AKL Foundry manufactures metal components for different kinds of equipment used by the aerospace, commercial aircraft, medical equipment, and electronic industries. The company uses investment casting to produce the required components. Investment casting consists of creating, in wax, a replica of the final product and pouring a hard shell around it. After removing the wax, molten metal is poured into the resulting cavity. What remains after the shell is broken is the desired metal object ready to be put to its designated use.

Metal components pass through eight processes: gating, shell creating, foundry work, cutoff, grinding, finishing, welding, and strengthening. Gating creates the wax mold and clusters the wax pattern around a sprue (a hole through which the molten metal will be poured through the gates into the mold in the foundry process), which is joined and supported by gates (flow channels) to form a tree of patterns. In the shell-creating process, the wax molds are alternately dipped in a ceramic slurry and a fluidized bed of progressively coarser refractory grain until a sufficiently thick shell (or mold) completely encases the wax pattern. After drying, the mold is sent to the foundry process. Here, the wax is melted out of the mold, and the shell is fired, strengthened, and brought to the proper temperature. Molten metal is then poured into the dewaxed shell. Finally, the ceramic shell is removed, and the finished product is sent to the cutoff process, where the parts are separated from the tree by the use of a band saw. The parts are then sent to the grinding process, where the gates that allowed the molten metal to flow into the ceramic cavities are ground off using large abrasive grinders. In the finishing process, rough edges caused by the grinders are removed by small handheld pneumatic tools. Parts that are flawed at this point are sent to welding for corrective treatment. The last process uses heat to treat the parts to bring them to the desired strength.

In 20X1, the two partners who owned AKL Foundry decided to split up and divide the business. In dissolving their business relationship, they were faced with the problem of dividing the business assets equitably. Since the company had two plants—one in Arizona and one in New Mexico—a suggestion was made to split the business on the basis of geographic location. One partner would assume ownership of the plant in New Mexico, and the other would assume ownership of the plant in Arizona. However, this arrangement had one major complication: the amount of WIP inventory located in the Arizona plant.

The Arizona facilities had been in operation for more than a decade and were full of WIP. The New Mexico facility had been operational for only 2 years and had much smaller WIP inventories. The partner located in New Mexico argued that to disregard the unequal value of the WIP inventories would be grossly unfair.

Unfortunately, during the entire business history of AKL Foundry, WIP inventories had never been assigned any value. In computing the cost of goods sold each year, the company had followed the policy of adding depreciation to the out-of-pocket costs of direct labor, direct materials, and overhead. Accruals for the company are nearly nonexistent, and there are hardly ever any ending inventories of materials.

During 20X1, the Arizona plant had sales of $2,028,670. The cost of goods sold is itemized as follows:

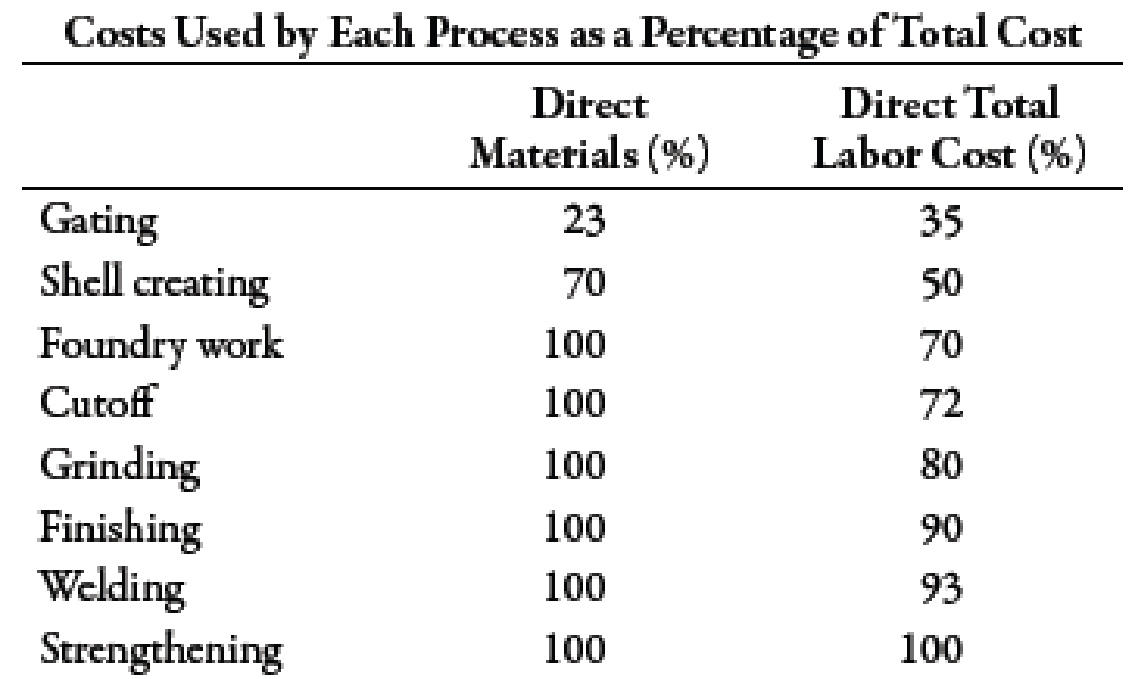

Upon request, the owners of AKL provided the following supplementary information (percentages are cumulative):

Gating had 10,000 units in BWIP, 60% complete. Assume that all materials are added at the beginning of each process. During the year, 50,000 units were completed and transferred out. The ending inventory had 11,000 unfinished units, 60% complete.

Required:

- 1. The partners of AKL want a reasonable estimate of the cost of WIP inventories. Using the gating department’s inventory as an example, prepare an estimate of the cost of the EWIP. What assumptions did you make? Did you use the FIFO or weighted average method? Why? (Note: Round unit cost to two decimal places.)

- 2. Assume that the shell-creating process has 8,000 units in BWIP, 20% complete. During the year, 50,000 units were completed and transferred out. (Note: All 50,000 units were sold; no other units were sold.) The EWIP inventory had 8,000 units, 30% complete. Compute the value of the shell-creating department’s EWIP. What additional assumptions had to be made?

1.

Provide an estimate of the ending WIP of gating process. Also, explain the method used to measure WIP and reason for such selection.

Explanation of Solution

Process Costing:

Process costing is a system in which an organization ascertains costs associated which specific processes undertaken within the company.

Step 1: Physical flow analysis:

| Particulars | Units |

| Units to account for: | |

| Units in beginning WIP | 10,000 |

| Add: Units started during the period1 | 51,000 |

| Units to account for | 61,000 |

| Units accounted for: | |

| Units completed and transferred | 50,000 |

| Add: Units in ending WIP | 11,000 |

| Units accounted for | 61,000 |

Table (1)

Step 2: Computation of equivalent units:

| Particulars | Material | Conversion |

| Units started and completed | 40,000 | 40,000 |

|

Equivalent units of beginning WIP | 4,000 | |

|

Equivalent units of ending WIP | 11,000 | 6,600 |

| Equivalent units | 51,000 | 50,600 |

Table (2)

Step 3: Computation of unit cost:

| Particulars | Material ($) | Conversion ($) |

| Material cost | 86,940 | |

| Labor cost | 185,605 | |

| Overhead cost | 225,231 | |

| Total cost | 86,940 | 410,836 |

| Equivalent units | 51,000 | 50,600 |

| Unit cost | 1.70 | 8.12 |

Table (3)

Step 4: Valuation of ending inventory:

| Particulars | Amount ($) |

| Equivalent units of material | 18,700 |

| Equivalent units for conversion | 53,592 |

| Total value | 72,292 |

Table (4)

FIFO method has been used since, costs associated with beginning inventory is to be removed from the equivalent units so that current period’s cost can be correctly allocated amongst the equivalent units for computation of unit cost.

Working Notes:

1. Computation of units started during the period:

2.

Provide an estimate of the ending WIP of shell-creating process.

Explanation of Solution

Step 1: Physical flow analysis:

| Particulars | Units |

| Units to account for: | |

| Units in beginning WIP | 8,000 |

| Add: Units started during the period1 | 50,000 |

| Units to account for | 58,000 |

| Units accounted for: | |

| Units completed and transferred | 50,000 |

| Add: Units in ending WIP | 8,000 |

| Units accounted for | 58,000 |

Table (5)

Step 2: Computation of equivalent units:

| Particulars | Material | Conversion |

| Units started and completed | 42,000 | 42,000 |

|

Equivalent units of beginning WIP | 6,400 | |

|

Equivalent units of ending WIP | 8,000 | 2,400 |

| Equivalent units | 50,000 | 50,800 |

Table (6)

Step 3: Computation of unit cost:

| Particulars | Material ($) | Conversion ($) |

| Material cost | 177,660 | |

| Labor cost | 79,545 | |

| Overhead cost | 96,528 | |

| Total cost | 177,660 | 176,073 |

| Equivalent units | 50,000 | 50,800 |

| Unit cost | 3.55 | 3.47 |

Table (7)

Step 4: Valuation of ending inventory:

| Particulars | Amount ($) |

| Equivalent units of material | 28,400 |

| Equivalent units for conversion | 8,328 |

| Transferred in | 78,560 |

| Total value | 115,288 |

Table (8)

Working Notes:

1.

Computation of units started during the period:

Want to see more full solutions like this?

Chapter 6 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost Per Unit Direct materials Direct labor $ 5.50 $3.00 Variable manufacturing overhead $ 1.50 Fixed manufacturing overhead $ 4.00 Fixed selling expense $2.50 Fixed administrative expense $2.00 Sales commissions $ Variable administrative expense $0.50 For financial accounting purposes, what is the total amount of product costs incurred to make 10,000 units?arrow_forwardGross profit? & General Accountarrow_forwardFinancial accounting questionarrow_forward

- Total assets turnoverarrow_forwardWhat is its return on equity?arrow_forwardDuring a specific period, Nexus Technologies reported a decrease in total assets of $14,500 and an increase in stockholders' equity of $9,800. By what amount and direction must total liabilities have changed during that same period?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College