Dana Rand owns a catering company that prepares banquets and parties for both individual and business functions throughout the year. Rand’s business is seasonal, with a heavy schedule during the summer months and the year-end holidays and a light schedule at other times. During peak periods, there are extra costs; however, even during nonpeak periods Rand must work more to cover her expenses.

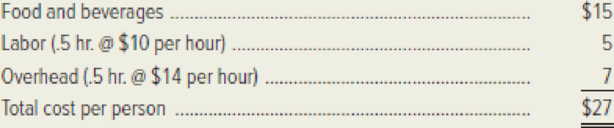

One of the major events Rand’s customers request is a cocktail party. She offers a standard cocktail party and has developed the following cost structure on a per-person basis.

When bidding on cocktail parties, Rand adds a 15 percent markup to this cost structure as a profit margin. Rand is quite certain about her estimates of the prime costs but is not as comfortable with the

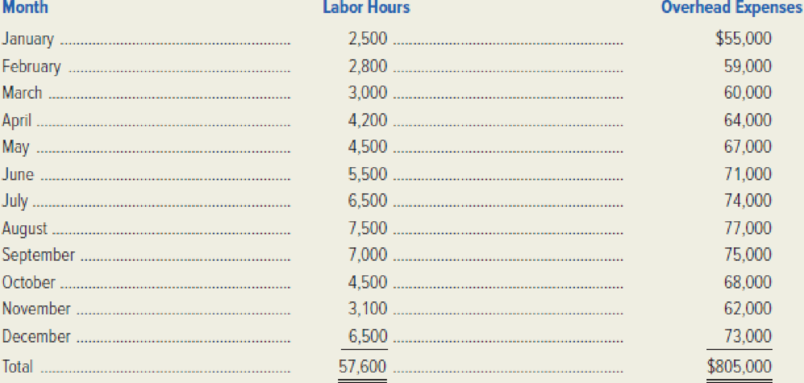

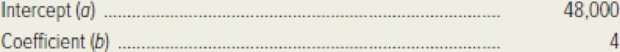

Rand recently attended a meeting of the local chamber of commerce and heard a business consultant discuss regression analysis and its business applications. After the meeting, Rand decided to do a regression analysis of the overhead data she had collected. The following results were obtained.

Required:

- 1. Explain the difference between the overhead rate originally estimated by Dana Rand and the overhead rate developed from the regression method.

- 2. Using data from the regression analysis, develop the following cost estimates per person for a cocktail party.

- a. Variable cost per person

- b. Absorption cost per person

Assume that the level of activity remains within the relevant range.

- 3. Dana Rand has been asked to prepare a bid for a 200-person cocktail party to be given next month. Determine the minimum bid price that Rand should be willing to submit.

- 4. What other factors should Dana Rand consider in developing the bid price for the cocktail party?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Managerial Accounting

- Calculate the value of COGS lifo for company Y?arrow_forwardCompany Y reported FIFO ending inventory of $126,500 and a beginning inventory of $119,200 for 2021. Inventory purchases for 2021 were $265,300, and the change in the LIFO reserve for 2020 was an increase in the LIFO reserve of $890. Calculate the value of COGS LIFO for Company Y in 2021.arrow_forwardSlove this general accounting problemarrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning