Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 1PEB

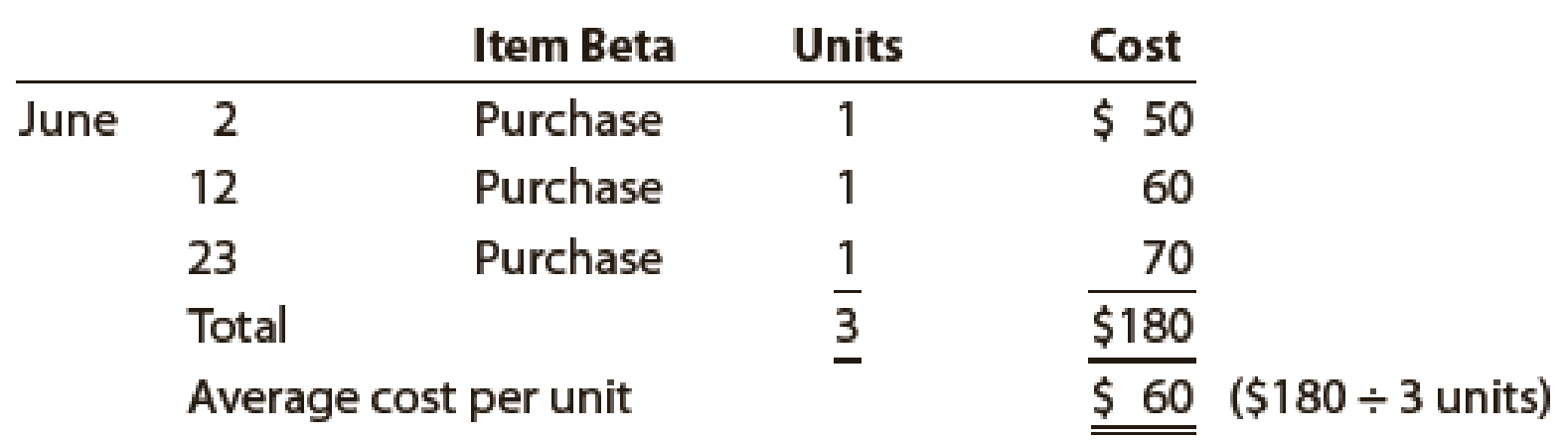

The following three identical units of Item Beta are purchased during June:

Assume that one unit is sold on June 27 for $110.

Determine the gross profit for June and ending inventory on June 30 using the (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average cost methods.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please help me solve this general accounting question using the right accounting principles.

I am searching for the correct answer to this general accounting problem with proper accounting rules.

I am searching for the correct answer to this financial accounting problem with proper accounting rules.

Chapter 7 Solutions

Financial Accounting

Ch. 7 - Prob. 1DQCh. 7 - Why is it important to take a physical inventory...Ch. 7 - Do the terms FIFO, LIFO, and weighted average...Ch. 7 - If merchandise inventory is being valued at cost...Ch. 7 - Which of the three methods of inventory...Ch. 7 - If inventory is being valued at cost and the price...Ch. 7 - Using the following data, how should the...Ch. 7 - The inventory at the end of the year was...Ch. 7 - Hutch Co. sold merchandise to Bibbins Company on...Ch. 7 - A manufacturer shipped merchandise to a retailer...

Ch. 7 - The following three identical units of Item BZ1810...Ch. 7 - The following three identical units of Item Beta...Ch. 7 - Beginning inventory, purchases, and sales for Item...Ch. 7 - Beginning inventory, purchases, and sales for Item...Ch. 7 - Beginning inventory, purchases, and sales for Item...Ch. 7 - Beginning inventory, purchases, and sales for Item...Ch. 7 - Beginning inventory, purchases, and sales for 30xT...Ch. 7 - Beginning inventory, purchases, and sales for...Ch. 7 - The units of an item available for sale during the...Ch. 7 - Prob. 5PEBCh. 7 - On the basis of the following data, determine the...Ch. 7 - Prob. 6PEBCh. 7 - Prob. 7PEACh. 7 - During the taking of its physical inventory on...Ch. 7 - Financial statement data for years ending December...Ch. 7 - Financial statement data for years ending December...Ch. 7 - Triple Creek Hardware Store currently uses a...Ch. 7 - Hardcase Luggage Shop is a small retail...Ch. 7 - Prob. 3ECh. 7 - Assume that the business in Exercise 7-3 maintains...Ch. 7 - Beginning inventory, purchases, and sales data for...Ch. 7 - Assume that the business in Exercise 7-5 maintains...Ch. 7 - The following units of an item were available for...Ch. 7 - Prob. 8ECh. 7 - The following units of a particular item were...Ch. 7 - Assume that the business in Exercise 7-9 maintains...Ch. 7 - Assume that the business in Exercise 7-9 maintains...Ch. 7 - Prob. 12ECh. 7 - Prob. 13ECh. 7 - Assume that a firm separately determined inventory...Ch. 7 - Prob. 15ECh. 7 - Based on the data in Exercise 7-15 and assuming...Ch. 7 - Missouri River Supply Co. sells canoes, kayaks,...Ch. 7 - Fonda Motorcycle Shop sells motorcycles, ATVs, and...Ch. 7 - During 2016, the accountant discovered that the...Ch. 7 - The following data (in thousands) were taken from...Ch. 7 - Kroger, Safeway Inc., and Whole Foods Markets,...Ch. 7 - A business using the retail method of inventory...Ch. 7 - A business using the retail method of inventory...Ch. 7 - A business using the retail method of inventory...Ch. 7 - On the basis of the following data, estimate the...Ch. 7 - The merchandise inventory was destroyed by fire on...Ch. 7 - Based on the following data, estimate the cost of...Ch. 7 - Based on the following data, estimate the cost of...Ch. 7 - The beginning inventory at Funky Party Supplies...Ch. 7 - The beginning inventory at Funky Party Supplies...Ch. 7 - The beginning inventory for Funky Party Supplies...Ch. 7 - The beginning inventory for Funky Party Supplies...Ch. 7 - Prob. 5PACh. 7 - Data on the physical inventory of Ashwood Products...Ch. 7 - Selected data on merchandise inventory, purchases,...Ch. 7 - The beginning inventory of merchandise at Dunne...Ch. 7 - The beginning inventory for Dunne Co. and data on...Ch. 7 - The beginning inventory for Dunne Co. and data on...Ch. 7 - The beginning inventory for Dunne Co. and data on...Ch. 7 - Pappas Appliances uses the periodic inventory...Ch. 7 - Data on the physical inventory of Katus Products...Ch. 7 - Selected data on merchandise inventory, purchases,...Ch. 7 - Anstead Co. is experiencing a decrease in sales...Ch. 7 - The following is an excerpt from a conversation...Ch. 7 - Golden Eagle Company began operations in 2016 by...Ch. 7 - Prob. 4CPCh. 7 - Prob. 5CPCh. 7 - Prob. 6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need guidance with this financial accounting problem using the right financial principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License