Concept explainers

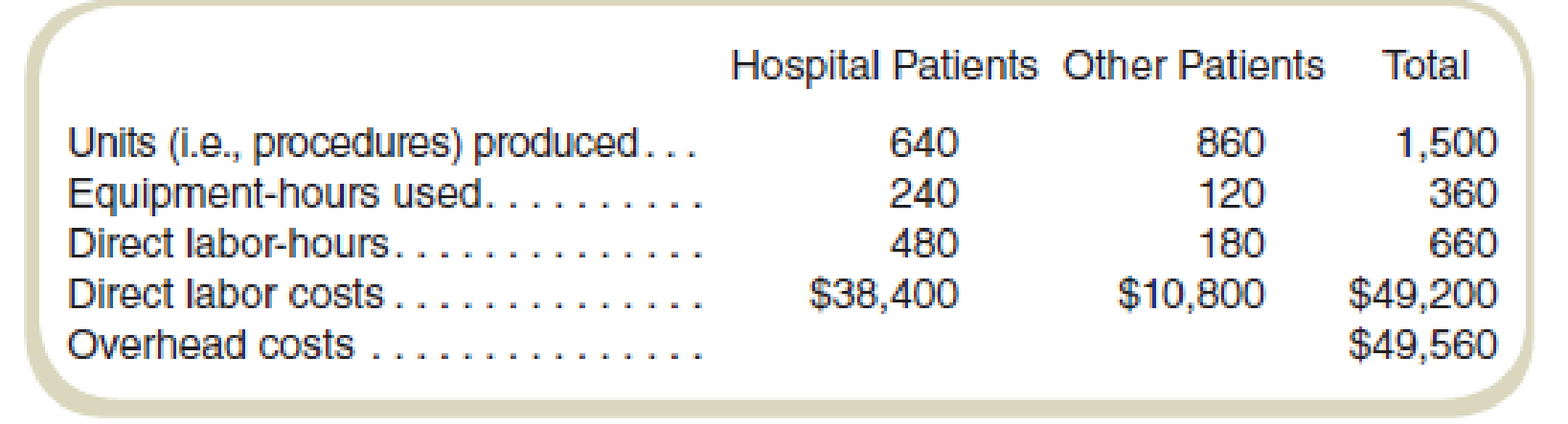

Owl-Eye Radiologists (OR) does various types of diagnostic imaging. Radiologists perform tests using sophisticated equipment. OR’s management wants to compute the costs of performing tests for two different types of patients: those who are hospitalized (including those in emergency rooms) and those who are not hospitalized but are referred by physicians. The data for June for the two categories of patients follow:

The accountant first assigns

Required

- a. Compute the predetermined overhead rates assuming that Owl-Eye Radiologists uses equipment-hours to allocate equipment-related overhead costs and labor-hours to allocate labor-related overhead costs.

- b. Compute the total costs of production and the cost per unit for each of the two types of patients undergoing tests in June.

a.

Calculate the predetermined overhead rates using equipment-hours for the allocation of equipment related overhead costs and labor-hours to allocate labor-related overhead costs.

Answer to Problem 56P

The Cost per unit is $46 for the overhead rates when using equipment-hours for allocation.

The Cost per unit is $50 for the overhead rates when using labor-hours for allocation.

Explanation of Solution

Predetermined overhead rate:

The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation.

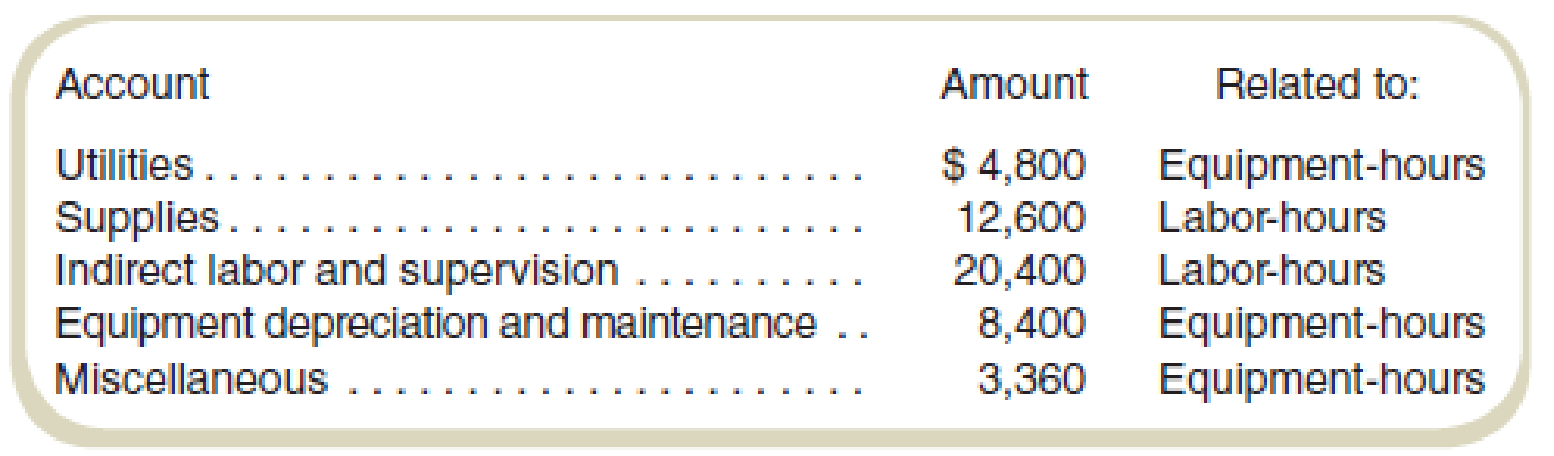

Analysis of overhead accounts by the cost accountant is as follows:

| Account | Amount | Related to: |

| Utilities | $ 4,800 | Equipment hours |

| Supplies | 12,600 | Labor-hours |

| Indirect labor and supervision | 20,400 | Labor-hours |

| Equipment depreciation and maintenance | 8,400 | Equipment hours |

| Miscellaneous | 3,360 | Equipment hours |

Compute equipment-hours related predetermined rate:

Hence, the equipment-hours related predetermined rate is $46.

Compute materials cost related predetermined rate:

Thus, the labor-hours related predetermined rate is $50.

b.

Compute the total costs of production and the cost per unit for each of the two types of patients undergoing tests in June.

Answer to Problem 56P

For hospital patients:

Total cost: $73,440

Cost per unit: $115

For other patients:

Total cost: $25,320

Cost per unit: $29

Explanation of Solution

Product cost:

Product cost includes all the costs that are attributed to the production of the product. All the money that has spent on the process of production or purchase of the product is known as product cost.

Product cost per unit:

The product cost per unit is determined by dividing the total of variable and fixed cost with the total number of units.

Compute the total cost of hospital patients:

Compute total cost of other patients:

Thus, the value of total cost for hospital patients and other patients are $73,440 and $25,320 respectively.

Compute cost per unit for product hospital patients:

Compute cost per unit for the product of other patients:

Working note 1:

Compute equipment hours related cost for hospital patients:

Working note 2:

Compute labor hours related cost for hospital patients:

Working note 3:

Compute equipment hours related cost for other patients:

Working note 4:

Compute labor hours related cost for other patients:

Want to see more full solutions like this?

Chapter 6 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- A broadcasting company failed to make a year-end accrual of $350,000 for fines due to a violation of FCC rules. Its tax rate is 44%. As a result of this error, net income was: general Accountingarrow_forwardBerkley Shoe Company's work-in-process inventory on July 1 has a balance of $25,600, representing Job No. 314. During July, $54,800 of direct materials were requisitioned for Job No. 314, and $37,200 of direct labor cost was incurred on Job No. 314. Manufacturing overhead is allocated at 130% of direct labor cost. Actual manufacturing overhead costs incurred in July amounted to $46,200. No new jobs were started during July. Job No. 314 is completed on July 30. Is manufacturing overhead overallocated or under-allocated for the month of July and by how much?arrow_forwardA broadcasting company failed to make a year-end accrual of $350,000 for fines due to a violation of FCC rules. Its tax rate is 44%. As a result of this error, net income was: don't Use AIarrow_forward

- The increase in the company planarrow_forwardProblem 07-11 (Algo) [LO 7-4, 7-11] Company XYZ manufactures a tangible product and sells the product at wholesale. In its first year of operations, XYZ manufactured 1,850 units of product and incurred $370,000 direct material cost and $240,500 direct labor costs. For financial statement purposes, XYZ capitalized $157,250 indirect costs to inventory. For tax purposes, it had to capitalize $214,600 indirect costs to inventory under the UNICAP rules. At the end of its first year, XYZ held 430 units in inventory. In its second year of operations, XYZ manufactured 3,700 units of product and incurred $821,400 direct material cost and $508,750 direct labor costs. For financial statement purposes, XYZ capitalized $257,150 indirect costs to inventory. For tax purposes, it had to capitalize $357,050 indirect costs to inventory under the UNICAP rules. At the end of its second year, XYZ held 470 items in inventory. Required: a. Compute XYZ's cost of goods sold for book purposes and for tax…arrow_forwardThe Pilot Corporation had 17,000 shares of common stock outstanding on January 1 and issued an additional 4,200 shares on October 1. There was no preferred stock outstanding. If Pilot reports earnings per share of $4.50 for the year ending December 31, how much is net income?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College