Concept explainers

Comprehensive Problem 1, Period 2: The Accounting Cycle

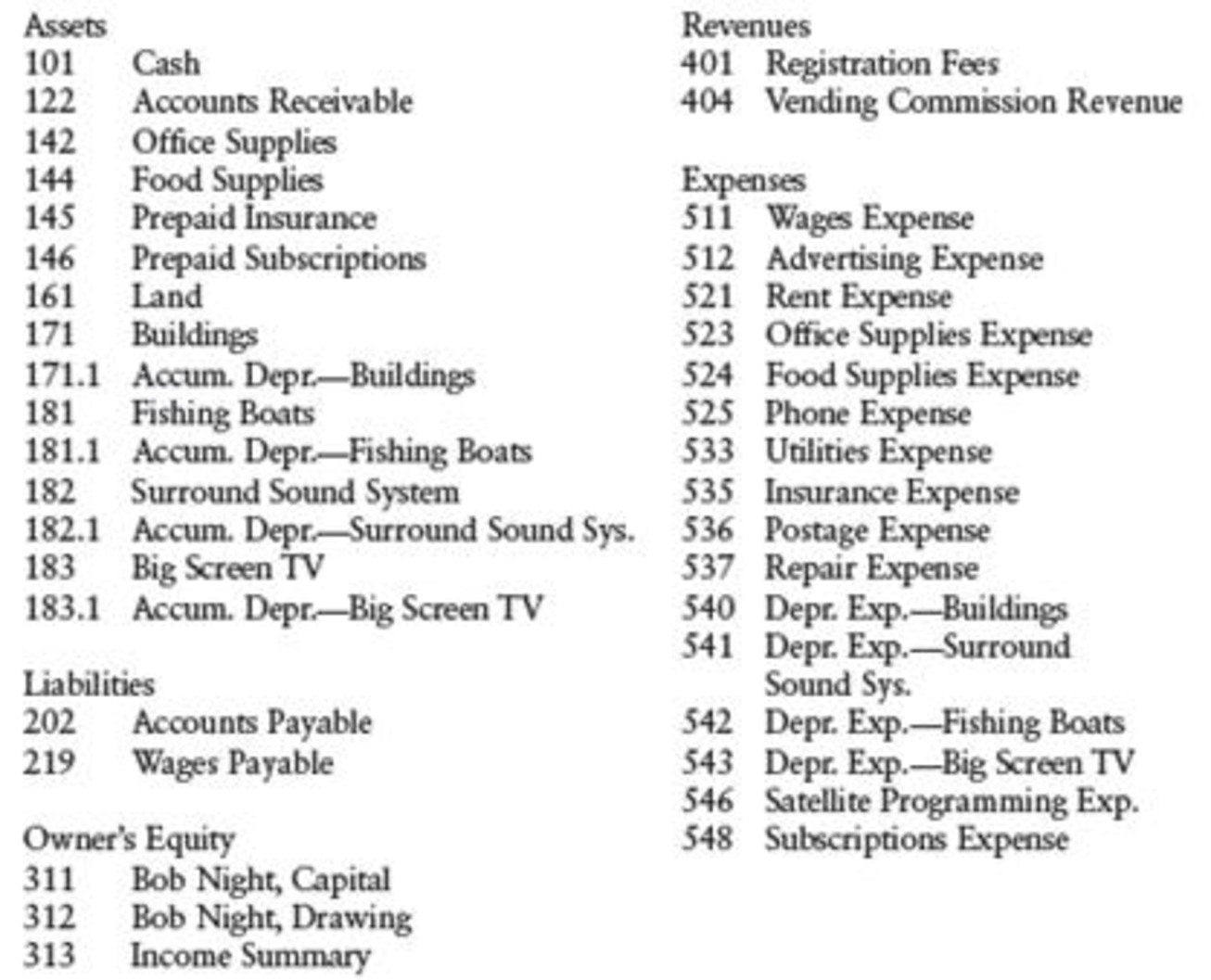

During the month of May 20--, The General’s Favorite Fishing Hole engaged in the following transactions. These transactions required an expansion of the chart of accounts as shown below.

May 1 In order to provide snacks for guests on a 24-hour basis, Night signed a contract with Snack Attack. Snack Attack will install vending machines with food and drinks and pay a 10% commission on all sales. Estimated payments are made at the beginning of each month. Night received a check for $200, the estimated commission on sales for May.

2 Night purchased a surround sound system and big screen TV with a digital satellite system for the guest lounge. The surround sound system cost $3,600 and has an estimated useful life of five years and no salvage value. The TV cost $8,000, has an estimated useful life of eight years, and has a salvage value of $800. Night paid cash for both items.

2 Paid for May’s programming on the new digital satellite system, $125.

3 Night’s office manager returned $100 worth of office supplies to Gordon Office Supply. Night received a $100 reduction on the account.

3 Deposited registration fees, $52,700.

May 3 Paid rent for lodge and campgrounds for the month of May, $40,000.

3 In preparation for the purchase of a nearby campground, Night invested an additional $600,000.

4 Paid Gordon Office Supply on account, $400.

4 Purchased the assets of a competing business and paid cash for the following: land, $100,000; lodge, $530,000; and fishing boats, $9,000. The lodge has a remaining useful life of 50 years and a $50,000 salvage value. The boats have remaining lives of five years and no salvage value.

5 Paid May’s insurance premium for the new camp, $1,000. (See above transaction.)

5 Purchased food supplies from Acme Super Market on account, $22,950.

5 Purchased office supplies from Gordon Office Supplies on account, $1,200.

7 Night paid $40 each for one-year subscriptions to Fishing Illustrated, Fishing Unlimited, and Fish Master. The magazines are published monthly.

10 Deposited registration fees, $62,750.

13 Paid wages to fishing guides, $30,000. (Don’t forget wages payable.)

14 A guest became ill and was unable to stay for the entire week. A refund was issued in the amount of $1,000.

17 Deposited registration fees, $63,000.

19 Purchased food supplies from Acme Super Market on account, $18,400.

21 Deposited registration fees, $63,400.

23 Paid $2,500 for advertising spots on National Sports Talk Radio.

25 Paid repair fee for damaged boat, $850.

27 Paid wages to fishing guides, $30,000.

28 Paid $1,800 for advertising spots on billboards.

29 Purchased food supplies from Acme Super Market on account, $14,325.

30 Paid utilities bill, $3,300.

30 Paid phone bill, $1,800.

30 Paid Acme Super Market on account, $47,350.

31 Bob Night withdrew cash for personal use, $7,500.

Adjustment information at the end of May is provided below.

- (a) Total vending machine sales were $2,300 for the month of May. A 10% commission is earned on these sales.

- (b) Straight-line

depreciation is used for the 10 boats purchased on April 2 for $60,000. The useful life for these assets is five years and there is no salvage value. A full month’s depreciation was taken in April on these boats. Straight-line depreciation is also used for the two boats purchased in May. Make one adjusting entry for all depreciation on the boats. - (c) Straight-line depreciation is used to depreciate the surround sound system.

- (d) Straight-line depreciation is used to depreciate the big screen TV.

- (e) Straight-line depreciation is used for the building purchased in May.

- (f) On April 2, Night paid $9,000 for insurance during the six-month camping season. May’s portion of this premium was used up during this month.

- (g) Night received his May issues of Fishing Illustrated, Fishing Unlimited, and Fish Master.

- (h) Office supplies remaining on hand, $150.

- (i) Food supplies remaining on hand, $5,925.

- (j) Wages earned, but not yet paid at the end of May, $6,000.

REQUIRED

- 1. Enter the transactions in a general journal. Enter transactions from May 1–4 on page 5, May 5–28 on page 6, and the remaining entries on page 7. To save time and space, don’t enter descriptions for the

journal entries. - 2. Post the entries to the general ledger. (If you are not using the working papers that accompany this text, you will need to enter the account titles, account numbers, and balances from April 30 in the general ledger accounts.)

- 3. Prepare a

trial balance on a work sheet. - 4. Complete the work sheet.

- 5. Journalize the

adjusting entries on page 8 of the general journal. - 6. Post the adjusting entries to the general ledger.

- 7. Prepare the income statement.

- 8. Prepare the statement of owner’s equity.

- 9. Prepare the

balance sheet . - 10. Journalize the closing entries on page 9 of the general journal.

- 11. Post the closing entries to the general ledger.

- 12. Prepare a post-closing trial balance.

Trending nowThis is a popular solution!

Chapter 6A Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- help me to solve this questionsarrow_forwardThe standard cost of Wonder Walkers includes 3 units of direct materials at $9.00 per unit. During July, the company buys 40,000 units of direct materials at $8.25 and uses those materials to produce 15,000 units. Compute the total, price, and quantity variances for materials.arrow_forwardBranson paid $465,000 cash for all of the outstanding common stock of Wolfpack, Incorporated, on January 1, 2023. On that date, the subsidiary had a book value of $340,000 (common stock of $200,000 and retained earnings of $140,000), although various unrecorded royalty agreements (10-year remaining life) were assessed at a $100,000 fair value. Any remaining excess fair value was considered goodwill. In negotiating the acquisition price, Branson also promised to pay Wolfpack's former owners an additional $50,000 if Wolfpack's income exceeded $120,000 total over the first two years after the acquisition. At the acquisition date, Branson estimated the probability-adjusted present value of this contingent consideration at $35,000. On December 31, 2023, based on Wolfpack's earnings to date, Branson increased the value of the contingency to $40,000. During the subsequent two years, Wolfpack reported the following amounts for income and dividends: Dividends Declared Year Net Income $ 65,000…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning