FUND.ACCT.PRIN.-CONNECT ACCESS

25th Edition

ISBN: 9781260780185

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 5PSA

Problem 6-5A

Lower of cost or market

P2

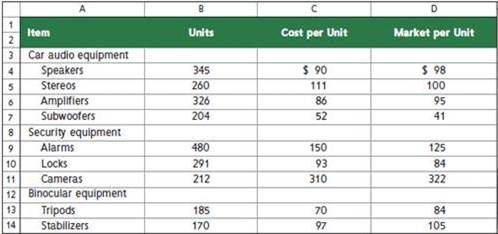

A physical inventory of Liverpool Company taken at December 31 reveals the following.

Required

1. Compute the lower of cost or market for the inventory applied separately to each item.

2. If the market amount is less than the recorded cost of the inventory, then record the LCM adjustment to the Merchandise Inventory account.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting problem with appropriate steps and explanations?

Please provide the correct answer to this financial accounting problem using accurate calculations.

Can you solve this general accounting question with accurate accounting calculations?

Chapter 6 Solutions

FUND.ACCT.PRIN.-CONNECT ACCESS

Ch. 6 - Inventory ownership Homestead Crafts, a...Ch. 6 - QS 6-2 Inventory costs C2

A car dealer acquires a...Ch. 6 - Prob. 3QSCh. 6 - Prob. 4QSCh. 6 - Perpetual: Inventory costing with FIFO P1 A...Ch. 6 - Perpetual: Inventory costing with LIFO Refer to...Ch. 6 - Perpetual Inventory costing with weighted average...Ch. 6 - Periodic: Inventory costing with FIFO P3 Refer to...Ch. 6 - Periodic: Inventory costing with LIFO Refer to the...Ch. 6 - Periodic: Inventory costing with weighted average...

Ch. 6 - Perpetual: Assigning costs with FIFO Trey Monson...Ch. 6 - QS6-11

Perpetual Inventory costing with LIFO

Refer...Ch. 6 - QS 6-12

Perpetual: Inventory costing with weighted...Ch. 6 - QS6.13

Perpetual Inventory costing with specific...Ch. 6 - Periodic: Inventory costing with FIFO P3 Refer to...Ch. 6 - Periodic Inventory costing with LIFO P3 Refer to...Ch. 6 - Periodic: Inventory costing with weighted average...Ch. 6 - Periodic: Inventory costing with specific...Ch. 6 - QS 6-18 Contrasting inventory costing methods...Ch. 6 - Inventory errors A2 In taking a physical inventory...Ch. 6 - Prob. 21QSCh. 6 - Prob. 22QSCh. 6 - Prob. 23QSCh. 6 - Prob. 24QSCh. 6 - Prob. 25QSCh. 6 - Prob. 26QSCh. 6 - Exercise 6-1 Inventory ownership C1

1. At...Ch. 6 - Exercise 6-2

Inventory costs

C2

Walberg...Ch. 6 - Exercise 6-3 Perpetual Inventory costing methods...Ch. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - Exercise 6-5A Periodic: Inventory costing P3 Refer...Ch. 6 - Prob. 7ECh. 6 - Exercise 6-7 Perpetual Inventory costing...Ch. 6 - Exercise 6.8 Specific identification Refer to the...Ch. 6 - Prob. 10ECh. 6 - Prob. 11ECh. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Prob. 14ECh. 6 - Prob. 15ECh. 6 - Prob. 16ECh. 6 - Prob. 17ECh. 6 - Prob. 18ECh. 6 - Prob. 19ECh. 6 - Prob. 20ECh. 6 - Prob. 21ECh. 6 - Problem 6-1A

Perpetual: Alternative cost...Ch. 6 - Prob. 2PSACh. 6 - Prob. 3PSACh. 6 - Prob. 4PSACh. 6 - Problem 6-5A Lower of cost or market P2 A physical...Ch. 6 - Prob. 6PSACh. 6 - Prob. 7PSACh. 6 - Prob. 8PSACh. 6 - Prob. 9PSACh. 6 - Prob. 10PSACh. 6 - Prob. 1PSBCh. 6 - Prob. 2PSBCh. 6 - Prob. 3PSBCh. 6 - Prob. 4PSBCh. 6 - Prob. 5PSBCh. 6 - Prob. 6PSBCh. 6 - Prob. 7PSBCh. 6 - Prob. 8PSBCh. 6 - Prob. 9PSBCh. 6 - Prob. 10PSBCh. 6 - Prob. 6.1SPCh. 6 - Prob. 6.2SPCh. 6 - AA 6-1 Use Apple's financial statements in...Ch. 6 - AA 6-2 Comparative figures for Apple and Google...Ch. 6 - Prob. 3AACh. 6 - Prob. 1DQCh. 6 - Where is the amount of merchandise inventory...Ch. 6 - If costs are declining, will the LIFO or FIFO...Ch. 6 - Prob. 4DQCh. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - BTN 6-3 Golf Challenge Corp. is a retail sports...Ch. 6 - Prob. 2BTNCh. 6 - Prob. 3BTNCh. 6 - Prob. 4BTNCh. 6 - Prob. 5BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardDetermine the price of a $1.3 million bond issue under each of the following independent assumptions: Maturity 10 years, interest paid annually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%.arrow_forward

- If total assets increase while liabilities remain unchanged, equity must: A) IncreaseB) DecreaseC) Remain the sameD) Be negativearrow_forwardNo chatgpt!! Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhich of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivableno aiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License