Dana Rand owns a catering company that prepares banquets and parties for both individual and business functions throughout the year. Rand’s business is seasonal, with a heavy schedule during the summer months and the year-end holidays and a light schedule at other times. During peak periods, there are extra costs; however, even during nonpeak periods Rand must work more to cover her expenses.

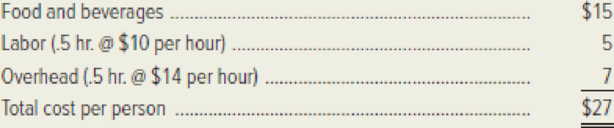

One of the major events Rand’s customers request is a cocktail party. She offers a standard cocktail party and has developed the following cost structure on a per-person basis.

When bidding on cocktail parties, Rand adds a 15 percent markup to this cost structure as a profit margin. Rand is quite certain about her estimates of the prime costs but is not as comfortable with the

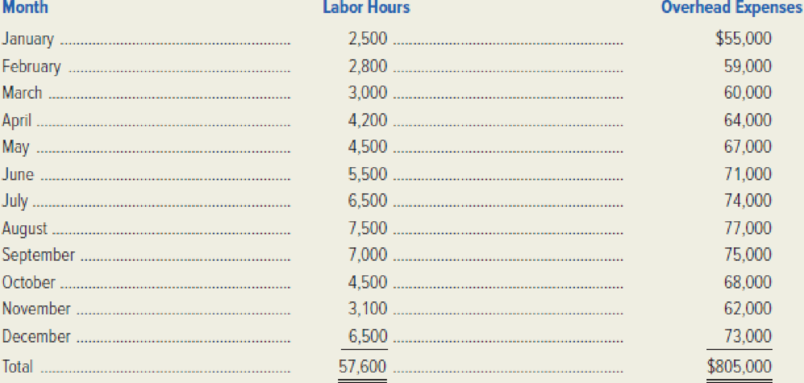

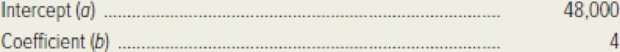

Rand recently attended a meeting of the local chamber of commerce and heard a business consultant discuss regression analysis and its business applications. After the meeting, Rand decided to do a regression analysis of the overhead data she had collected. The following results were obtained.

Required:

- 1. Explain the difference between the overhead rate originally estimated by Dana Rand and the overhead rate developed from the regression method.

- 2. Using data from the regression analysis, develop the following cost estimates per person for a cocktail party.

- a. Variable cost per person

- b. Absorption cost per person

Assume that the level of activity remains within the relevant range.

- 3. Dana Rand has been asked to prepare a bid for a 200-person cocktail party to be given next month. Determine the minimum bid price that Rand should be willing to submit.

- 4. What other factors should Dana Rand consider in developing the bid price for the cocktail party?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Assume another customer has returned a pair of duck boots (original cost $109) to L.L. Bean. What journal entry would L.L. Bean make to process the return and refund the original purchase price to the customer?arrow_forwardKreeps Corporation produces a single productarrow_forwardA college's food operation has an average meal price of $9.20. Variable costs are $4.35 per meal and fixed costs total $95,000. How many meals must be sold to provide an operating income of $33,000? How many meals would have to be sold if fixed costs declined by 23%? (round to the nearest meal)arrow_forward

- A firm has net working capital of $980, net fixed assets of $4,418, sales of $9,250, and current liabilities of $1,340. How many dollars worth of sales are generated from every $1 in total assets? Need answerarrow_forwardA firm has net working capital of $980, net fixed assets of $4,418, sales of $9,250, and current liabilities of $1,340. How many dollars worth of sales are generated from every $1 in total assets?arrow_forward???arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT