Concept explainers

Inferring Missing Amounts Based on Income Statement Relationships

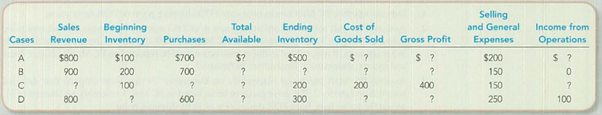

Supply the missing dollar amounts for each of the following independent cases:

Explanation of Solution

Inventory:

It refers to the current assets that a company expects to sell during the normal course of business operations, the goods that are under process to be completed for future sale, or currently used for producing goods to be sold in the market.

Beginning inventory

The balance of stock of goods in hand during the beginning of the accounting period is stated as beginning inventory.

Ending inventory:

The balance of stock of goods in hand during the end of the accounting period is stated as ending inventory.

Cost of goods sold:

Cost of goods sold indicates the costs involved for the inventory sold by the business in a specific period of time.

Following is the table for missing information:

| Case | ||||

| Particulars | (Amount in Dollars) | |||

| A | B | C | D | |

| Sales revenue | $800 | $900 | $600(9) | $800 |

| Less: Cost of Goods sold: | ||||

| Beginning inventory | $100 | $200 | $100 | $150(13) |

| Add: Purchases | $700 | $700 | $300(10) | $600 |

| Total available for sale | $800(1) | $900(5) | $400(11) | $750(14) |

| Less: Ending inventory | $500 | $150(6) | $200 | $300 |

| Total cost of goods sold | $300(2) | $750(7) | $200 | $450(15) |

| Gross profit | $500(3) | $150(8) | $400 | $350(16) |

| Less: Operating expenses | $200 | $150 | $150 | $250 |

| Income from operations | $300(4) | $0 | $250(12) | $100 |

Table (1)

Working notes:

Calculate the total value available for sale of case A.

Calculate the value of total cost of goods sold of case A.

Calculate the value of gross profit of case A.

Calculate the value of income from operations of case A.

Calculate the total value available for sale of case B.

Calculate the value of ending inventory of case B.

Calculate the value of total cost of goods sold of case B.

Calculate the value of gross profit of case B.

Calculate the sales revenue of case C.

Calculate the value of purchases of case C.

Calculate the total value available for sale of case C.

Calculate the value of income from operations of case C.

Calculate the value of beginning inventory of case D.

Calculate the total value available for sale of case D.

Calculate the value of total cost of goods sold of case D.

Calculate the value of gross profit of case D.

Want to see more full solutions like this?

Chapter 6 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING LL

- Your investment department has researched possible investments in corporate debt securities. Among the available investments are the following $100 million bond issues, each dated January 1, 2024. Prices were determined by underwriters at different times during the last few weeks. Company 1. BB Corporation Bond Price $ 109 million Stated Rate 11% 2. DD Corporation $ 100 million 3. GG Corporation $ 91 million 10% 9% Each of the bond issues matures on December 31, 2043, and pays interest semiannually on June 30 and December 31. For bonds of similar risk and maturity, the market yield at January 1, 2024, is 10%. Required: Other things being equal, which of the bond issues offers the most attractive investment opportunity if it can be purchased at the prices stated? The least attractive? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Most attractive investment Least attractive investmentarrow_forwardQ ▼ 0 1 / 3 Тт з Problem Set 1 Cariman Company manufactures and sells three styles of door Handles: Gold, Bronze and Silver Production takes 50, 50, and 20 machine hours to manufacture 1,000-unit batches of Gold, Brune, and Silver Handles, respectively. The following additional data apply: Projected sales in units Gold Bronze Silver 60,000 100,000 80,000 Per Unit data: Selling price $80 540 560 Direct materials $16 $8 $16 Direct labour $30 $5 518 Overhead cost based on direct labour hours (traditional system) $24 56 $18 Hours per 1,000-unit butch: Direct labour hours Machine hours Setup hours Inspection hours 80 50 20 60 20 # 5 8 8 40 40 20 50 20 8558 Activity Total overhead costs and activity levels for the year are estimated as follows: Overhead costs Activity levels Direct labour hours 5,800 hours Machine hours 4,800 hours Setups $931,000 190 setup hours Inspections $810,000 5,400 inspection hours $1741.000 Required: 1. Using the traditional coding system, determine the operating…arrow_forwardLawrence Industries produces kitchen knives. The selling price is $25 per unit, and the variable costs are $10 per knife. Fixed costs per month are $6,000. If Lawrence Industries sells 30 more units beyond breakeven, how much does profit increase as a result? Answerarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning