Concept explainers

Multiple-step income statement and report form of

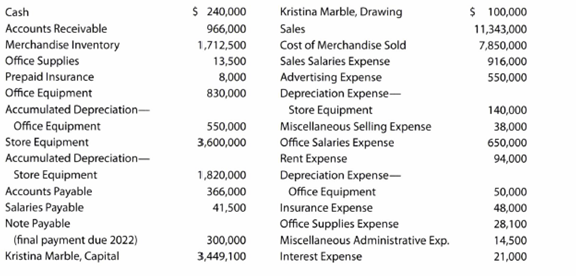

The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2016:

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a statement of owner’s equity.

3. Prepare a report form of balance sheet, assuming that the current portion of the note payable is $50,000.

4. Briefly explain (a) how multiple-step and single-step income statements differ and (b) how report-form and account-form balance sheets differ.

Trending nowThis is a popular solution!

Chapter 6 Solutions

Bundle: Accounting, Chapters 1-13, 26th + Working Papers, Chapters 1-17 For Warren/reeve/duchac's Accounting, 26th And Financial Accounting, 14th + ... For Warren/reeve/duchac's Accounting, 26th

- Please provide answer this financial accounting questionarrow_forwardBrentwood Manufacturing forecasts that total overhead for the current year will be $12,000,000 and that total machine hours will be 240,000 hours. Year to date, the actual overhead is $13,200,000, and the actual machine hours are 260,000 hours. Suppose Brentwood Manufacturing uses a predetermined overhead rate based on machine hours for applying overhead as of this point in time (year to date). In that case, the overhead is? Helparrow_forwardSolve this Accounting problemarrow_forward

- Brentwood Manufacturing forecasts that total overhead for the current year will be $12,000,000 and that total machine hours will be 240,000 hours. Year to date, the actual overhead is $13,200,000, and the actual machine hours are 260,000 hours. Suppose Brentwood Manufacturing uses a predetermined overhead rate based on machine hours for applying overhead as of this point in time (year to date). In that case, the overhead is?arrow_forwardCan you help me with accounting questionsarrow_forwardWhat is the ending balance in stockholders equity?arrow_forward

- hi expert please help mearrow_forwardSummit Mechanical Co. has a normal capacity of 25,000 direct labor hours. The company's variable costs are $32,500, and its fixed costs are $18,750 when operating at normal capacity. What is its standard manufacturing overhead rate per unit?arrow_forwardhello teacher please solve questionsarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,