SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

5th Edition

ISBN: 9781264010653

Author: Edmonds

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6E

LO 8-1 Exercise 8-6 A Allocating costs for a basket purchase

Pitney Co. purchased an office building, land, and furniture for $500,000 cash. The appraised value of the assets was as follows:

| Land | $180,000 |

| Building | 300,000 |

| Furniture | 120,000 |

| Total | $600,000 |

Required

- a. Compute the amount to be recorded on the books for each asset.

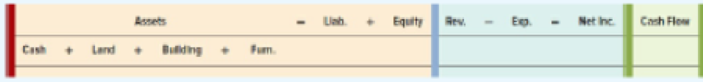

- b. Show the purchase in a horizontal statements model like the following one:

- c. Prepare the general

journal entry to record the purchase.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please explain the solution to this general accounting problem with accurate principles.

Can you explain the correct approach to solve this general accounting question?

What is the original cost of the equipment?

Chapter 6 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

Ch. 6 - 1. What is the difference between the functions of...Ch. 6 - Prob. 2QCh. 6 - Prob. 3QCh. 6 - 4. Define depreciation. What kind of asset...Ch. 6 - Prob. 5QCh. 6 - Prob. 6QCh. 6 - Prob. 7QCh. 6 - 8. Explain the historical cost concept as it...Ch. 6 - Prob. 9QCh. 6 - Prob. 10Q

Ch. 6 - Prob. 11QCh. 6 - 12. Explain straight-line, units-of-production,...Ch. 6 - Prob. 13QCh. 6 - Prob. 14QCh. 6 - Prob. 15QCh. 6 - Prob. 16QCh. 6 - 17. What is salvage value?Ch. 6 - Prob. 18QCh. 6 - Prob. 19QCh. 6 - Prob. 20QCh. 6 - Prob. 21QCh. 6 - 22. Why would a company choose to depreciate one...Ch. 6 - Prob. 23QCh. 6 - 27. How are capital expenditures made to improve...Ch. 6 - Prob. 25QCh. 6 - Prob. 26QCh. 6 - Prob. 27QCh. 6 - Prob. 28QCh. 6 - Prob. 1ECh. 6 - Prob. 2ECh. 6 - Prob. 3ECh. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - LO 8-1 Exercise 8-6 A Allocating costs for a...Ch. 6 - Effect of depreciation on the accounting equation...Ch. 6 - Prob. 8ECh. 6 - Prob. 9ECh. 6 - Prob. 10ECh. 6 - Events related to the acquisition, use, and...Ch. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Prob. 14ECh. 6 - Prob. 15ECh. 6 - Prob. 16ECh. 6 - Prob. 17ECh. 6 - Prob. 18ECh. 6 - Prob. 19ECh. 6 - Prob. 20ECh. 6 - Prob. 21ECh. 6 - Accounting for acquisition of assets, including a...Ch. 6 - Calculating depreciation expense using three...Ch. 6 - Determining the effect of depreciation expense on...Ch. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - Prob. 27PCh. 6 - Prob. 28PCh. 6 - Revision of estimated salvage value Delta Machine...Ch. 6 - Purchase and use of tangible asset: Three...Ch. 6 - Recording continuing expenditures for plant assets...Ch. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35PCh. 6 - Performing ratio analysis using real-world data...Ch. 6 - Prob. 1ATCCh. 6 - ATC 6-3 Research Assignment Comparing Microsofts...Ch. 6 - Prob. 4ATCCh. 6 - ATC 6-5 Ethical Dilemma Whats an expense? Several...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Terra Manufacturing purchased equipment for $55,000 with a residual value of $7,500 and an estimated useful life of 10 years. What is the annual depreciation under the straight-line method? a) $5,500.00 b) $4,750.00 c) $5,250.00 d) $4,375.50arrow_forward??!!arrow_forwardSolve with explanation and accountingarrow_forward

- Please show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardAK Technologies sold equipment for $83,000. The equipment had an original cost of $190,000 and accumulated depreciation of $92,000. Ignoring the tax effect, as a result of the sale, how will net income be affected?arrow_forwardKindly help me with this financial accounting questions not use chart gpt please fast given solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY