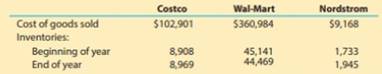

Analyze and compare Costco, Wal-Mart, and Nordstrom

The general merchandise retail industry has a number of segments represented by the following companies:

| Company Name | Merchandise Concept |

| Costco Wholesale Corporation (COST) | Membership warehouse |

| Wal-Mart Stores, Inc. (WMT) | Discount general merchandise |

| Nordstrom, Inc. (JWN) | Fashion department store |

For a recent war, the following cost of goods sold and beginning and ending inventories are provided from corporate annual reports (in millions) for these three companies:

- a. Determine the inventory turnover ratio for all three companies. Round all calculations to one decimal place.

- b. Determine the number of days’ sales in inventory for all three companies. Use 365 days and round all calculations to one decimal place.

- c.

Interpret these results based on each company’s merchandising concept.

Interpret these results based on each company’s merchandising concept.

(a)

Inventory turnover ratio: Inventory turnover ratio is used to determine the number of times inventory used or sold during the particular accounting period. The formula to calculate the inventory turnover ratio is as follows:

To determine: the inventory turnover for Company C, Company W and Company N

Answer to Problem 6.3MAD

Explanation of Solution

The inventory turnover ratio for Company C is calculated as follows:

Working notes:

The average inventory is calculated as follows:

The inventory turnover ratio for Company W is calculated as follows:

Working notes:

The average inventory is calculated as follows:

The inventory turnover ratio for Company N is calculated as follows:

Working notes:

The average inventory is calculated as follows:

The inventory turnover of Company C is 11.5 Times, the inventory turnover of Company W is 8 Times and the inventory turnover of Company N is 5 Times.

(b)

Days’ sales in inventory: Days’ sales in inventory are used to determine number of days a particular company takes to make sales of the inventory available with them. The formula to calculate the days’ sales in inventory ratio is as follows:

To determine: the Days’ sales in inventory ratio for Company C, Company W and Company N.

Answer to Problem 6.3MAD

Explanation of Solution

The Days’ sale in inventory ratio for Company C is calculated as follows:

The Days’ sale in inventory ratio for Company W is calculated as follows:

The Days’ sale in inventory ratio for Company N is calculated as follows:

The Days’ sales in inventory of Company C is 31.7 days, the Days’ sales in inventory of Company W is 45.6 days, & the Days’ sales in inventory of Company N is 73 days.

(c)

Inventory turnover ratio: Inventory turnover ratio is used to determine the number of times inventory used or sold during the particular accounting period. The formula to calculate the inventory turnover ratio is as follows:

Days’ sales in inventory: Days’ sales in inventory are used to determine number of days a particular company takes to make sales of the inventory available with them. The formula to calculate the days’ sales in inventory ratio is as follows:

To interpret: the above calculated ratios.

Explanation of Solution

The inventory turnover ratio and number of days’ sales in inventory of all the three companies reflect the merchandising approaches of all companies. Company C is a club warehouse and it has approach of holding only items which are quickly sold. Most of the items are sold in bulk at very attractive prices.

In case of company W, it has a traditional discounter approach. Even though it has attractive pricing, the inventory movement is slower than in the case of company C.

In the case of company N, it is a high-end fashioner retailer. It offers a wide collection of specialty and unique goods that are specifically designed for fashion market rather than for general mass market. Therefore, the movement is slower than other two companies yet it has highest margin.

Want to see more full solutions like this?

Chapter 6 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/jones’ Corporate Financial Accounting, 15th

- Waiting for your solution general accounting questionarrow_forwardAnswer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning