Concept explainers

Inventory ownership

Homestead Crafts, a distributor of handmade gifts, operates out of owner Emma Finn’s house. At the end of the current period., Emma looks over

her inventory and finds that she has:

- 1,300 units (products) in her basement, 20 of which were damaged by water and cannot be sold.

- 350 units in her van, ready to deliver per a customer order, terms FOB destination.

- 80 units out on consignment to a friend who owns a retail store.

How many units should Emma include in her company’s period-end inventory?

Introduction:

FOB destination:

FOB destination stands for Free On Board destination. It is a term for selling the merchandise, under which the delivery of goods is completed when the goods are reached at buyer's destination. The goods in transit belong to the seller and seller bears the cost of transportation till the buyer's destination. In case of FOB destination, the goods in transit should be included in the seller inventory.

Consignment:

Consignment is a process of selling merchandise, where the seller sends goods to its agent for sale. In this process, the seller is called the consignor and the agent selling the goods on behalf of the seller is called the consignee. The unsold merchandises on consignment are included in the inventory of the consignor and not the consignee.

To Calculate:

The number of units in the period end inventory

Answer to Problem 1QS

Solution:

The number of units in the period end inventory should be 1,710 units

Explanation of Solution

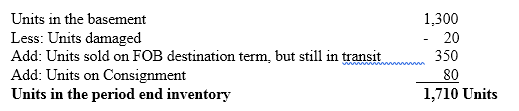

The numbers of units in the period end inventory are calculated as follows:

Note:

- In case of GOF destination terms, the goods in transit belong to the seller, hence 350 units are added in the ending inventory.

- The unsold merchandises on consignment are included in the inventory of the consignor; hence 80 units are added in the ending inventory.

Hence, it can be concluded that the number of units in the period end inventory should be 1,710 units

Want to see more full solutions like this?

Chapter 6 Solutions

FUND.ACCT.PRIN.-CONNECT ACCESS

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardaccounting questionarrow_forwardYoung Technology has an accounts receivable turnover for the year of 6.4. Net sales for the period are $225,000. What is the number of days' sales in receivables?arrow_forward

- Don't use ai given answer accounting questionarrow_forwardDuring the current year, Magna Supplies sold merchandise for $78,000 cash and $422,000 on account. The cost of the merchandise sold is $375,000. What is the amount of the gross profit?arrow_forwardIn the first month of operations, the total of the debit entries to the cash account for Sunway Logistics amounted to $7,200, and the total of the credit entries to the cash account amounted to $4,850. What is the balance in the cash account at the end of the month?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning