Effect of

The following events apply to Gulf Seafood for the 2018 fiscal year:

1. The company started when it acquired $60,000 cash by issuing common stock.

2. Purchased a new cooktop that cost $40,000 cash.

3. Earned $72,000 in cash revenue.

4. Paid $25,000 cash for salaries expense.

5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, 2018, the cooktop has an expected useful life of four years and an estimated salvage value of $4,000. Use straightline depreciation. The

Required

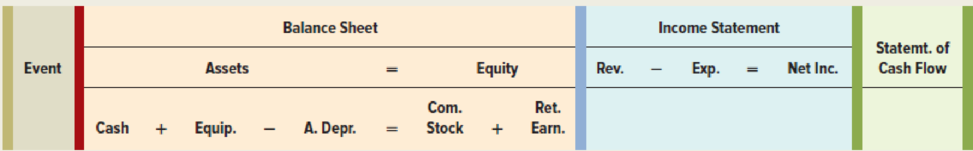

a. Record the previous transactions in a horizontal statements model like the following one.

b. What amount of depreciation expense would Gulf Seafood report on the 2018 income statement?

c. What amount of

d. Would the

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Dennis Green and Peter Olinto are equal partners in Foxy PartneDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). 2. Cost of goods sold 3. Salaries and wages 4. Guaranteed payments to partners 5. Repairs and maintenance 6. Bad debts 7. Rent 8. Depreciation 9. Other deductions 10. Ordinary business income (loss)arrow_forwardIf a business pays off a loan, which of the following will occur?A. Assets and liabilities increaseB. Assets and liabilities decreaseC. Only liabilities increaseD. Equity decreasesarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementneedarrow_forward

- No chatgpt! Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings StatementNo Aiarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrectarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrect solutuarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentarrow_forwardChoose the items of income or expense that belong in the described areas of Form 1120, Schedule M-1 (Sections: Income subject to tax not recorded on books, Expenses recorded on books this year not deducted on this return, Income recorded on books this year not included on this return, and Deductions on this return not charged against book income.) Note the appropriate amount for the item selected under each section. If the amount decreases taxable income relative to book income, provide the amount as a negative number. If the amount increases taxable income relative to book income, provide the amount as a positive number. The following adjusted revenue and expense accounts appeared in the accounting records of Pashi, Inc., an accrual basis taxpayer, for the year ended December 31, Year 2. Revenues Net sales $3,000,000 Interest 18,000 Gains on sales of stock 5,000 Key-man life insurance proceeds 100,000 Subtotal $3,123,000 Costs and Expenses Cost of…arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education