Inventory Costing and LCM

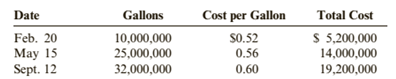

Ortman Enterprises sells a chemical used in various manufacturing processes. On January 1, 2019, Ortman had 5,000,000 gallons on hand, for which it had paid $0.50 per gallon. During 2019, Ortman made the following purchases:

During 2019, Ortman sold 65 000,000 gallons at $0.75 per gallon (35,000,000 gallons were sold on June 29 and 30,000,000 gallons were sold on Nov. 22), leaving an ending inventory of 7,000,000 gallons. Assume that Ortman uses a perpetual inventory system. Ortman uses the lower of cost or market for its inventories, as required by generally accepted accounting principles.

Required:

1. Assume that the market value of the chemical is $0.76 per gallon on December 31, 2019. Compute the cost of ending inventory using the FIFO and average cost methods, and then apply LCM. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

2. Assume that the market value of the chemical is $0.58 per gallon on December 31, 2019. Compute the cost of ending inventory using the FIFO and average cost methods, and then apply LCM. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

(a)

Lower of cost or market value:

Usually the businesses follow the historical cost principle in which the inventory is valued at the cost of the purchase. But in some instances, it has been seen that the market value falls below the cost due to its obsolescence or damaged nature. In those cases, the businesses follow the principle to value the inventory at lower of cost or market value.

The cost of ending inventory using the FIFO and other cost methods and then apply LCM with given market value of

Answer to Problem 70APSA

| Particular | |||

| Closing inventory value |

Explanation of Solution

The given information for the year

Total available gallons are:

The given market value in the question is of

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory is

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory are

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory is

(b)

Lower of cost or market value:

Usually the businesses follow the historical cost principle in which the inventory is valued at the cost of the purchase. But in some instances, it has been seen that the market value falls below the cost due to its obsolescence or damaged nature. In those cases, the businesses follow the principle to value the inventory at lower of cost or market value.

The cost of ending inventory using the FIFO and other cost methods and then apply LCM with given market value of

Answer to Problem 70APSA

| Particular | |||

| Closing inventory value |

Explanation of Solution

The given information for the year

Total available gallons are:

The given market value in the question is of

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory is

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory are

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory is

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Financial Accounting - With CengageNow

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardCan you explain the process for solving this General accounting question accurately?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardI am looking for the most effective method for solving this financial accounting problem.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning