FOUND.OF FINANCIAL MANAGEMENT-ACCESS

17th Edition

ISBN: 9781260519969

Author: BLOCK

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 11P

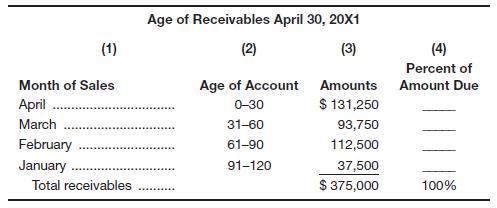

Route Canal Shipping Company has the following schedule for aging of accounts receivable:

a. Fill in column (4) for each month.

b. If the firm had

c. If the firm likes to see its bills collected in 35 days, should it be satisfied with the average collection period?

d. Disregarding your answer to part c and considering the aging schedule for accounts receivable, should the company be satisfied?

e. What additional information does the aging schedule bring to the company that the average collection period may not show?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Could you please help explain what is the research assumptions, research limitations, research delimitations and their intent?

How the research assumptions, research limitations can shape the study design and scope?

How the research delimitations could help focus the study and ensure its feasibility?

What are the relationship between biblical principles and research concepts such as reliability and validity?

What is the concept of the working poor ? Introduction form. Explain.

What is the most misunderstanding of the working poor? Explain.

Chapter 7 Solutions

FOUND.OF FINANCIAL MANAGEMENT-ACCESS

Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - Why would a financial manager want to slow down...Ch. 7 - Use The Wall Street Journal or some other...Ch. 7 - Why are Treasury bills a favorite place for...Ch. 7 - Explain why the bad debt percentage or any other...Ch. 7 - What are three quantitative measures that can be...Ch. 7 - Prob. 8DQCh. 7 - What does the EOQ formula tell us? What assumption...Ch. 7 - Why might a firm keep a safety stock? What effect...

Ch. 7 - If a firm uses a just-in-time inventory system,...Ch. 7 - City Farm Insurance has collection centers across...Ch. 7 - Prob. 2PCh. 7 - Orbital Communications has operating plants in...Ch. 7 - Postal Express has outlets throughout the world....Ch. 7 - Thompson Wood Products has credit sales of...Ch. 7 - Oral Roberts Dental Supplies has annual sales of...Ch. 7 - Knight Roundtable Co. has annual credit sales of...Ch. 7 - Darla’s Cosmetics has annual credit sales of...Ch. 7 - Barney’s Antique Shop has annual credit sales of...Ch. 7 - Mervyn’s Fine Fashions has an average collection...Ch. 7 - Route Canal Shipping Company has the following...Ch. 7 - Nowlin Pipe & Steel has projected sales of 72,000...Ch. 7 - Fisk Corporation is trying to improve its...Ch. 7 - Prob. 14PCh. 7 - Diagnostic Supplies has expected sales of 84,100...Ch. 7 - Wisconsin Snowmobile Corp. is considering a switch...Ch. 7 - Johnson Electronics is considering extending trade...Ch. 7 - Henderson Office Supply is considering a more...Ch. 7 - Fast Turnstiles Co. is evaluating the extension of...Ch. 7 - Slow Roll Drum Co. is evaluating the extension of...Ch. 7 - Global Services is considering a promotional...Ch. 7 - Problems 22-25 are a series and should be...Ch. 7 - Problems 22-25 are a series and should be...Ch. 7 - Problems 22-25 are a series and should be...Ch. 7 - Problems 22-25 are a series and should be...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Problem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardYour father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 4%. He currently has $240,000 saved, and he expects to earn 8% annually on his savings. Required annuity payments Retirement income today $45,000 Years to retirement 10 Years of retirement 25 Inflation rate 4.00% Savings $240,000 Rate of return 8.00% Calculate value of…arrow_forward

- Problem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now…arrow_forward

- You are considering a 10-year, $1,000 par value bond. Its coupon rate is 11%, and interest is paid semiannually. Bond valuation Years to maturity 10 Par value of bond $1,000.00 Coupon rate 11.00% Frequency interest paid per year 2 Effective annual rate 8.78% Calculation of periodic rate: Formulas Nominal annual rate #N/A Periodic rate #N/A Calculation of bond price: Formulas Number of periods #N/A Interest rate per period 0.00% Coupon payment per period #N/A Par value of bond $1,000.00 Price of bond #N/Aarrow_forwardHow much do investor psychology and market sentiment play into stock price movements? Do these emotional reactions having a bigger impact on short-term swings, or do they also shape long-term trends in a meaningful way?arrow_forwardExplain The business of predatory tax return preparation, including: How they deceive the working poor,The marketing tactics the preparers use, and Other than paying high fees, what negative impact can the use of these unqualified and unregulated preparers have on the taxpayer?arrow_forward

- Explain the changes in tax return preparation you would like to see in Alabama, based on what has been successful in other states.arrow_forwardExplain the understanding (or misunderstanding) of the working poor with tax return preparation within one page report.arrow_forwardExplain the regulations or requirements for tax return preparers in Alabama.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The management of receivables Introduction - ACCA Financial Management (FM); Author: OpenTuition;https://www.youtube.com/watch?v=tLmePnbC3ZQ;License: Standard YouTube License, CC-BY