Fundamentals of Cost Accounting

5th Edition

ISBN: 9781259565403

Author: William N. Lanen Professor, Shannon Anderson Associate Professor, Michael W Maher

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 21E

Assigning Costs to Jobs

The following transactions occurred in April at Steve’s Cabinets, a custom cabinet firm:

- 1. Purchased $80,000 of materials.

- 2. Issued $4,000 of supplies from the materials inventory.

- 3. Purchased $56,000 of materials.

- 4. Paid for the materials purchased in transaction (1).

- 5. Issued $68,000 in direct materials to the production department.

- 6. Incurred direct labor costs of $100,000, which were credited to Wages Payable.

- 7. Paid $106,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant.

- 8. Applied

overhead on the basis of 125 percent of $100,000 direct labor costs. - 9. Recognized

depreciation on manufacturing property, plant, and equipment of $50,000.

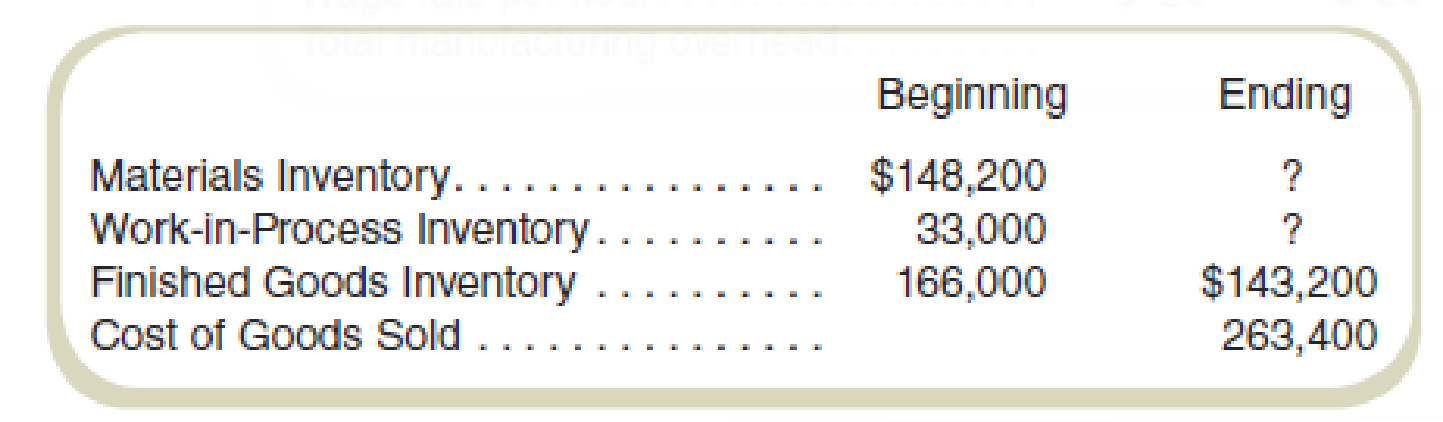

The following balances appeared in the accounts of Steve’s Cabinets for April:

Required

- a. Prepare

journal entries to record the transactions. - b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Computing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019.

Need help with this general accounting question

I want answer

Chapter 7 Solutions

Fundamentals of Cost Accounting

Ch. 7 - What are characteristics of companies that are...Ch. 7 - Direct labor-hours and direct labor dollars are...Ch. 7 - What is the purpose of having two manufacturing...Ch. 7 - How does the accountant know what to record for...Ch. 7 - How is job costing in service organizations (for...Ch. 7 - What are the costs of a product using normal...Ch. 7 - Prob. 7RQCh. 7 - What are three common sources of improprieties in...Ch. 7 - In the context of job costing, what are projects?...Ch. 7 - Why do most companies use normal or standard...

Ch. 7 - Why is control of materials important from a...Ch. 7 - Worrying about the choice of an overhead...Ch. 7 - Prob. 13CADQCh. 7 - Interview the manager of a campus print shop or a...Ch. 7 - Would a dentist, an architect, a landscaper, and a...Ch. 7 - Consider two firms in the same industry. Is it...Ch. 7 - Prob. 17CADQCh. 7 - Assume that you have been asked to paint the...Ch. 7 - Prob. 19CADQCh. 7 - ABC Consultants works for only two clients: a...Ch. 7 - Assigning Costs to Jobs The following transactions...Ch. 7 - Assigning Costs to Jobs Sunset Products...Ch. 7 - Assigning Costs to Jobs Forest Components makes...Ch. 7 - Assigning Costs to Jobs Partially completed...Ch. 7 - Assigning Costs to Jobs Selected information from...Ch. 7 - Assigning Costs to Jobs Partially completed...Ch. 7 - Predetermined Overhead Rates Dixboro Company...Ch. 7 - Predetermined Overhead Rates Southern Rim Parts...Ch. 7 - Prob. 29ECh. 7 - Predetermined Overhead Rates Aspen Company...Ch. 7 - Prorate Over- or Underapplied Overhead Refer to...Ch. 7 - Applying Overhead Using a Predetermined Rate Marys...Ch. 7 - Applying Overhead Using a Predetermined Rate Turco...Ch. 7 - Calculating Over- or Underapplied Overhead Toms...Ch. 7 - Predetermined Overhead Rates: Ethical Issues...Ch. 7 - Prob. 36ECh. 7 - Job Costing in a Service Organization At the...Ch. 7 - Job Costing in a Service Organization For August,...Ch. 7 - Job Costing in a Service Organization Allocation...Ch. 7 - Job Costing in a Service Organization TechMaster...Ch. 7 - Estimate Machine-Hours Worked from Overhead Data...Ch. 7 - Estimate Hours Worked from Overhead Data Capitol,...Ch. 7 - Assigning CostsMissing Data The following...Ch. 7 - Assigning Costs: Missing Data The following...Ch. 7 - Analysis of Overhead Using a Predetermined Rate...Ch. 7 - Analysis of Overhead Using a Predetermined Rate...Ch. 7 - Finding Missing Data A new computer virus...Ch. 7 - Cost Accumulation: Service Youth Athletic Services...Ch. 7 - Job Costs: Service Company For the month of July,...Ch. 7 - Job Costs in a Service Company On September 1, two...Ch. 7 - Tracing Costs in a Job Company The following...Ch. 7 - Cost Flows through Accounts Brighton Services...Ch. 7 - Show Flow of Costs to Jobs Kims Asphalt does...Ch. 7 - Reconstruct Missing Data A tornado struck the only...Ch. 7 - Find Missing Data IYF Corporation manufactures...Ch. 7 - Find Missing Data Accounting records for NIC...Ch. 7 - Incomplete Data: Job Costing Chelsea Household...Ch. 7 - Job Costing and Ethics Old Port Shipyards does...Ch. 7 - Job Costing and Ethics Chuck Moore supervises two...Ch. 7 - Job Costing and Ethics Global Partners is a...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General Accountingarrow_forwardIf the federal government spends 12% of GDP and collects revenues of 10% of GDP, what is the deficit as a percentage of GDP? I want answerarrow_forwardIf the federal government spends 12% of GDP and collects revenues of 10% of GDP, what is the deficit as a percentage of GDP?arrow_forward

- Provide Answerarrow_forwardIf the federal government spends 12% of GDP and collects revenues of 10% of GDP, what is the deficit as a percentage of GDP? Answerarrow_forwardSherryhill Corporation's capital structure consists of 50,000 shares of common stock. At December 31, 2025 an analysis of the accounts and discussions with the company officials revealed the following information; Sales Revenue $1,2,38,000, Discontinued operations loss (net of tax) $55,300, Selling expenses $126,700, Cash $59,100, Accounts receivable $88,000, Common Stock $200,000, COGS $698,500, Accumulated depreciation-machinery. $183,600, Dividend Revenue $7,200, Unearned service revenue 4,300, Interest payable $1,800, Land $360,000, Patents $117,000, Retained earnings, January 1, 2025 224,950, Interest expense 19,900, Administrative expenses $165,600, Dividends declared. $24,600 Allowance for Doubtful Accounts 5,100 Notes Payable (maturity 7/1/28) $218,000 Machinery 459,000 Materials 39,800 accounts payable. 60,200 The amount of income taxes applicable to income was $70,350, excluding the tax effect of the discontinued operations loss, which amounted to $23,700…arrow_forward

- Why is it important for companies to use the matching principle in accounting, and how does it affect the recognition of expenses? Explain how this principle ensures that financial statements provide a true representation of profitability during a specific period.arrow_forwardWhat are some advantages and disadvantages of the single-step income statement?arrow_forwardPLEASE DO PART B OF THIS ACCOUNTING PROBLEMarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY