Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 15P

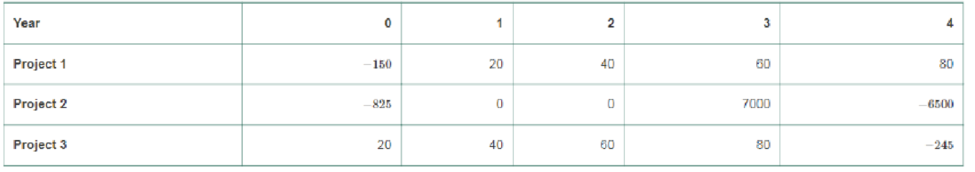

You have 3 projects with the following cash flows:

- a. For which of these projects is the IRR rule reliable?

- b. Estimate the IRR for each project (to the nearest 1%).

- c. What is the

NPV of each project if the cost of capital is 5%? 20%? 50%?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How to rewrite the problem statement, correcting the identified errors of the Business Problem Information and the current Bank Problem Statement (for the discussion: Evaluating a Problem Statement)

Don't used hand raiting and don't used Ai solution

3 years ago, you invested $9,200. In 3 years, you expect to have $14,167. If you expect to earn the same annual return after 3 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $28,798?

Chapter 7 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 7.1 - Explain the NPV rule for stand-alone projects.Ch. 7.1 - What does the difference between the cost of...Ch. 7.2 - Prob. 1CCCh. 7.2 - If the IRR rule and the NPV rule lead to different...Ch. 7.3 - Can the payback rule reject projects that have...Ch. 7.3 - Prob. 2CCCh. 7.4 - For mutually exclusive projects, explain why...Ch. 7.4 - What is the incremental RR and what are its...Ch. 7.5 - Prob. 1CCCh. 7.5 - Prob. 2CC

Ch. 7 - Your brother wants to borrow 10,000 from you. He...Ch. 7 - You are considering investing in a start-up...Ch. 7 - You are considering opening a new plant. The plant...Ch. 7 - Your firm is considering the launch of a new...Ch. 7 - Bill Clinton reportedly was paid 15 million to...Ch. 7 - FastTrack Bikes, Inc. is thinking of developing a...Ch. 7 - OpenSeas, Inc. is evaluating the purchase of a new...Ch. 7 - You are CEO of Rivet Networks, maker of ultra-high...Ch. 7 - You are considering an investment in a clothes...Ch. 7 - You have been offered a very long term investment...Ch. 7 - You are considering opening a new plant. The plant...Ch. 7 - Bill Clinton reportedly was paid 15 million to...Ch. 7 - Prob. 13PCh. 7 - Innovation Company is thinking about marketing a...Ch. 7 - You have 3 projects with the following cash flows:...Ch. 7 - You own a coal mining company and are considering...Ch. 7 - Prob. 17PCh. 7 - Prob. 18PCh. 7 - Prob. 19PCh. 7 - Prob. 20PCh. 7 - You are a real estate agent thinking of placing a...Ch. 7 - Prob. 22PCh. 7 - You are deciding between two mutually exclusive...Ch. 7 - You have just started your summer Internship, and...Ch. 7 - Prob. 25PCh. 7 - Prob. 26PCh. 7 - Prob. 27PCh. 7 - Prob. 28PCh. 7 - Prob. 29PCh. 7 - Prob. 30PCh. 7 - Prob. 31PCh. 7 - Prob. 32PCh. 7 - Prob. 33PCh. 7 - Orchid Biotech Company is evaluating several...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the value at the end of year 3 of a perpetual stream of $70,000 semi-annual payments that begins at the end of year 7? The APR is 12% compounded quarterly.arrow_forwardFirm A must pay $258,000 to firm B in 10 years. The discount rate is 16.44 percent per year. What is the present value of the cash flow associated with this arrangement for firm A? -I got the answer of 56331.87773=56332 (rounded to the nearest dollar), but it says incorrect.arrow_forwardSuppose you have two histograms: one where the mean equals the median, and one where the mean is different from the median. How would you expect the two histograms to differ.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License