College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 7SPA

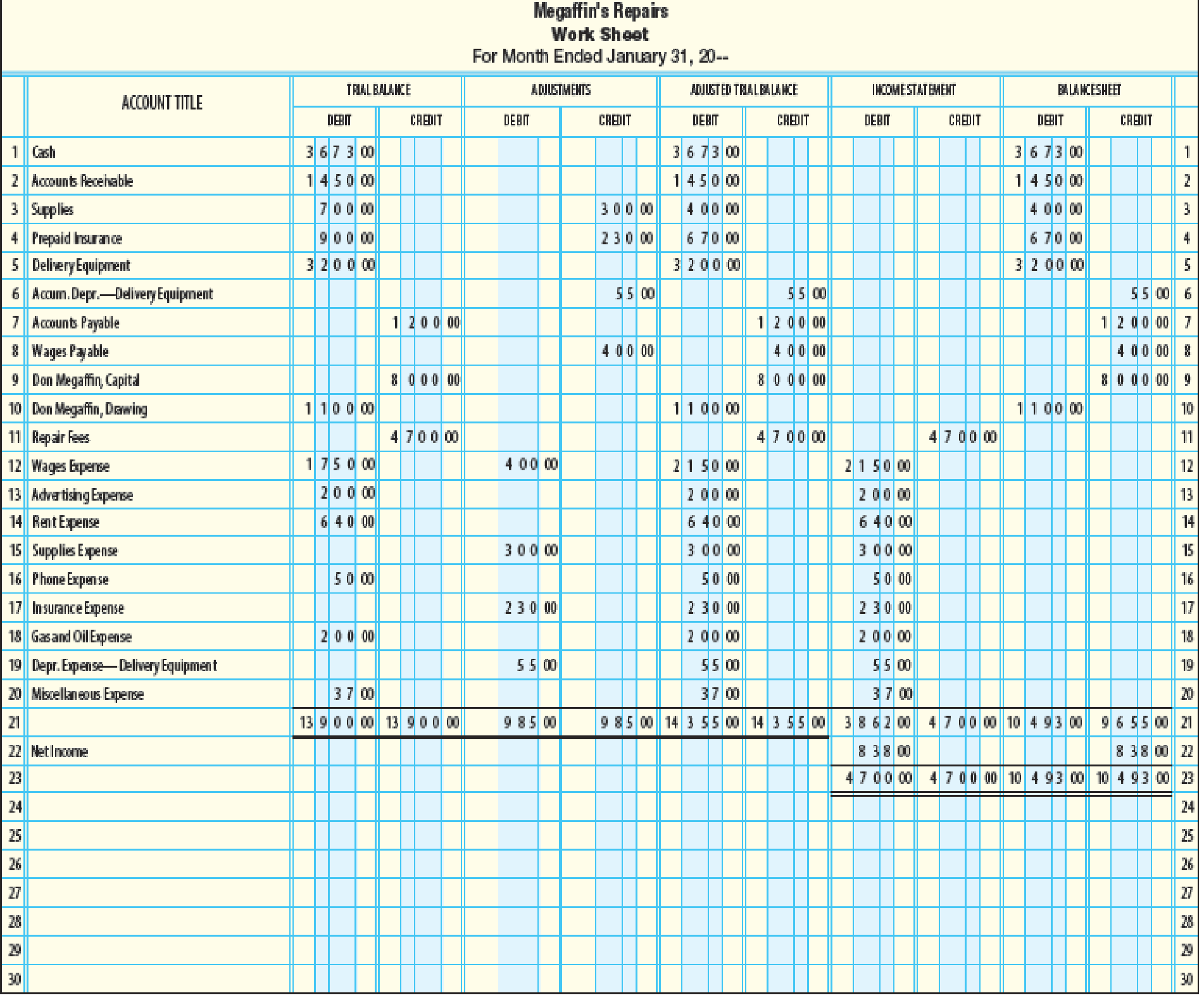

FINANCIAL STATEMENTS Page 206 shows a work sheet for Megaffin’s Repairs. No additional investments were made by the owner during the month.

REQUIRED

1. Prepare an income statement.

2. Prepare a statement of owner’s equity.

3. Prepare a

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

hello tutor please help me

What is the gross margin percentage of this financial accounting question?

managerial accoun

Chapter 6 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 6 - Expenses are listed on the income statement as...Ch. 6 - Additional investments of capital during the month...Ch. 6 - Prob. 3TFCh. 6 - Prob. 4TFCh. 6 - Temporary accounts are closed at the end of each...Ch. 6 - Multiple choice Which of these types of accounts...Ch. 6 - Which of these accounts is considered a temporary...Ch. 6 - Which of these is the first step in the closing...Ch. 6 - The ________ is prepared after closing entries are...Ch. 6 - Steps that begin with analyzing source documents...

Ch. 6 - Joe Fisher operates Fisher Consulting. A partial...Ch. 6 - Prob. 2CECh. 6 - Prob. 3CECh. 6 - Identify the source of the information needed to...Ch. 6 - Describe two approaches to listing the expenses in...Ch. 6 - Prob. 3RQCh. 6 - If additional investments were made during the...Ch. 6 - Identify the sources of the information needed to...Ch. 6 - What is a permanent account? On which financial...Ch. 6 - Prob. 7RQCh. 6 - Prob. 8RQCh. 6 - Prob. 9RQCh. 6 - Prob. 10RQCh. 6 - List the 10 steps in the accounting cycle.Ch. 6 - Prob. 1SEACh. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS Page 206 shows a work sheet...Ch. 6 - PROBLEM 6-7A CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - INCOME STATEMENT From the partial work sheet for...Ch. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS A work sheet for Juanitas...Ch. 6 - PROBLEM 6-7B CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - MASTERY PROBLEM Elizabeth Soltis owns and operates...Ch. 6 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License