Effects of FIFO and LIFO

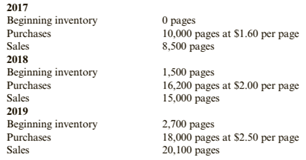

Sheepskin Company sells to colleges and universities a special paper that is used for diplomas. Sheepskin typically makes one purchase of the special paper each year on January 1. Assume that Sheepskin uses a perpetual inventory system. You have the following data for the 3 years ending in 2019:

Required:

1. What would the ending inventory and cost of goods sold be for each year if FIFO is used?

2. What would the ending inventory and cost of goods sold be for each year if LIFO is used?

3. CONCEPTUAL CONNECTION For each year, explain the cause of the differences in cost of goods sold under FIFO and LIFO.

(a)

Inventory costing methods:

FIFO and LIFO are those methods which are used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the FIFO.

Answer to Problem 55E

| Particular | |||

| Cost of goods sold | |||

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

In the year

In the year

Opening Inventory

In the year

Opening Inventory

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

In the year

Cost of goods sold will be

In the year

Cost of goods sold will be

In the year

Cost of goods sold will be

(b)

Inventory costing methods:

FIFO and LIFO are those methods which are used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the LIFO.

Answer to Problem 55E

| Particular | |||

| Cost of goods sold | |||

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

In the year

In the year

Opening Inventory

In the year

Opening Inventory

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

In the year

Cost of goods sold will be

In the year

Cost of goods sold will be

In the year

Cost of goods sold will be

(c)

Inventory costing methods:

FIFO and LIFO are those methods which are used for calculation of closing inventory and cost of goods sold.

The reason for difference in cost of goods sold under both methods.

Answer to Problem 55E

The reason for the difference in the cost of goods sold in both the methods i.e. FIFO and LIFO is their different nature of taking the purchases for the sale. It means FIFO takes the purchases which came first and LIFO takes the purchases which came last i.e. latest purchases.

Explanation of Solution

| FIFO | LIFO | |||||

| Particular | ||||||

| Cost of goods sold | ||||||

| Closing inventory value | ||||||

As seen un above table, the difference in cost of goods sold in FIFO and LIFO is due to the recording the sales in different manner. In the FIFO method, the sales are made from the purchases which are made at first place i.e. first come first out scenario by which old stock is cleared first and then the latest one.

In the LIFO method, it is opposite which means the sales are made from the purchases which are made latest i.e. last come last out scenario by which new stock is sold out first and then the old one.

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Financial Accounting - With CengageNow

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,