Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 7EA

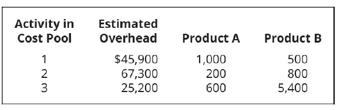

Rex Industries has two products. They manufactured 12,539 units of product A and 8.254 units of product B. The data are:

What is the activity rate for each cost pool?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please explain the solution to this general accounting problem using the correct accounting principles.

Solve this

I need guidance with this general accounting problem using the right accounting principles.

Chapter 6 Solutions

Principles of Accounting Volume 2

Ch. 6 - Active Frame, Inc., manufactures clear and tinted...Ch. 6 - TyeDye Lights makes two products: Party and...Ch. 6 - Which is not a step in analyzing the cost driver...Ch. 6 - Overhead costs are assigned to each product based...Ch. 6 - Which of the following is a reason a company would...Ch. 6 - Which is the correct formula for computing the...Ch. 6 - A company anticipates the cost to heat the...Ch. 6 - A company calculated the predetermined overhead...Ch. 6 - Which is not a step In activity-based costing? A....Ch. 6 - What is the proper order of tasks In an ABC...

Ch. 6 - Which is not a task typically associated with ABC...Ch. 6 - Which statement is correct? A. Activity-based cost...Ch. 6 - Activity-based costing systems: A. use a single...Ch. 6 - Activity-based costing is preferable in a system:...Ch. 6 - Absorption costing is also referred to as: A....Ch. 6 - Under variable costing, a unit of product includes...Ch. 6 - Under absorption costing, a unit of product...Ch. 6 - A downside to absorption casting is: not including...Ch. 6 - When the number of units in ending inventory...Ch. 6 - Product costs under variable costing are...Ch. 6 - What is the predetermined overhead rate, and when...Ch. 6 - When is an activity-based costing system better...Ch. 6 - What is the advantage of labeling activities as...Ch. 6 - What conditions are necessary to designate an...Ch. 6 - For each cost pool, identify an appropriate cost...Ch. 6 - How is the primary focus of activity-based costing...Ch. 6 - What are the primary differences between...Ch. 6 - How are service companies similar or different...Ch. 6 - How are costs allocated in an ABC system?Ch. 6 - In production, what has changed to allow ABC...Ch. 6 - Why is it important to know the true cost for a...Ch. 6 - What is the primary difference between variable...Ch. 6 - Why would managers prefer variable costing over...Ch. 6 - Why is absorption costing the method allowable for...Ch. 6 - Can a company gather information for both variable...Ch. 6 - Steeler Towel Company estimates its overhead to be...Ch. 6 - Crystal Pools estimates overhead will utilize...Ch. 6 - A company estimated 100,000 direct labor hours and...Ch. 6 - Cozy, Inc., manufactures small and large blankets....Ch. 6 - Identify appropriate cost drivers for these cost...Ch. 6 - Match the activity with the most appropriate cost...Ch. 6 - Rex Industries has two products. They manufactured...Ch. 6 - Rex Industries has identified three different...Ch. 6 - Customs makes two types of hats: polyester (poly)...Ch. 6 - Customs has three cost pools and an associated...Ch. 6 - Potterii sells its products to large box stores...Ch. 6 - Assign each of the following expenses to either...Ch. 6 - Tri-bikes manufactures two different levels of...Ch. 6 - Cool Pool has these costs associated with...Ch. 6 - Using this information from Planters. Inc., what...Ch. 6 - Green Bay Cheese Company estimates its overhead to...Ch. 6 - Boarders estimates overhead will utilize 160,000...Ch. 6 - A company estimated 50,000 direct labor hours and...Ch. 6 - Cozy, Inc., manufactures small and large blankets....Ch. 6 - Identify appropriate cost drivers for these cost...Ch. 6 - Match the activity with the most appropriate cost...Ch. 6 - Rocks Industries has two products. They...Ch. 6 - Rocks Industries has identified three different...Ch. 6 - Frenchys makes two types of scarves: polyester...Ch. 6 - Frenchys has three cost pools and an associated...Ch. 6 - Carboni recently added a carbon line in addition...Ch. 6 - Assign each of the following expenses to either...Ch. 6 - Stacks manufactures two different levels of hockey...Ch. 6 - Crafts 4 All has these costs associated with...Ch. 6 - Using this information from Outdoor Grills, what...Ch. 6 - Colonels uses a traditional cost system and...Ch. 6 - Five Card Draw manufactures and sells 24,000 units...Ch. 6 - A local picnic table manufacturer has budgeted...Ch. 6 - Explain how each activity in this list can be...Ch. 6 - Medical Tape makes two products: Generic and...Ch. 6 - Box Springs, Inc., makes two sizes of box springs:...Ch. 6 - Please use the information from this problem for...Ch. 6 - A company has traditionally allocated its overhead...Ch. 6 - Carltons Kitchens makes two types of pasta makers:...Ch. 6 - Carltons Kitchens three cost pools and overhead...Ch. 6 - Lampierre makes brass and gold frames. The company...Ch. 6 - Portable Seats makes two chairs: folding and...Ch. 6 - Grainger Company produces only one product and...Ch. 6 - Summarized data for Walrus Co. for its first year...Ch. 6 - Happy Trails has this information for its...Ch. 6 - Appliance Apps has the following costs associated...Ch. 6 - This information was collected for the first year...Ch. 6 - Bobcat uses a traditional cost system and...Ch. 6 - Five Card Draw manufactures and sells 10,000 units...Ch. 6 - A local picnic table manufacturer has budgeted the...Ch. 6 - Explain how each activity in this list can be...Ch. 6 - Wrappers Tape makes two products: Simple and...Ch. 6 - Box Springs. Inc., makes two sizes of box springs:...Ch. 6 - Please use the information from this problem for...Ch. 6 - A company has traditionally allocated its overhead...Ch. 6 - Caseys Kitchens makes two types of food smokers:...Ch. 6 - Caseys Kitchens three cost pools and overhead...Ch. 6 - Lampierre makes silver and gold candlesticks. The...Ch. 6 - Portable Seats makes two chairs: folding and...Ch. 6 - Submarine Company produces only one product and...Ch. 6 - Summarized data for Backdraft Co. for its first...Ch. 6 - Trail Outfitters has this information for its...Ch. 6 - Wifi Apps has these costs associated with its...Ch. 6 - This information was collected for the first year...Ch. 6 - What conditions are optimal for using traditional...Ch. 6 - College Cases sells cases for electronic devices...Ch. 6 - How would a service industry apply activity-based...Ch. 6 - Cape Cod Adventures makes foam noodles with sales...Ch. 6 - In designing a bonus structure to reward your...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Communication Activity 9-1

In 150 words or fewer, explain the different methods that can be used to calculate d...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Using the numbers in the preceding question, what is the size of Ectenias labor force? a. 50 b. 60 c. 70 d. 80

Principles of Economics (MindTap Course List)

The monthly lease payment of fair market value lease. Introduction: A lease is a contract between the lessee an...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Quick ratio and current ratio (Learning Objective 7) 1520 min. Consider the following data COMPANY A B C D Cash...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardOakridge Hardware has assets equal to $475,000 and liabilities equal to $290,000 at year-end. What is the total equity for Oakridge Hardware at year-end? HELParrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY