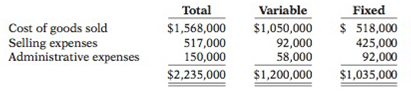

Midlands Inc. had a bad year in 2016. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 80,000 units of product: net sales $2,000,000: total costs and expenses $2,235,000: and net loss $235,000. Costs and expenses consisted of the following.

Compute break-even point under alternative courses of action.

(LO 1), AN

Management is considering the following independent alternatives for 2017.

1. Increase unit selling price 25% with no change in costs and expenses.

2. Change the compensation of salespersons from fixed annual salaries totaling $200,000 to total salaries of $40,000 plus a 3% commission on net sales.

3. Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50:50.

Instructions

(a) Compute the break-even point in dollars for 2017.

(b) Compute the break-even point in dollars under each of the alternative courses of action. (Round to the nearest dollar.) Which course of action do you recommend?

(b) (2) $2,500,000

Trending nowThis is a popular solution!

Chapter 6 Solutions

Managerial Accounting: Tools For Business Decision Making, Seventh Edition Wileyplus Card

- Please give me true answer this financial accounting questionarrow_forwardRefer to the Hartley Ltd statement of cash flows for the year ended 31 December 2022 and answer the following questions: 1.1 Calculate the following: 1.1.1 Depreciation 1.1.2 Interest paid 1.1.3 Net increase (decrease) in cash 1.1.4 Cash balance as at 31 December 2022. 1.2 Comment on the following: 1.2.1 Cash flows from operating activities of (R390 000) 1.2.2 Cash flows from investing activities of R150 000 1.2.3 Increase in inventory of (R700 000) 1.2.4 Increase in receivables of (R500 000).arrow_forwardAbcarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education