Concept explainers

Refer to the data in Exercise 7.20. The company has decided to use the sequential method of allocation instead of the direct method. The support departments are ranked in order of highest cost to lowest cost.

Required:

- 1. Allocate the

overhead costs to the producing departments using the sequential method. (Take allocation ratios out to four significant digits. Round allocated costs to the nearest dollar.) - 2. Using machine hours, compute departmental overhead rates. (Round the overhead rates to the nearest cent.)

1.

Allocate the overhead costs to the producing departments suing the sequential method.

Explanation of Solution

Sequential method of allocation: The sequential method of allocation foresees that the interactions between the supports departments occur; conversely the sequential method considers only partial account of this interaction.

Calculation allocation ratio:

| Power |

General Factory | Purchasing | Pesticide |

Liquid Fertilizer | |

| Square feet | (1)0.125 | (2)0.125 | (3)0.35 | (4)0.4 | |

| Machine hours | (5)0.75 | (6)0.25 | |||

| Purchase orders | (7)0.1 | (8)0.6 | (9)0.3 |

Table (1)

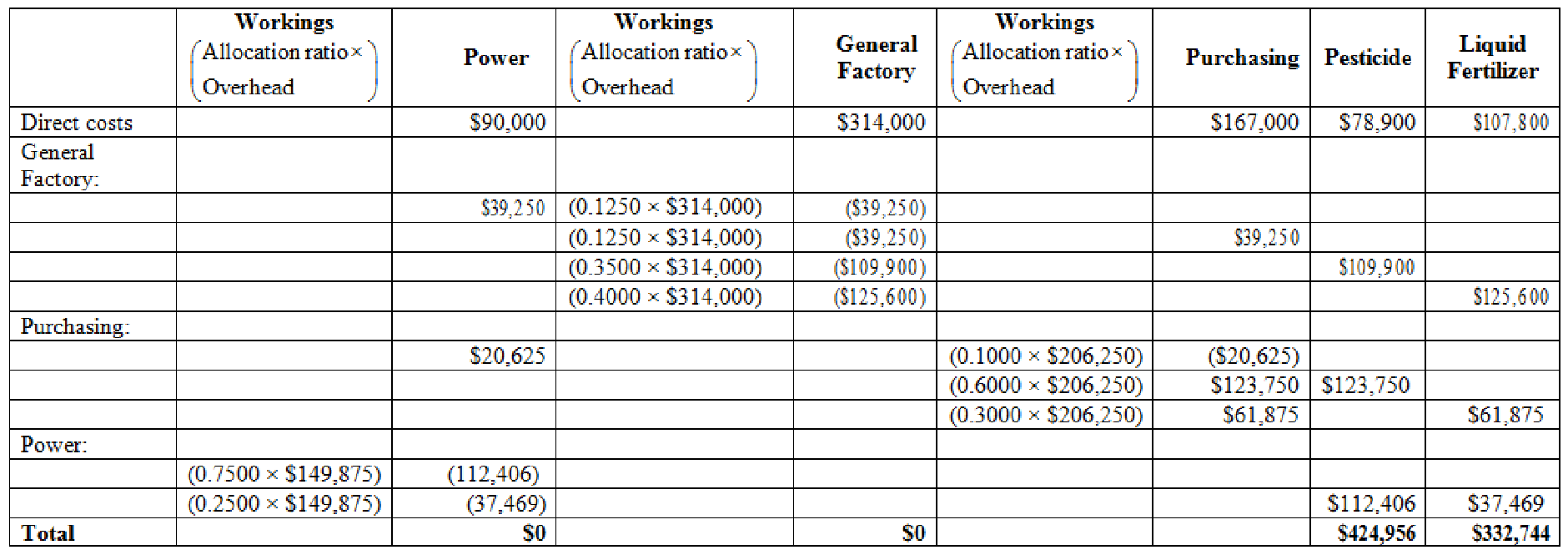

Calculate assignment of costs:

Figure (1)

Working notes:

(1)Calculate the allocation of square feet to Power department:

(2)Calculate the allocation of square feet to Purchasing department:

(3)Calculate the allocation of square feet to Pesticide department:

(4)Calculate the allocation of square feet to Liquid fertilizer department:

(5)Calculate the allocation of machine hours to Pesticide department:

(6)Calculate the allocation of machine hours to Liquid Fertilizer department:

(7)Calculate the allocation of purchase orders to power department:

(8)Calculate the allocation of purchase orders to pesticide department:

(9)Calculate the allocation of purchase orders to liquid fertilizer department:

2.

Calculate departmental overhead rates using machine hours.

Explanation of Solution

Departmental overhead rates: Departmental overhead rate is calculated by adding the allocated service costs to the overhead costs that are directly noticeable to the producing departments and dividing this total by some measure of activity, such as direct labor hours or machine hours.

Calculate the departmental overhead rate for pesticide department:

Therefore, the departmental overhead rate for pesticide department is $17.71 per machine hour.

Calculate the departmental overhead rate for Liquid fertilizer department:

Therefore, the departmental overhead rate for liquid fertilizer department is $41.59 per machine hour.

Want to see more full solutions like this?

Chapter 7 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- How much of every retail sales dollar is made up of merchandise cost on these general accounting question?arrow_forwardThe company where Daniel works produces skateboards locally but sells them globally for $60 each. Daniel is one of the production managers in a meeting to discuss preliminary results from the year just ended. Here is the information they had in front of them: Standard Quantity per Unit Standard Price Wood 2.50 feet $4.00 per foot Wheels 5.00 wheels $0.50 per wheel Direct labor 0.30 hours $14.00 per hour Actual results: . • Quantity of wood purchased, 225,000 feet; quantity of wood used, 220,000 feet. Quantity of wheels purchased, 418,800 wheels; quantity of wheels used, 400,800 wheels. Actual cost of the wood, $4.20 per foot. Actual cost of the wheels, $0.55 per wheel. • Quantity of DL hours used, 26,400 hours; actual cost of DL hours, $15.20 per hour. Actual units produced, 80,000 skateboards. (a) Complete a variance analysis for DM (both wood and wheels) and DL, determining the price and efficiency variances for each; be sure to specify the amount and sign of each variance. DM- Wood…arrow_forwardNeed help with this financial accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College