Concept explainers

Question:

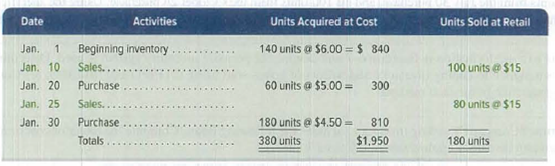

Laker Company reported the following January purchases and sales data for its only product.

Required

The company uses a perpetual inventory system. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. (Round per unit costs and inventory amounts to cents.) For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory.

Exercise 6-4 Use the data in Exercise 6-3 to prepare comparative income statements for the month of January for Laker Company similar to those shown in Exhibit 6.8 for the four inventory methods. Assume expenses are $1,250 and the applicable income tax rate is 40%. (Round amounts to cents.)

- 1. Which method yields the highest net income?

- 2. Does net income using weighted average fall above, between, or below that using FIFO and LIFO?

- 3. If costs were rising instead of falling, which method would yield the highest net income?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Principles of Financial Accounting.

- Namita's Salon purchased equipment for $12,000 on January 1. The equipment has an estimated useful life of 5 years and a salvage value of $2,000. Calculate the annual depreciation expense using the straight-line method and the book value at the end of year 3. Need answerarrow_forwardI need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forwardIf Safeway needs to make a 22% profit from 480 shillings, what price should they place on their goods?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning