a.

Prepare journal entries to record all the transactions in Central Garage Fund accounts and governmental activities accounts.

a.

Explanation of Solution

Internal service fund: Internal service funds record the activities that are related to purchase and distribution within the departments of the government. This fund accounts for the internal financial transactions.

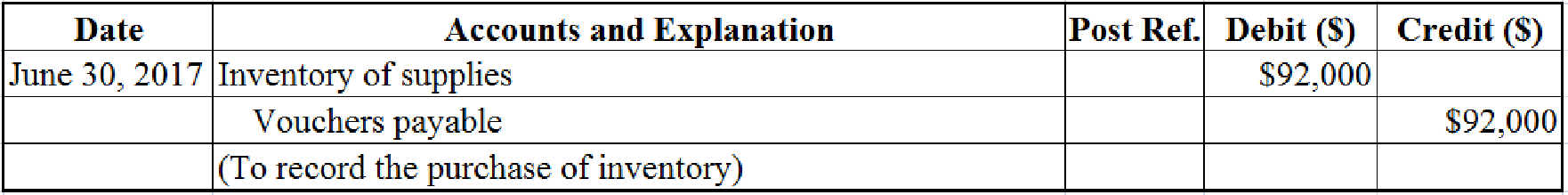

The purchase of inventory is recorded as below in Central Garage Fund accounts and governmental activities accounts:

Table (1)

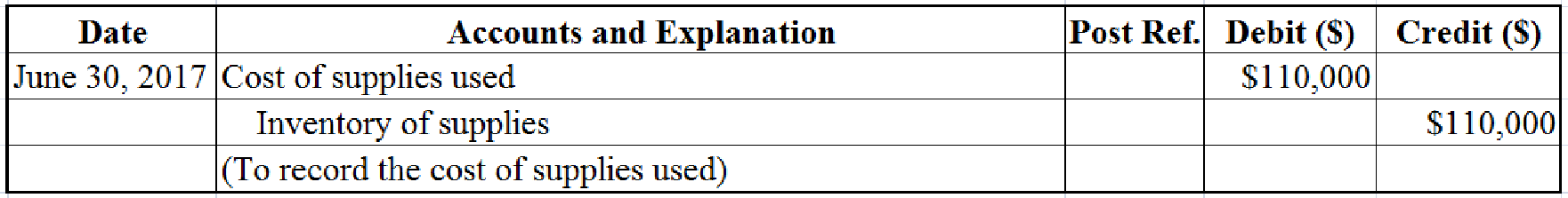

The value of supplies used is recorded as below in Central Garage Fund accounts:

Table (2)

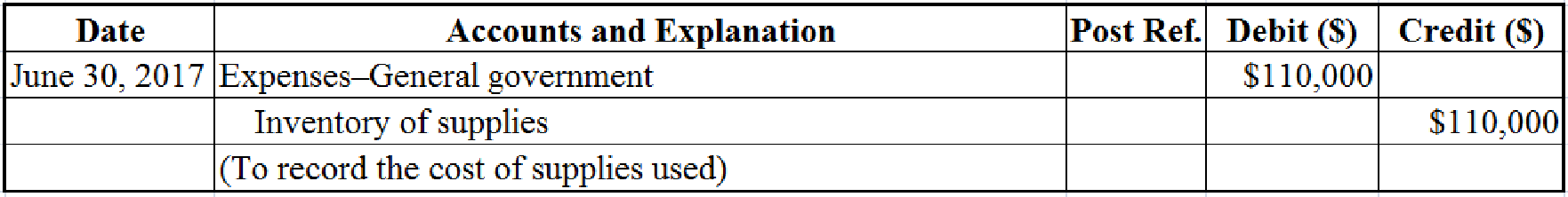

The value of supplies used is recorded as below in Governmental activities accounts:

Table (3)

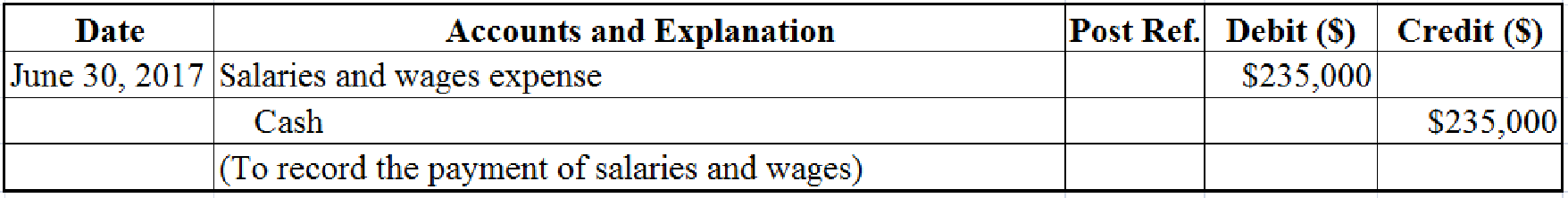

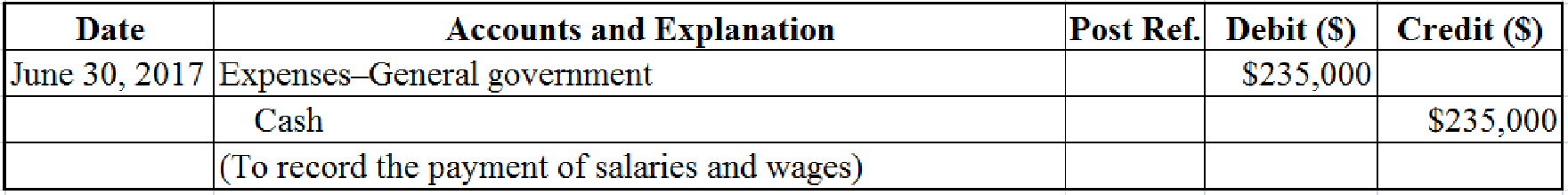

The payment of salaries and wages is recorded as below in Central Garage Fund accounts:

Table (4)

The payment of salaries and wages is recorded as below in Governmental activities accounts:

Table (5)

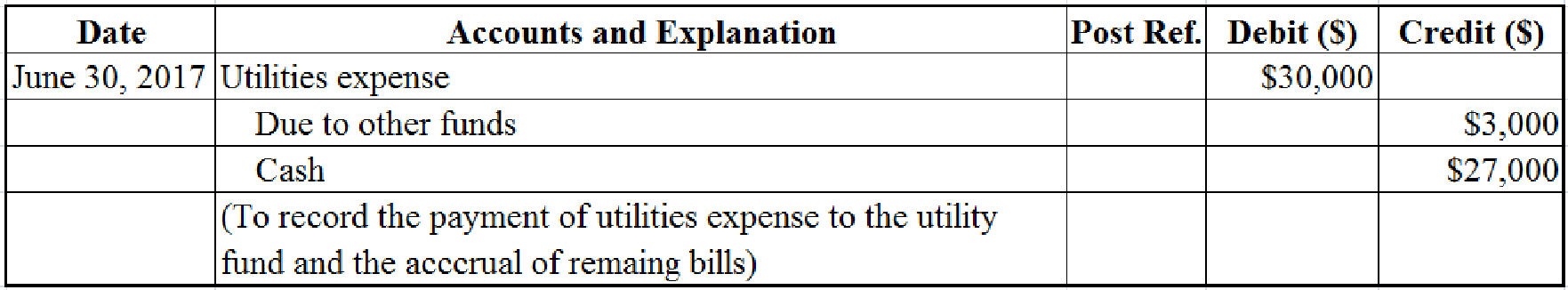

The accrual and payment of utilities expense is recorded as below in Central Garage Fund accounts:

Table (6)

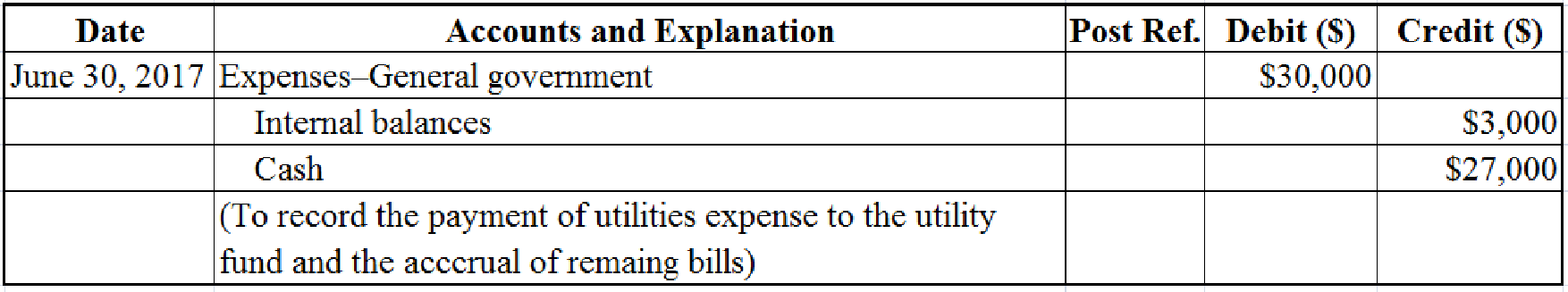

The accrual and payment of utilities expense is recorded as below in Governmental activities accounts:

Table (7)

The

Table (8)

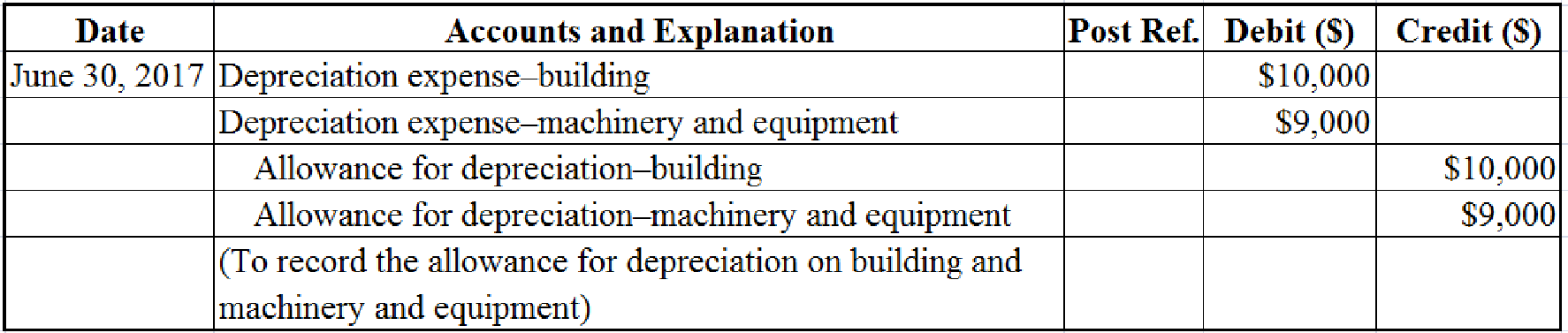

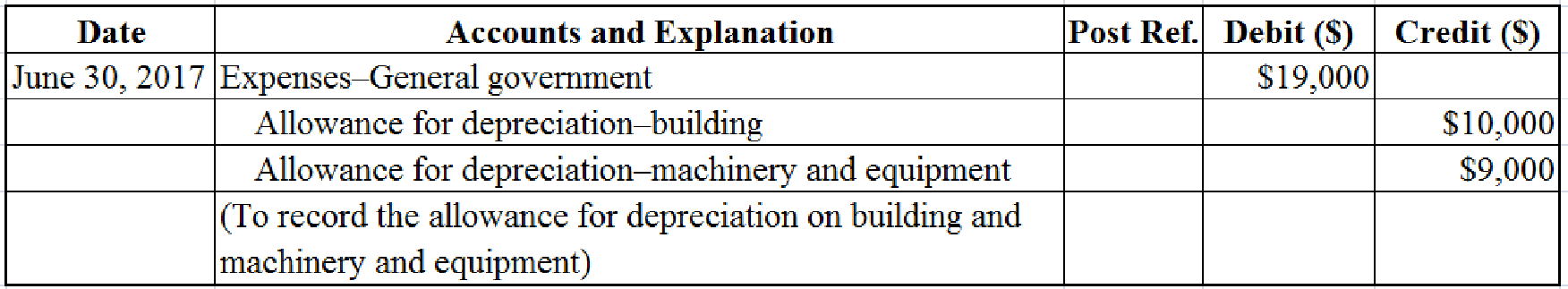

The depreciation expense is recorded as below in Governmental activities accounts:

Table (9)

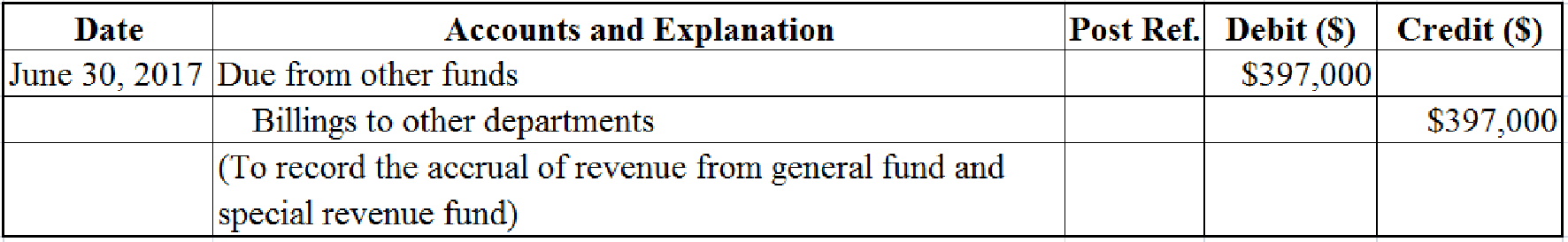

The due from other funds is recorded is recorded as below in Central Garage Fund accounts:

Table (10)

Note to the above table: It is given that the “central garage fund” is billed $270,000 to general fund and $127,000 to special revenue fund. Hence, the total due to other funds is $397,000

Note: As the “central garage fund” has dues from the other governmental funds like general fund and special revenue fund, there is no need for an entry in the governmental activities. The reason is that both the “internal service funds” and “governmental funds” will be recorded in the same column of the governmental activities.

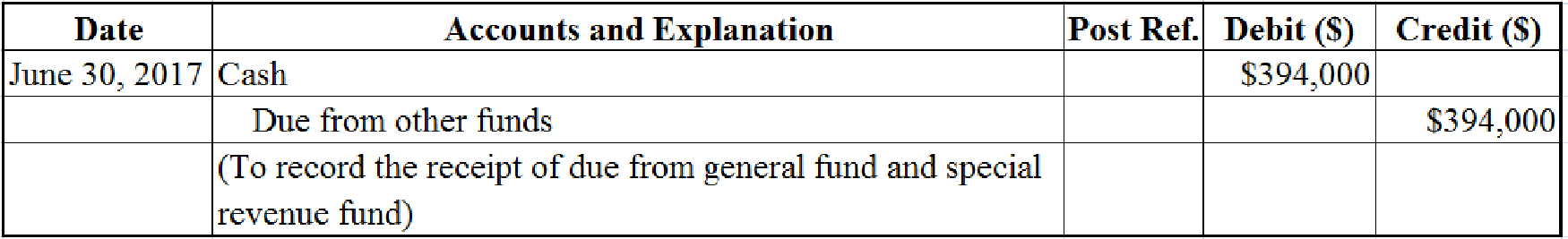

The receipt of dues from other funds is recorded as below in Central Garage Fund accounts:

Table (11)

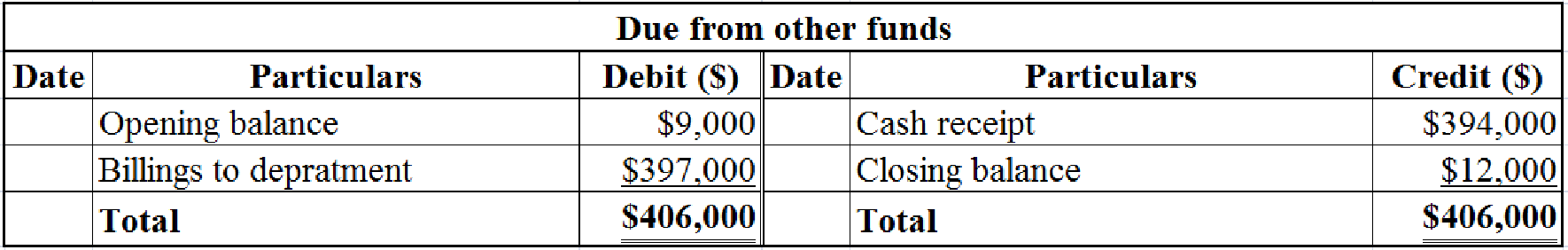

Note to the above table: The opening balance of general fund is $2,500 and the special revenue fund is $6,500. Hence, the opening balance of dues from other funds would be $9,000

The current year’s “dues from other funds” is $397,000. The opening balance is $9,000. Hence, the cash receipt of dues is $394,000

Note: As the “central garage fund” has dues from the other governmental funds like general fund and special revenue fund, there is no need for an entry in the governmental activities. The reason is that both the “internal service funds” and “governmental funds” will be recorded in the same column of the governmental activities.

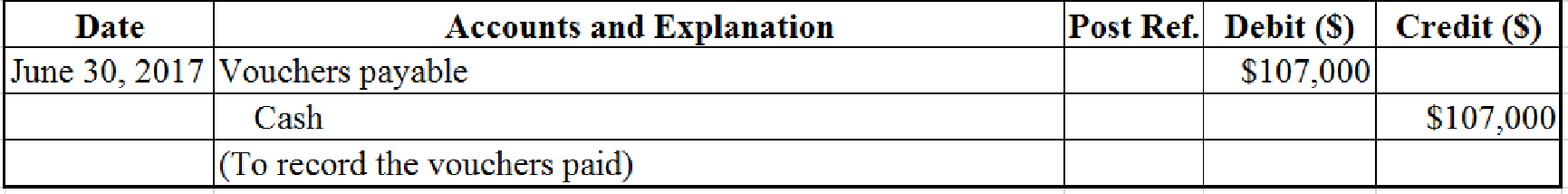

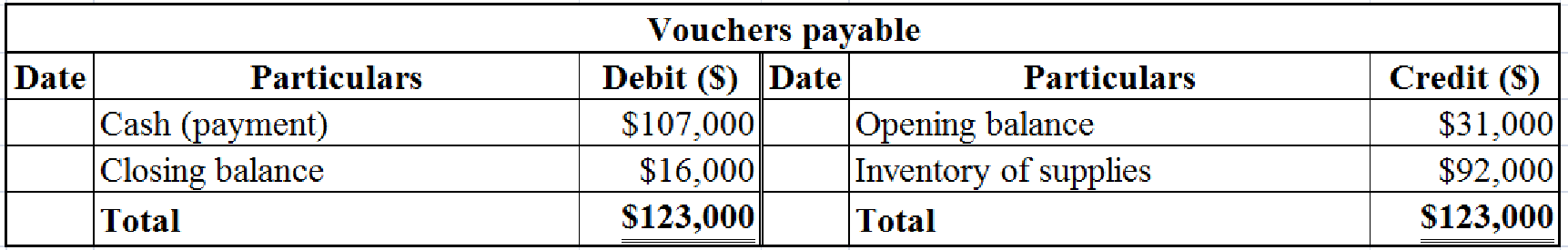

The payment of vouchers payable is recorded as below in Central Garage Fund accounts and governmental activities accounts:

Table (12)

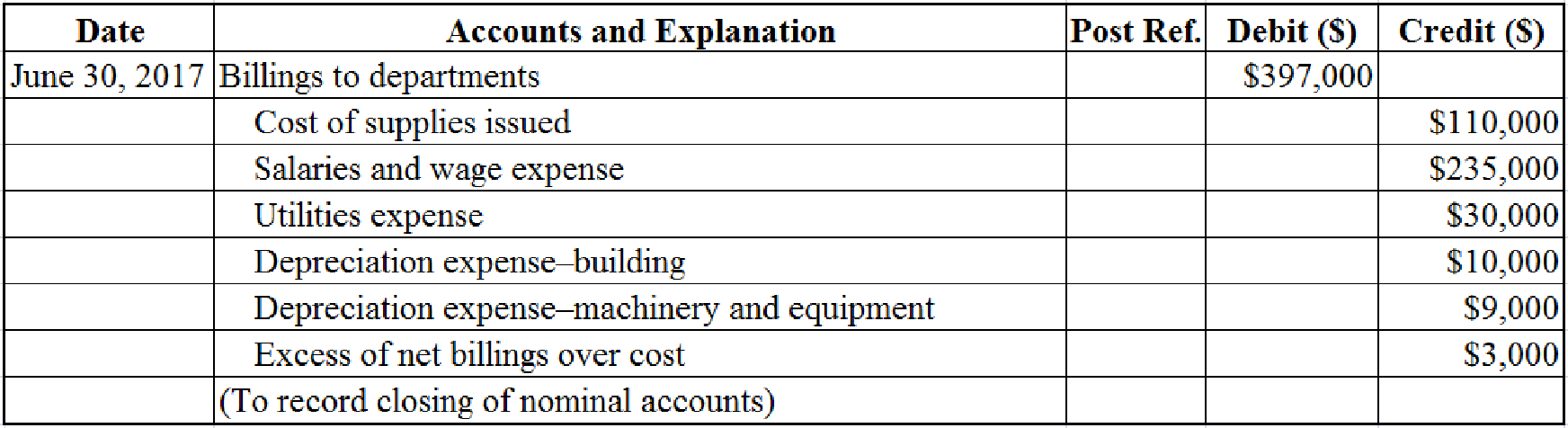

The closing entry is recorded as below in Central Garage Fund accounts:

Table (13)

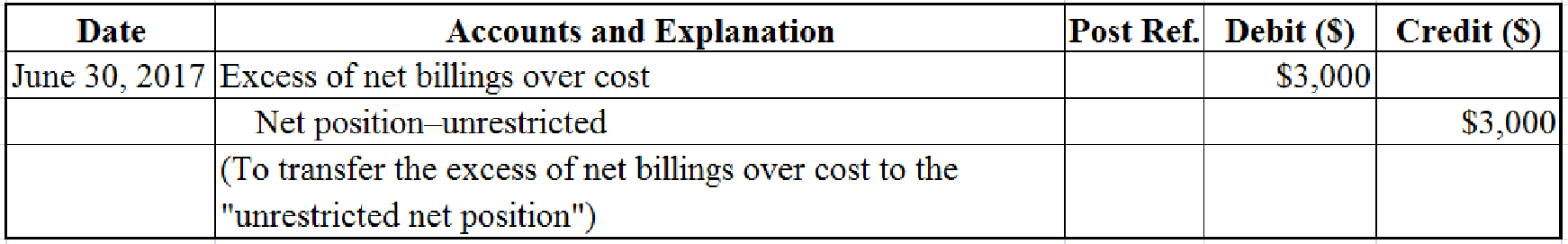

The

Table (14)

The journal entry to allocate the decrease in “net investment in capital assets” to the “unrestricted net position” is recorded as below:

Table (15)

b.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Garage Fund.

b.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

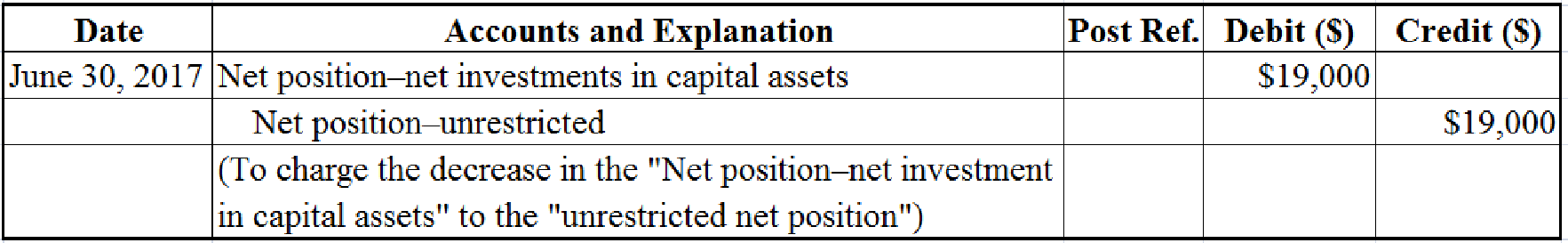

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Garage Fund.

Table (16)

Note to the above table:

Determine the opening net position:

Before the fiscal year adjustments, the net position of “net investment is capital assets” is $333,000 and the unrestricted net position is $178,000. Hence, the total opening net position is $511,000

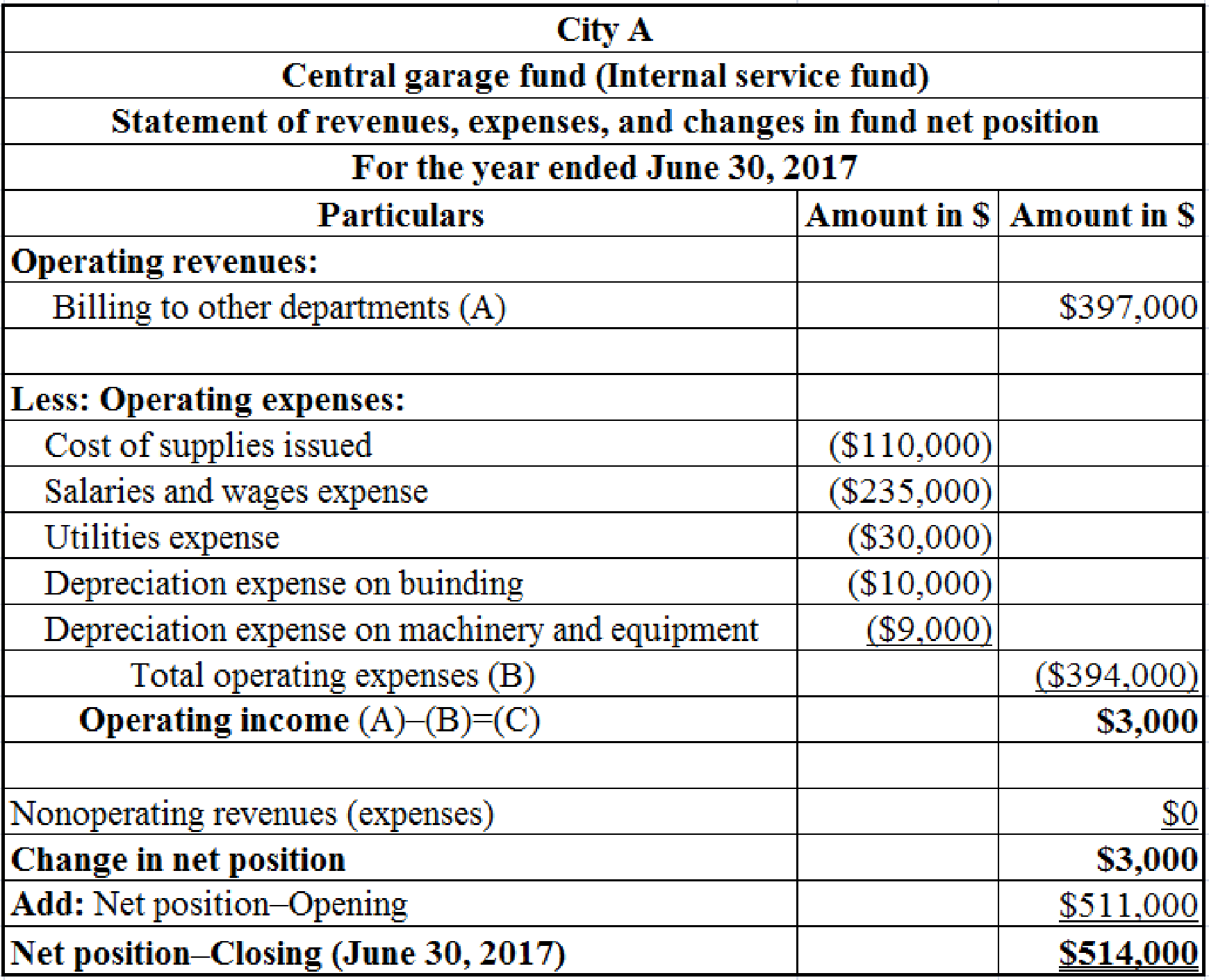

(c)

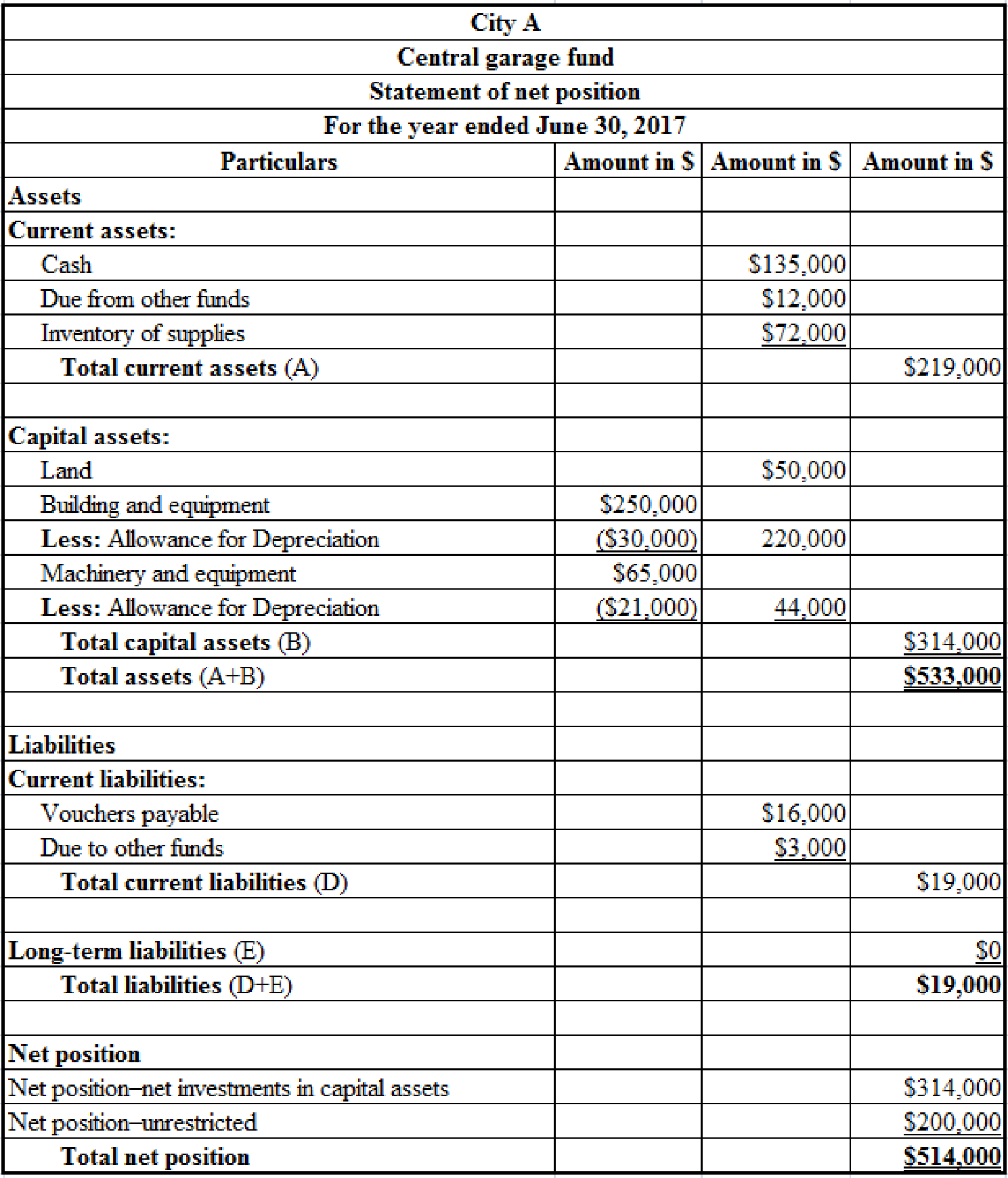

Prepare a “statement of net position” for Central Garage Fund.

(c)

Explanation of Solution

Statement of net position:

Prepare a “statement of net position” for Central Garage Fund.

Table (17)

Notes to the above table:

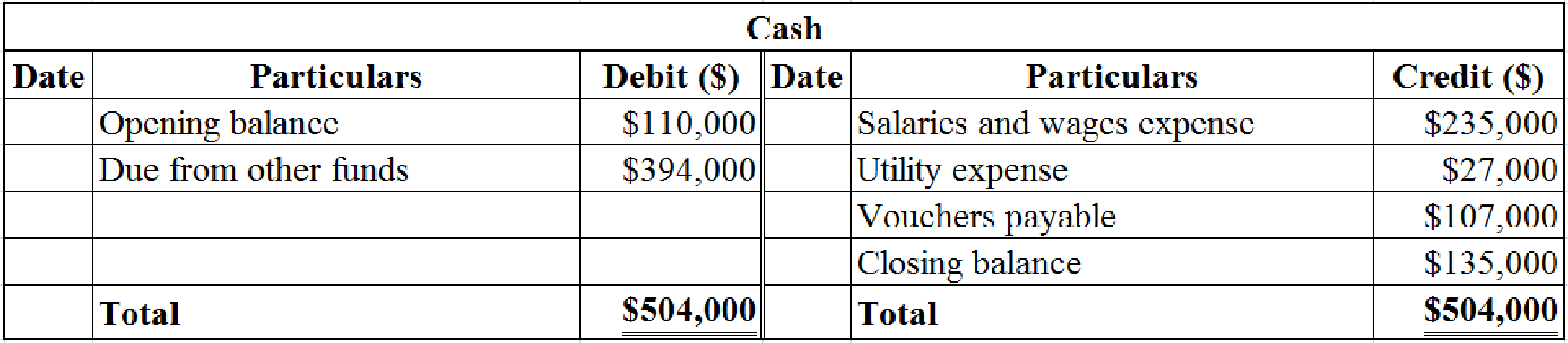

- Determine the closing balance of cash.

Table (18)

- Determine the closing balance of due from other funds.

Table (19)

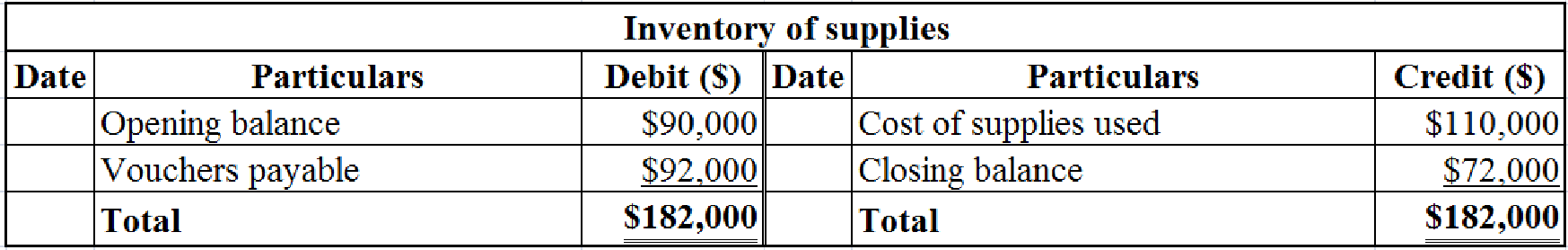

- Determine the closing balance of inventory of supplies.

Table (20)

- Determine the

accumulated depreciation for building.

The accumulated depreciation on building is the sum of current year depreciation ($10,000) and the previous year accumulated depreciation (20,000). Hence, the accumulated depreciation for current year is $30,000

- Determine the accumulated depreciation for machinery and equipment.

The accumulated depreciation on machinery is the sum of current year depreciation ($9,000) and the previous year accumulated depreciation (12,000). Hence, the accumulated depreciation for current year is $21,000

- Determine the closing balance of vouchers payable.

Table (21)

- Determine the net position of “net investment in capital assets”.

The opening balance of “net investment in capital assets” is $333,000. The current year’s depreciation is $19,000. Hence, the closing balance of “net investment in capital assets” is $314,000

- Determine the unrestricted net position as on June 30, 2017.

(d)

Discuss about the information that the “central garage fund” has to report in the governmental activities.

(d)

Explanation of Solution

Since, the “Central Garage Fund” is an internal service fund; it has to report its activities and net assets in the “governmental activities” statements. It has to merge the “garage fund” with the “governmental funds” and report it in the “governmental activities column”.

Want to see more full solutions like this?

Chapter 7 Solutions

ACCOUNTING F/GOVT+NONPROFIT CONNECT+>I

- Need help this accounting questionarrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardCreditors Sales Revenue 22,500 1,143,700 Land at cost 550,000 Building at cost 570,000 Furniture and fittings at cost 85,000 Bank 14,000 Provision for Depreciation Buildings 120,000 Furniture and fittings 15,000 Discounts 5,700 5,800 Retained Earnings at 1 Oct 2022 14,800 Provision for bad debts 2,200 Goodwill 400,000 Cash 16,400 Inventory at 1 Oct 2022 48,000 Rent Received(from Breezy Ltd) 27,000 Rent 7,900 Wages and Salaries 122,000 Insurance 16,300 Carriage Inwards 2,300 Returns 8,500 12,000 Commission received 5,200 8% Mortgage 100,000 Other Operating Expenses 2,500 Debtors 45,000 Purchases 340,000 Debenture Interest 1,200 Mortgage Interest 4,600 Bad debt 4,700 7% Debentures 150,000 4% Preference Shares @ $0.5 130,000 Ordinary Shares @ $0.75 375,000 General Reserves 127,000 Interim ordinary dividends paid 4,500 2,249,400 2,249,400arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education