Concept explainers

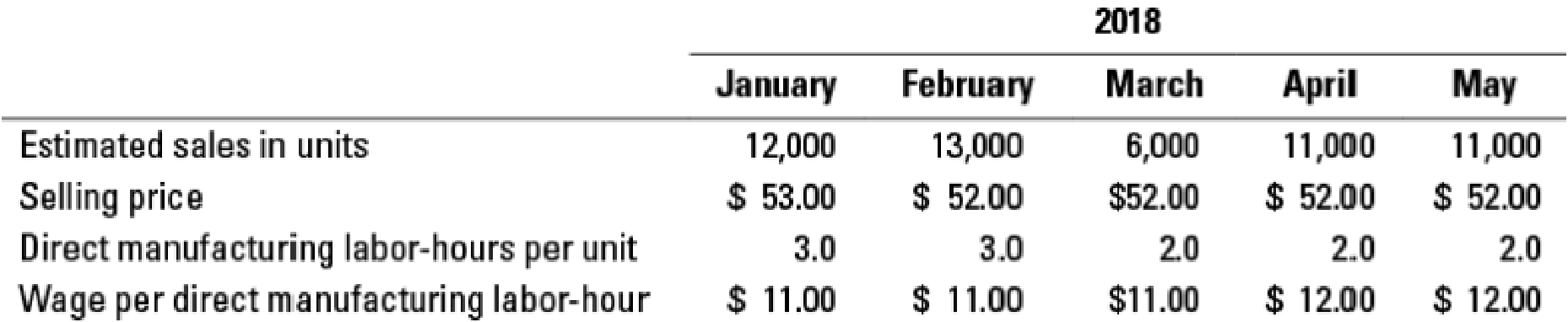

Budgets for production and direct manufacturing labor. (CMA, adapted) DeWitt Company makes and sells artistic frames for pictures of weddings, graduations, and other special events. Ron Bahar, the controller, is responsible for preparing DeWitt’s

In addition to wages, direct manufacturing labor-related costs include pension contributions of $0.40 per hour, worker’s compensation insurance of $0.10 per hour, employee medical insurance of $0.50 per hour, and Social Security taxes. Assume that as of January 1, 2018, the Social Security tax rates are 7.5% for employers and 7.5% for employees. The cost of employee benefits paid by DeWitt on its direct manufacturing employees is treated as a direct

DeWitt has a labor contract that calls for a wage increase to $12 per hour on April 1, 2018. New labor-saving machinery has been installed and will be fully operational by March 1, 2018. DeWitt expects to have 16,000 frames on hand at December 31, 2017, and it has a policy of carrying an end-of-month inventory of 100% of the following month’s sales plus 50% of the second following month’s sales.

- 1. Prepare a production budget and a direct manufacturing labor cost budget for DeWitt Company by month and for the first quarter of 2018. You may combine both budgets in one schedule. The direct manufacturing labor cost budget should include labor-hours and show the details for each labor cost category.

Required

- 2. What actions has the budget process prompted DeWitt’s management to take?

- 3. How might DeWitt’s managers use the budget developed in requirement 1 to better manage the company?

Trending nowThis is a popular solution!

Chapter 6 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

- Please provide answer in text (Without image)arrow_forwardShilongo Ltd uses costing to attribute costs to individual products and services provided to its customers. It has begun the preparation of its fixed production cost budget for the forthcoming period. The company three production departments Machining, Assembly and Finishing; and two service departments Stores and Maintenance. The following costs have been produced: Machining Assembly Finishing Stores Maintenance 2,500 1,500 1,000 Overhead cost $ 6,000 800 The number of machine and labor hours budgeted for the forthcoming period is budgeted as follows:- Machining Assembly Finishing Machine hours 500 40 50 Labor hours 100 300 200 Overheads are absorbed in Assembly and Finishing departments on a Labor hour basis; and in Machining departments they are absorbed on a machine hour basis. It has been estimated that service departments usage is as follows: Machining Assembly Finishing Stores Maintenance Maintenance 55% 20% 20% 5% - Stores 40% 30% 20% 10% Required: b) Calculate the overhead…arrow_forwardShilongo Ltd uses costing to attribute costs to individual products and services provided to its customers. It has begun the preparation of its fixed production cost budget for the forthcoming period. The company three production departments Machining, Assembly and Finishing; and two service departments Stores and Maintenance. The following costs have been produced: Machining Assembly Finishing Stores Maintenance 2,500 1,500 1,000 Overhead cost $ 6,000 800 The number of machine and labor hours budgeted for the forthcoming period is budgeted as follows:- Machining Assembly Finishing Machine hours 500 40 50 Labor hours 100 300 200 Overheads are absorbed in Assembly and Finishing departments on a Labor hour basis; and in Machining departments they are absorbed on a machine hour basis. It has been estimated that service departments usage is as follows: Machining Assembly Finishing Stores Maintenance Maintenance 55% 20% 20% 5% - Stores 40% 30% 20% 10% Required: c) Prepare a quotation for…arrow_forward

- Shilongo Ltd uses costing to attribute costs to individual products and services provided to its customers. It has begun the preparation of its fixed production cost budget for the forthcoming period. The company three production departments Machining, Assembly and Finishing; and two service departments Stores and Maintenance. The following costs have been produced: Machining Assembly Finishing Stores Maintenance 1,000 Overhead cost $ 6,000 2,500 1,500 800 The number of machine and labor hours budgeted for the forthcoming period is budgeted as follows:- Machining Assembly Finishing Machine hours 500 40 50 Labor hours 100 300 200 Overheads are absorbed in Assembly and Finishing departments on a Labor hour basis; and in Machining departments they are absorbed on a machine hour basis. It has been estimated that service departments usage is as follows: Machining Assembly Finishing Stores Maintenance Maintenance 55% 20% 20% 5% - Stores 40% 30% 20% 10% Required: (a) Prepare a schedule of…arrow_forwardPlease show your work.arrow_forwardCalculate the budgeted manufacturing overhead rate per machine hour. Calculate the amount of under- or over-allocated manufacturing overhead.arrow_forward

- kindly provide clear handwritten solutions so i would understand please. thank you!arrow_forwardJoe Barker is the production manager of Auto Parts Company (APC) and has been asked to prepare 2020's ending finished goods budget for the S222 product. Based on historical figures, Joe determines the following information regarding direct materials, direct labor and manufacturing overhead for the S222 product. Direct Materials Costs per Unit $1.10 per unit Direct Labor Cost per Direct Labor Hour (DLH) $15 per DLH DLH per Unit 0.25 DLH per unit Predetermined Manufacturing Overhead Rate $4 per DLH Calculate the value of the cost of goods manufactured per unit.arrow_forwardSeroja Sdn. Bhd. manufactures customized equipment for local market. The budgeted data for the month of February 2019 were as follows: Machining Department Finishing Department Manufacturing overhead RM40,000 RM65,000 Direct labour hours 2,000 hours 10,000 hours Machine hours 4,000 hours 5,700 hours During the month, an order was received from Mr. Eric to manufacture an equipment for his personnel use. The job is known as Job E and the data pertaining to the job were as follows: Machining Department Finishing Department Direct material RM2,800 RM1,200 Direct labour hours 500 hours 50 hours Machine hours 300 hours 200 hours Wage rate per hour RM2.50 RM3.20 Additional information about Job E: 1. Manufacturing overhead is absorbed based on machine hour for Machining department and direct labour hour for Finishing department. 2. Administrative…arrow_forward

- Answer question 1arrow_forwardThe Meyers CPA firm has the following overhead budget for the year: Overhead Indirect materials Indirect labor Depreciation-Building Depreciation-Furniture Utilities Insurance Property taxes Other expenses Total $ 500,000 1,900,000 333,000 65,000 385,000 54,000 68,000 175,000 $ 3,480,000 The firm estimates total direct labor cost for the year to be $2,175,000. The firm uses direct labor cost as the cost driver to apply overhead to clients. During January, the firm worked for many clients; data for two of them follow: Gargus account Direct labor $ 4,500 Feller account Direct labor $ 10,500 Required: 1. Compute the firm's predetermined overhead rate. 2. Compute the amount of overhead to be charged to the Gargus and Feller accounts using the predetermined overhead rate calculated in requirement 1. 3. Compute total job cost for the Gargus account and the Feller account.arrow_forwardPlease help me solve this questionarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning