Concept explainers

Segment Reporting and Decision-Making L07—4

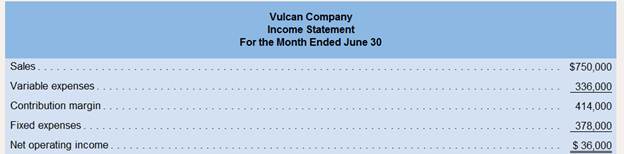

Vulcan Company’s contribution format income statement for June is as follows:

Management is disappointed with the company’s performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following:

a. The company is divided into two sales territories—Northern and Southern. The Northern territory recorded $300.000 in salesand $156,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southernterritory. Fixed expenses of $120,000 and $108,000 are traceable to the Northern and Southern territories, respectively. Therest of the fixed expenses are common to the two territories.

b. The company is the exclusive distributor for two products—Paks and Tibs. Sales of Paks and Tibs totaled $50,000 and$250,000, respectively, in the Northern territory during June. Variable expenses are 22% of the selling price for Paks and 58%for Tibs. Cost records show that $30,000 of the Northern territory’s fixed expenses are traceable to Paks and $40,000 toTibs, with the remainder common to the two products.

Required:

1. Prepare contribution format segmented income statements first showing the total company broken down between sales territories andthen showing the Northern territory broken down by product line. In addition, for the company as a whole and for each segment, showeach item on the segmented income statements as a percent of sales.

2. Look at the statement you have prepared showing the total company segmented by sales territory. What insights revealed by thisstatement should be mentioned to management?

3. Look at the statement you have prepared showing the Northern territory segmented by product lines. What insights revealed by thisstatement should be mentioned to management?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Loose Leaf For Introduction To Managerial Accounting

- What is the value of the retained earning account at the end of the year?arrow_forwardA company sold office furniture costing $12,700 with accumulated depreciation of $10,150 for $2,200 cash. The entry to record the sale would include a gain or loss of what amount?arrow_forwardLattimer enterprises reported the following information for the year please answer the general accounting questionarrow_forward

- Alam Store recorded the following: cash sales $52,000, credit sales $78,000, sales return $6,000, sales allowances $4,300, and early payment discount taken by customers $3,600. Calculate the net sales.arrow_forwardWhat is the production cost per unit?arrow_forwardAegis Corp. has assets of $215,630 and liabilities of $97,425. Then the firm receives $30,215 from an investor in exchange for new stock, which the firm issues to the investor. What is the value of stockholders' equity after the investment?helparrow_forward

- Calculate the inventory turnover ratio of this financial accounting questionarrow_forwardFinancial Accounting Problem: A project requires an investment of $4,500 and has a net present value of $810. If the IRR is 10%, what is the profitability index for the project?arrow_forwardCalculate variable manufacturing overheadarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning