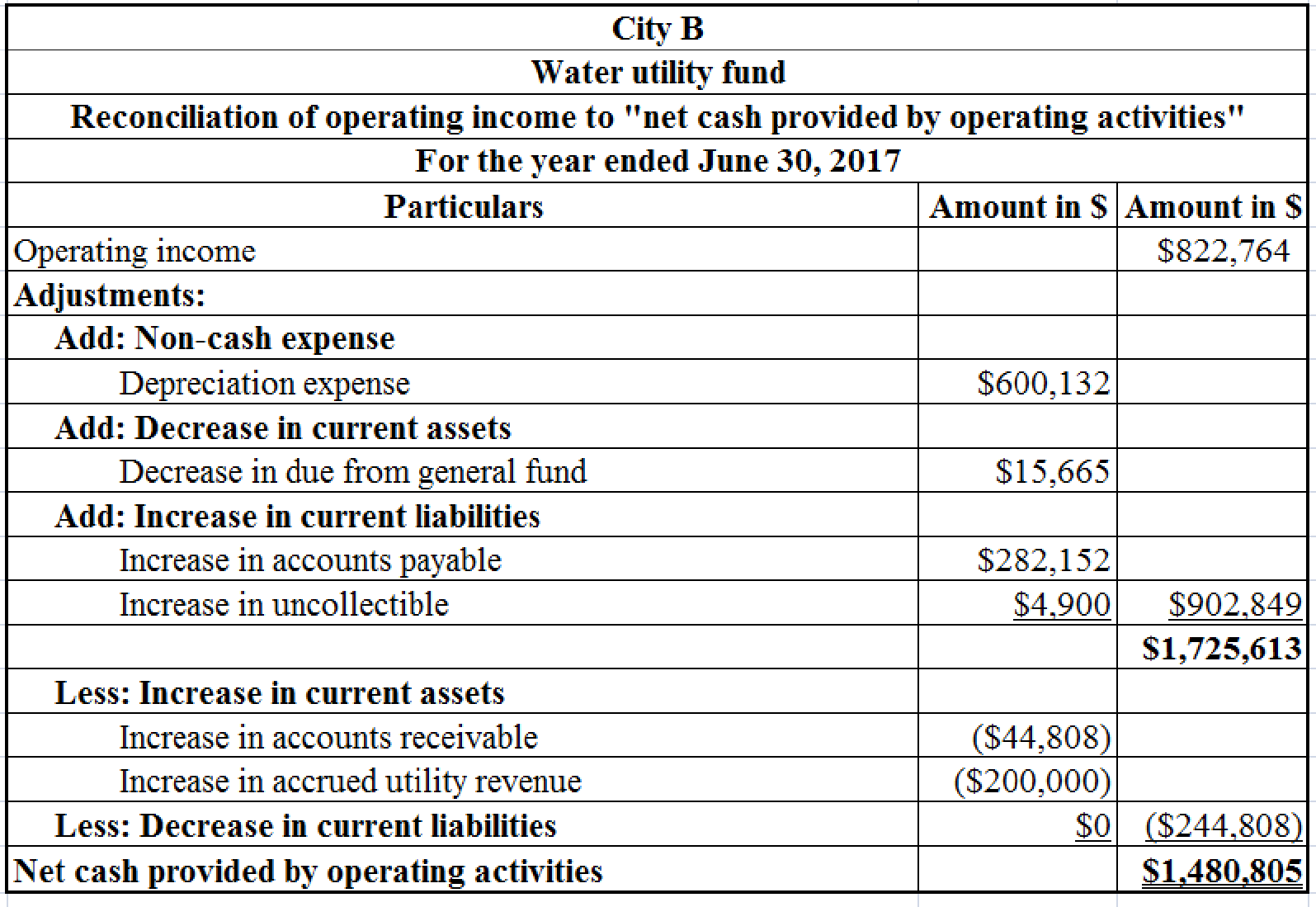

Step 1: Prepare the

Table (28)

Notes to the above table:

- Determine the increase in accounts payable.

The opening balance of accounts payable is $532,047 and the closing balance of accounts payable is $814,199. Hence, the accounts payable is increased by $282,152

- Determine the increase in “due from general fund”.

The opening balance of “due from general fund” is $29,311 and the closing balance of “due from general fund” is $13,646. Hence, the “due from general fund” is decreased by $15,665

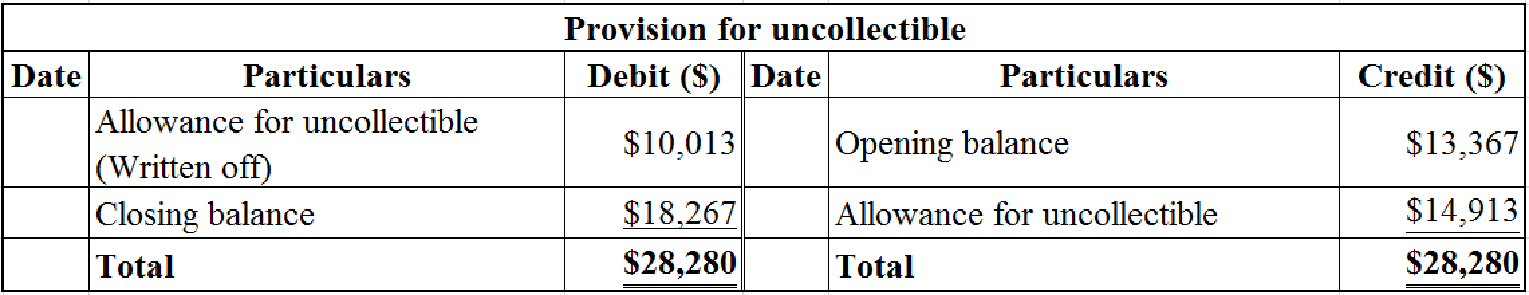

- Determine the balance in provision for uncollectible account.

Table (29)

- Determine the increase in uncollectible.

The opening balance of uncollectible is $13,367 and the closing balance of uncollectible is $18,267. Hence, the uncollectible is increased by $4,900

- Determine the increase in accounts receivable.

The opening balance of accounts receivable is $306,869. The closing balance of accounts receivable is $361,690. The written off portion of accounts receivable is $10,013. So, the net closing balance of accounts receivable is $351,677

- Determine the increase in accrued utility revenue.

The opening balance of accrued utility revenue is $500,000 and the closing balance of accrued utility revenue is $700,000. Hence, the accrued utility revenue is increased by $200,000

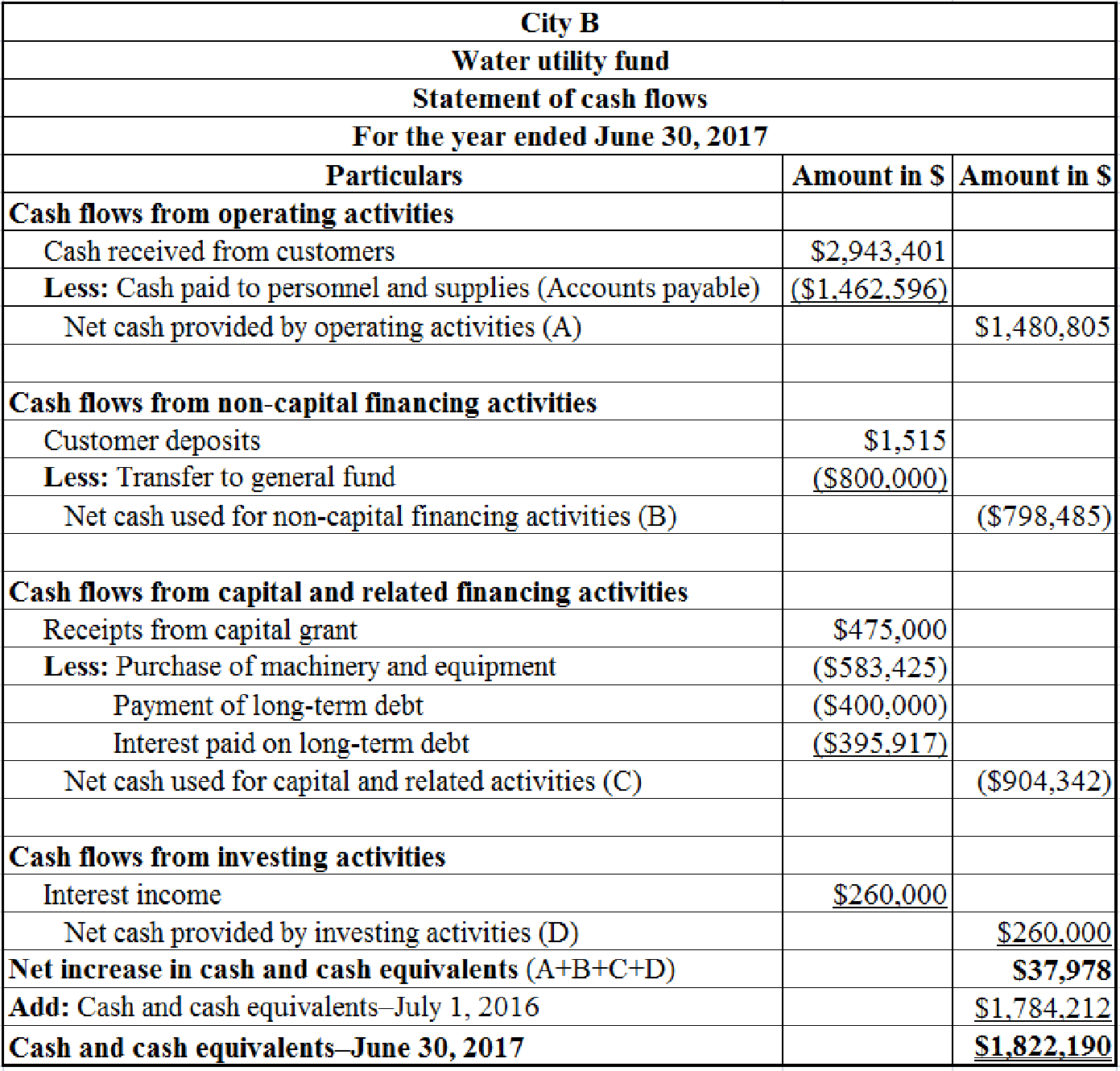

Step 2: Prepare “a statement of cash flows”.

Table (30)

Want to see more full solutions like this?

Chapter 7 Solutions

ACCOUNTING F/GOVT+NONPROFIT CONNECT+>I

- Please provide the answer to this general accounting question with proper steps.arrow_forwardOrville Manufacturing Company's work-in-process inventory on August 1 has a balance of $32,400, representing Job No. 527. During August, $61,500 of direct materials were requisitioned for Job No. 527, and $42,800 of direct labor cost was incurred on Job No. 527. Manufacturing overhead is allocated at 125% of direct labor cost. Actual manufacturing overhead costs incurred in August amounted to $52,500. No new jobs were started during August. Job No. 527 is completed on August 28. Is manufacturing overhead overallocated or underallocated for the month of August and by how much? Answerarrow_forwardNeil Enterprises has total assets of $4,800,000 and liabilities of $1,750,000. The company needs to raise $2,300,000 to purchase new equipment for expansion. They could either borrow the funds using 12-year bonds or issue 200,000 shares of common stock at an estimated market price of $11.50 per share. What is the debt-to-equity ratio before any choices are made? solve this financial accounting problemarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education