a)

Determine the percentage increase in sales and prepare the pro forma income statement.

a)

Explanation of Solution

The formula to calculate the percentage of increase in sales:

Compute net income:

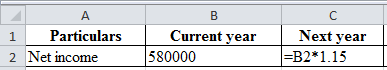

Excel workings:

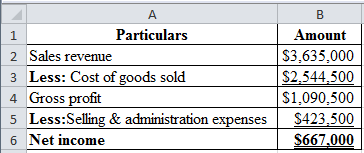

Table (1)

Excel spread sheet:

Table (2)

Compute the sales value:

Consider sales as X:

Hence, sales are $3,635,000.

Compute selling and administration expenses:

Hence, the selling and administration expenses are $423,500.

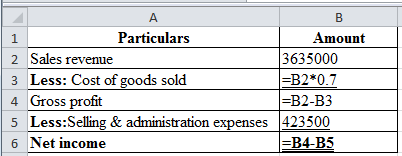

Prepare a pro forma income statement:

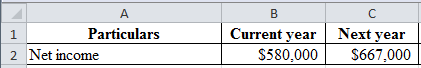

Excel workings:

Excel spreadsheet:

Table (3)

Hence, the net income is $667,000.

Compute the percentage of increase in sales:

Hence, the percentage of increase in sales is 13.59%.

b)

Prepare the pro forma income statement and the other ideas to reach the Company P’s goal.

Given information:

Discount rate of 2% on COGS

b)

Explanation of Solution

Compute the COGS:

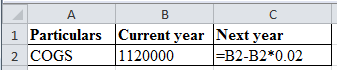

Excel workings:

Table (4)

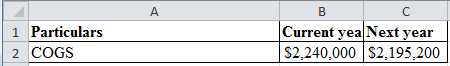

Excel spread sheet:

Table (5)

Hence, the COGS are $2,195,200.

Compute the selling and administration expenses:

Consider selling and administration expenses as X:

Hence, selling and administration expenses are $337,800.

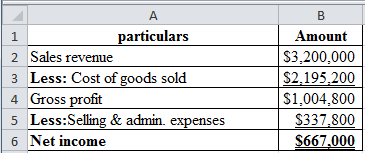

Prepare a pro forma income statement:

Excel spreadsheet:

Table (6)

Hence, the net income is $667,000.

The management cuts the selling and administrative expenses by the amount of $42,200 that is

c)

Whether the company can reach the goal of Company P

c)

Explanation of Solution

Compute projected sales:

Hence, the projected sales are $3,680,000

Compute the projected cost of goods sold:

Hence, the projected cost of goods sold is $2,576,000.

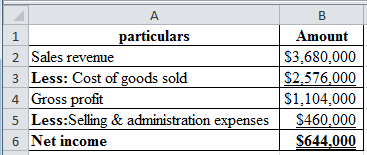

Prepare a pro forma income statement:

Excel spreadsheet:

Table (7)

Hence, the net income is $644,000.

The company cannot reach the goal as the desired profit is less than the actual that is $644,000 is less than the $667,000.

Want to see more full solutions like this?

Chapter 7 Solutions

Fundamental Managerial Accounting Concepts with Access

- Please show me how to solve this financial accounting problem using valid calculation techniques.arrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forwardDenzel Corporation had $8.5 million in gross income, operating expenses of $2.3 million, paid $1.7 million in interest on $15 million borrowed, and paid a dividend of $1.2 million. What is Denzel Corporation's taxable income? a) $3.3 million b) $3 million c) $4.5 million d) $4 millionarrow_forward

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardHow much income should Griffin recognize on this investment in 2024 ?arrow_forwardIf a firm has revenues of $18,500, operating expenses of $10,250, and a tax expense of $2,750, what is the firm's net income?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education