ACC 201/202 MYACCLAB E-TEXT ONLY >I<

16th Edition

ISBN: 9781323118047

Author: Pearson

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 6.9SE

Determining the effect of an inventory error

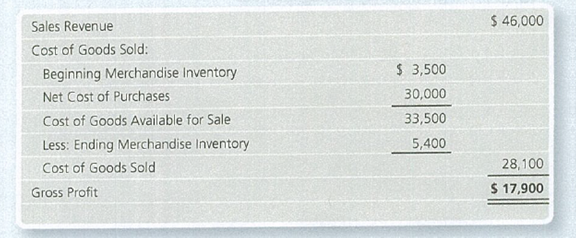

Mountain Pool Supplies’s merchandise inventory data for the year ended December 31, 2017, follow:

Requirements

- 1. Assume that the ending merchandise inventory was accidentally overstated by $1,300. What are the correct amounts for cost of goods sold and gross profit?

- 2. How would the inventory error affect Mountain Pool Supplies’s cost of goods sold and gross profit for the year ended December 31, 2018, if the error is not corrected in 2017?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

??

Can you please solve this questions

Accounting 25

Chapter 6 Solutions

ACC 201/202 MYACCLAB E-TEXT ONLY >I<

Ch. 6 - Which principle or concept states that businesses...Ch. 6 - Which inventory costing method assigns to ending...Ch. 6 - Assume Nile.com began April with 14 units of...Ch. 6 - Suppose Nile.com used the weighted-average...Ch. 6 - Which inventory costing method results in the...Ch. 6 - Prob. 6QCCh. 6 - At December 31, 2016, Stevenson Company overstated...Ch. 6 - Suppose Maestros had cost of goods sold during the...Ch. 6 - Suppose Nile.com used the LIFO inventory costing...Ch. 6 - Prob. 1RQ

Ch. 6 - Prob. 2RQCh. 6 - Prob. 3RQCh. 6 - What is the goal of conservatism?Ch. 6 - Prob. 5RQCh. 6 - Under a perpetual inventory system, what are the...Ch. 6 - Prob. 7RQCh. 6 - Prob. 8RQCh. 6 - What does the lower-of-cost-or-market (LCM) rule...Ch. 6 - What account is debited when recording the...Ch. 6 - What is the effect on cost of goods sold, gross...Ch. 6 - When does an inventory error cancel out, and why?Ch. 6 - Prob. 13RQCh. 6 - Prob. 14RQCh. 6 - Prob. 15ARQCh. 6 - Prob. 16ARQCh. 6 - Determining inventory accounting principles Ward...Ch. 6 - Determining inventory costing methods Ward Hard...Ch. 6 - Use the following information to answer Short...Ch. 6 - Use the following information to answer Short...Ch. 6 - Use the following information to answer Short...Ch. 6 - Use the following information to answer Short...Ch. 6 - Comparing Cost of Goods Sold under FIFO, UFO, and...Ch. 6 - Applying the lower-of-cost-or-market rule Assume...Ch. 6 - Determining the effect of an inventory error...Ch. 6 - Computing the rate of inventory turnover and days...Ch. 6 - Use the following information to answer Short...Ch. 6 - Prob. 6.12SECh. 6 - Prob. 6.13SECh. 6 - Using accounting vocabulary Match the accounting...Ch. 6 - Comparing inventory methods Zippy, a regional...Ch. 6 - Prob. 6.16ECh. 6 - Use the following information to answer Exercises...Ch. 6 - Use the following information to answer Exercises...Ch. 6 - Comparing amounts for cost of goods sold, ending...Ch. 6 - Comparing cost of goods sold and gross...Ch. 6 - Prob. 6.21ECh. 6 - Prob. 6.22ECh. 6 - Prob. 6.23ECh. 6 - Prob. 6.24ECh. 6 - Prob. 6.25ECh. 6 - Prob. 6.26ECh. 6 - Prob. 6.27ECh. 6 - Accounting for inventory using the perpetual...Ch. 6 - Accounting for inventory using the perpetual...Ch. 6 - Prob. 6.30APCh. 6 - Correcting inventory errors over a three-year...Ch. 6 - Accounting for inventory using the periodic...Ch. 6 - Accounting for inventory using the perpetual...Ch. 6 - Prob. 6.34BPCh. 6 - Prob. 6.35BPCh. 6 - Prob. 6.36BPCh. 6 - Prob. 6.37BPCh. 6 - Prob. 6.38CPCh. 6 - Accounting for inventory using the perpetual...Ch. 6 - Suppose you manage Campbell Appliance. The stores...Ch. 6 - Ever since he was a kid, Carl Montague wanted to...Ch. 6 - The notes are an important part of a companys...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License