a)

Determine the percentage increase in sales and prepare the pro forma income statement.

a)

Explanation of Solution

The formula to calculate the percentage of increase in sales:

Compute net income:

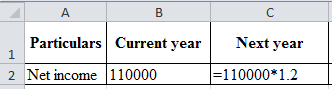

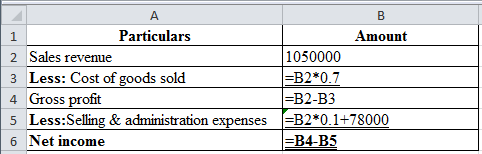

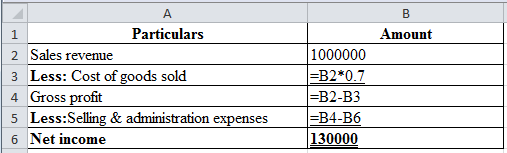

Excel workings:

Table (1)

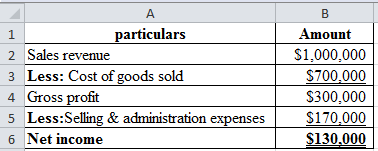

Excel spread sheet:

Table (2)

Compute the percentage of COGS for next year:

Hence, the percentage of COGS for next year is 70%.

Compute the sales value:

Consider sales as X:

Hence, sales are $1,050,000.

Compute selling and administration expenses:

Hence, the selling and administration expenses are $183,000.

Compute the percentage of increase in sales:

Hence, the percentage of increase in sales is 31.25%.

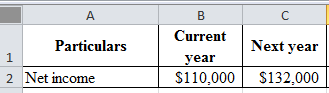

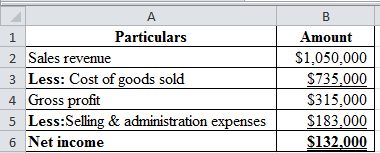

Prepare a pro forma income statement:

Table (3)

Table (4)

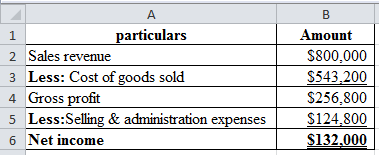

Hence, the net income is $132,000.

b)

Prepare the pro forma income statement and the other ideas to reach the Person H’s goal.

Given information:

Discount rate of 3% on COGS

b)

Explanation of Solution

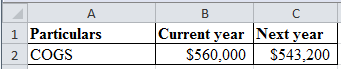

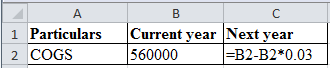

Compute the COGS:

Excel spread sheet:

Table (5)

Excel workings:

Table (6)

Hence, the COGS are $543,200.

Compute the selling and administration expenses:

Consider selling and administration expenses as X:

Hence, selling and administration expenses are $124,800.

Prepare a pro forma income statement:

Excel spreadsheet:

Table (7)

The management cuts the selling and administrative expenses by the amount of $5,200 to reach the goals of Person H.

c)

Whether the company can reach the goal of Person H

c)

Explanation of Solution

Compute projected sales:

Hence, the projected sales are $1,000,000.

Compute the projected cost of goods sold:

Hence, the projected cost of goods sold is $700,000.

Prepare a pro forma income statement:

Excel workings:

Table (8)

Excel spreadsheet:

Table (9)

Hence, the net income is $130,000.

The company cannot reach the goal as the desired profit more than the actual that is $130,000 is more than the $132,000.

Want to see more full solutions like this?

Chapter 7 Solutions

Fundamental Managerial Accounting Concepts with Access

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardI am looking for the most effective method for solving this financial accounting problem.arrow_forward

- Subject : Financial accountingarrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardCooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal? Helparrow_forward

- Cooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education