EBK CORPORATE FINANCE

4th Edition

ISBN: 9780134202778

Author: DeMarzo

Publisher: PEARSON CUSTOM PUB.(CONSIGNMENT)

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 15P

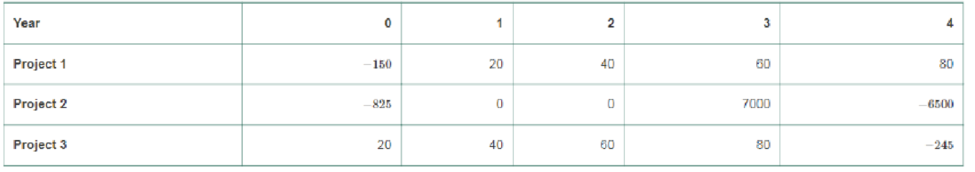

You have 3 projects with the following cash flows:

- a. For which of these projects is the IRR rule reliable?

- b. Estimate the IRR for each project (to the nearest 1%).

- c. What is the

NPV of each project if the cost of capital is 5%? 20%? 50%?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

One year ago, the Jenkins Family Fun Center deposited $3,700 into an investment account for the purpose of buying new equipment four years from today. Today, they

are adding another $5,500 to this account. They plan on making a final deposit of $7,700 to the account next year. How much will be available when they are ready to buy

the equipment, assuming they earn a rate of return of 9 percent?

It is anticipated that Pinnaclewalk will next pay an annual dividend of $2.2 per share in one year. The

firm's cost of equity is 19.2% and its anticipated growth rate is 3.1%. There are 420000 outstanding.

Use the Gordon Growth Model to price Pinnaclewalk's shares. {Express your answer in dollars and

cents}

What is Pinnaclewalk's market capitalization? {Express your answer in millions of dollars rounded to two

decimal places}

Thumbtack's capital structure is shown in table below. If taxes are paid annually and

Thumbtack's combined tax

rate is 36 percent, determine the weighted average cost of capital

Loans

Bonds

12%/yr/semi

$3,000,000

8%/yr/qtr

$4,500,000

Common Stock

$72/share price;

$2,000,000

$8/shr/yr dividend;

Retained Earnings

(Answer should be in %)

1%/yr share

price growth

$1,500,000

Chapter 7 Solutions

EBK CORPORATE FINANCE

Ch. 7.1 - Explain the NPV rule for stand-alone projects.Ch. 7.1 - What does the difference between the cost of...Ch. 7.2 - Prob. 1CCCh. 7.2 - If the IRR rule and the NPV rule lead to different...Ch. 7.3 - Can the payback rule reject projects that have...Ch. 7.3 - Prob. 2CCCh. 7.4 - For mutually exclusive projects, explain why...Ch. 7.4 - What is the incremental RR and what are its...Ch. 7.5 - Prob. 1CCCh. 7.5 - Prob. 2CC

Ch. 7 - Your brother wants to borrow 10,000 from you. He...Ch. 7 - You are considering investing in a start-up...Ch. 7 - You are considering opening a new plant. The plant...Ch. 7 - Your firm is considering the launch of a new...Ch. 7 - Bill Clinton reportedly was paid 15 million to...Ch. 7 - FastTrack Bikes, Inc. is thinking of developing a...Ch. 7 - OpenSeas, Inc. is evaluating the purchase of a new...Ch. 7 - You are CEO of Rivet Networks, maker of ultra-high...Ch. 7 - You are considering an investment in a clothes...Ch. 7 - You have been offered a very long term investment...Ch. 7 - You are considering opening a new plant. The plant...Ch. 7 - Bill Clinton reportedly was paid 15 million to...Ch. 7 - Prob. 13PCh. 7 - Innovation Company is thinking about marketing a...Ch. 7 - You have 3 projects with the following cash flows:...Ch. 7 - You own a coal mining company and are considering...Ch. 7 - Prob. 17PCh. 7 - Prob. 18PCh. 7 - Prob. 19PCh. 7 - Prob. 20PCh. 7 - You are a real estate agent thinking of placing a...Ch. 7 - Prob. 22PCh. 7 - You are deciding between two mutually exclusive...Ch. 7 - You have just started your summer Internship, and...Ch. 7 - Prob. 25PCh. 7 - Prob. 26PCh. 7 - Prob. 27PCh. 7 - Prob. 28PCh. 7 - Prob. 29PCh. 7 - Prob. 30PCh. 7 - Prob. 31PCh. 7 - Prob. 32PCh. 7 - Prob. 33PCh. 7 - Orchid Biotech Company is evaluating several...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have an investment worth $61,345 that is expected to make regular monthly payments of $1,590 for 20 months and a special payment of $X in 3 months. The expected return for the investment is 0.92 percent per month and the first regular payment will be made in 1 month. What is X? Note: X is a positive number.arrow_forwardA bond with a par value of $1,000 and a maturity of 8 years is selling for $925. If the annual coupon rate is 7%, what’s the yield on the bond? What would be the yield if the bond had semiannual payments?arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Fashion would let you make quarterly payments of $14,930 for 8 years at an interest rate of 1.88 percent per quarter. Your first payment to Silver Fashion would be today. Valley Fashion would let you make X monthly payments of $73,323 at an interest rate of 0.70 percent per month. Your first payment to Valley Fashion would be in 1 month. What is X?arrow_forward

- You just bought a new car for $X. To pay for it, you took out a loan that requires regular monthly payments of $1,940 for 12 months and a special payment of $25,500 in 4 months. The interest rate on the loan is 1.06 percent per month and the first regular payment will be made in 1 month. What is X?arrow_forwardYou own 2 investments, A and B, which have a combined total value of $38,199. Investment A is expected to pay $85,300 in 6 years and has an expected return of 18.91 percent per year. Investment B is expected to pay $37,200 in X years and has an expected return of 18.10 percent. What is X?arrow_forwardYou own 2 investments, A and B, which have a combined total value of $51,280. Investment A is expected to pay $57,300 in 5 years and has an expected return of 13.13 percent per year. Investment B is expected to pay $X in 11 years and has an expected return of 12.73 percent per year. What is X?arrow_forward

- Equipment is worth $225,243. It is expected to produce regular cash flows of $51,300 per year for 9 years and a special cash flow of $27,200 in 9 years. The cost of capital is X percent per year and the first regular cash flow will be produced in 1 year. What is X?arrow_forward2 years ago, you invested $13,500. In 2 years, you expect to have $20,472. If you expect to earn the same annual return after 2 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $55,607?arrow_forwardYou plan to retire in 5 years with $650,489. You plan to withdraw $88,400 per year for 20 years. The expected return is X percent per year and the first regular withdrawal is expected in 6 years. What is X?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License