Lorena likes to play golf. The number of times per year that she plays depends on both the

a. Using the data under D1 and D2, calculate the cross elasticity of Lorena’s demand for golf at all three prices. (To do tins, apply the midpoints approach to the cross

b. Using the data under D2 and D3, calculate the income elasticity of Lorena's demand for golf at all three prices. (To do this, apply the midpoint approach to the income elasticity of demand.) Is the income elasticity the same at all three prices? Is golf an inferior good?

Subpart (a):

Explanation of Solution

In scenario D1, Lorena’s income is $50,000 per year and movies cost $9 each. In scenario D2, Lorena’s income is also $50,000 per year, but the price to watch a movie rises to $11. And in scenario D3, Lorena’s income rises up to $70,000 per year while the movies cost $11.

Cross price elasticity of demand can be calculated by using the midpoint formula:

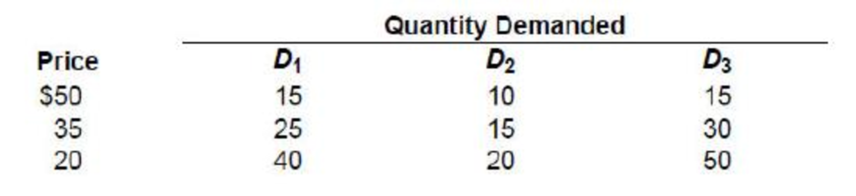

Table -1 shows the demand schedule for the three different goods.

Table -1

| Price | Demand 1 | Demand 2 | Demand 3 |

| 50 | 15 | 10 | 15 |

| 35 | 25 | 15 | 30 |

| 20 | 40 | 20 | 50 |

Substitute the respective values in Equation (1), to calculate the cross elasticity when the demand changes from 15 units to 10 units and the price changes from $9 to $11:

Substitute the respective values in Equation (1), to calculate the cross elasticity When the demand changes from 25 units to 15 units and the price changes from $9 to $11.

Price elasticity is 2.5 (Ignore the sign).

Substitute the respective values in Equation (1), to calculate the cross elasticity when the demand changes from 40 units to 20 units and the price changes from $9 to $11:

Price elasticity is 3.33.

It can be concluded that the cross price elasticities are not same in all three cases (for three different prices). As the price decreases, the percentage change in quantity increases.

In all three cases, the cross price elasticities are negative which indicates that golf and movie are complements. If the price of the movie increases, the quantity of movie falls and the consumption of golf games also decline. This implies that, the consumption of a movie and golf games decline as the price of movies rises and vice versa.

Concept introduction:

Cross price elasticity of demand: The cross price elasticity of demand is the change in the quantity demanded for a good due to the price change in another good. The sign of the coefficients of cross price elasticity of demand tells that whether the good is a complement or substitute. If the cross price elasticity of demand is positive, both goods are substitutes. Two goods are complement to each other if the cross price elasticity of demand is negative.

Income elasticity of demand: The income elasticity of demand is the change in the quantity demand for a good due to the change in income. The sign of the coefficients of income elasticity of demand tells whether the good is normal or inferior. If the income elasticity of demand is positive, the good is considered to be a normal good. The good is an inferior good if the income elasticity of demand is negative.

Subpart (b):

Explanation of Solution

Income elasticity of demand can be calculated by using the midpoint formula:

Substitute the respective values in Equation (2), to calculate the cross elasticity when the quantity changes from 10 units to 15 units and the income changes from $50,000 to $70,000.

Substitute the respective values in Equation (2), to calculate the cross elasticity when the quantity changes from 15 units to 30 units and the income changes from $50,000 to $70,000.

Substitute the respective values in Equation (2), to calculate the cross elasticity when the quantity changes from 20 units to 50 units and the income changes from $50,000 to $70,000, required income elasticity of demand is given by;

In all three cases, the income elasticity of demand is not the same. As the price declines, the change in the quantity demanded becomes more sensitive to the change in income. The demand for the golf games is more sensitive to the income at lower prices.

Here, signs of the coefficients of income elasticity of demand are positive which indicates that, as the income increases, the demand for golf games increases and as income decreases, the demand for the golf game falls. That is the income and the demand for golf is positively related. Thus, the golf game is a considered to be a normal good.

If the demand for a good increases with the decrease in income, the sign of the coefficients of income elasticity of demand is negative and thus the good is an inferior good.

In short, if the sign of the coefficient of income elasticity of demand is positive, the good is a normal good and if it is negative, the good is an inferior good.

The golf game is a normal good and not an inferior good.

Concept introduction:

Cross price elasticity of demand: The cross price elasticity of demand is the change in the quantity demanded for a good due to the price change in another good. The sign of the coefficients of cross price elasticity of demand tells that whether the good is a complement or substitute. If the cross price elasticity of demand is positive, both goods are substitutes. Two goods are complement to each other if the cross price elasticity of demand is negative.

Income elasticity of demand: The income elasticity of demand is the change in the quantity demand for a good due to the change in income. The sign of the coefficients of income elasticity of demand tells whether the good is normal or inferior. If the income elasticity of demand is positive, the good is considered to be a normal good. The good is an inferior good if the income elasticity of demand is negative.

Want to see more full solutions like this?

Chapter 6 Solutions

Economics: Principles, Problems, & Policies (McGraw-Hill Series in Economics) - Standalone book

- Brazil, Russia, India, China, and South Africa, also known as BRICS, are emerging countries poised to be dominant economic players in the 21st century. What are some of the political, legal and economic conditions that help or hinder economic expansion for these countries?arrow_forwardExplain what is Microeconomics? Why is it important for all of us to understand what are the drivers in microeconomics?arrow_forwardThe production function for a product is given by Q =100KL.if the price of capital is 120 dollars per day and the price of labor 30 dollars per day what is the minimum cost of producing 1000 units of output ?arrow_forward

- خصائص TVAarrow_forwardplease show complete solution, step by step, thanksarrow_forwardTo determine the benefits of extending hours of operation for a food truck business, the couple should calculate additional revenue, break-even analysis, market demand, and raise prices. They should analyze competitors' prices and customer sensitivity to price changes, determine price elasticity, and test the strategy by implementing a slight price increase and monitoring sales closely. If costs exceed revenues, the couple should analyze their financials, evaluate their business model, explore new revenue streams, and consider long-term viability. They should analyze their financial statements to identify high costs and areas for reduction, evaluate their business model based on market demand, and explore new revenue streams like catering, special events, or partnerships with local businesses. Long-term viability is a key consideration, as if the business still operates at a loss after making adjustments, it may be necessary to consider shutting down. Staying in business should be…arrow_forward

- Respond to following post. You can charge higher prices if the parents think these are valuable by providing different services such as extended hours, healthy lunches, and smaller staff-to-child ratios. But pushing for prices much higher won’t make sense unless parents think the added value is worth the price hike. You should research your local parents to find out what they want. If you want your business to be profitable, then focus on your strengths, do great work and have a reputation. Promote your special products and keep your prices low. If you want to see if you’re making money, keep a log of all your profits and losses. You’re making money if you’re earning more than you’re losing. A break-even analysis can help you figure out how many customers you need to eat and start making money. Keep an eye on your budget so you don’t get off track.arrow_forwardIf you are willing to pay up to $8 for your first cup of coffee the blank of your first cup of coffee is $8arrow_forwardnot use ai pleasearrow_forward

- (Figure: Good Y and Good X) Suppose the budget constraint shifted from constraint 2 to constraint 1. What could have caused this change? Quantity of good Y 18 16 14 Budget constraint 2 12- 10 8 Budget constraint 1 6 4 2 0 2 4 6 8 10 12 14 16 18 20 Quantity of good X an increase in income and an decrease in the price of good X relative to that of good Y a decrease in income an decrease in the price of good X and no change in the price of Y a decrease in income and an increase in the price of good X relative to that of good Y an increase in income a decrease in the price of good X relative to that of good Yarrow_forwardSuppose you have the three scenarios proposed below. Using the language of the Levy and Meltzer paper, Scenario(s). Scenario(s) _ can best be described as a randomized experiment. can best be described as an observational study, and Scenario A: Researchers randomly assign some individuals to a high-intensity workout program and others to a low-intensity program. They then track the participants to see how their cardiovascular health changes over time. Scenario B: Researchers randomly assign individuals to receive varying levels of nutrition education. They track participants and see how eating habits changed. Scenario C: Researchers have data on individuals' workout habits and their cardiovascular health. They use this data to describe the relationship between workout intensity and cardiovascular health. A; B and C A; B and C × A and B; C C; A and B B and C; Aarrow_forwardSuppose you observe that when the price of a particular vitamin supplement_ by 3%, the quantity purchased increased by 0.9%. This implies that this vitamin supplement is price in demand and that the price elasticity of demand is equal to _ ☑ rises; inelastic; 0.3 O O rises; inelastic; 0.9 falls; inelastic; 0.3 rises; elastic; 3 falls; inelastic; 0.9arrow_forward

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning