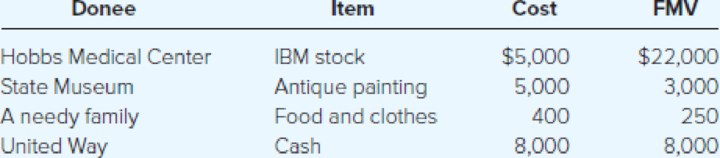

Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005.

Calculate Calvin’s charitable contribution deduction and carryover (if any) under the following circumstances.

- a) Calvin’s AGI is $100,000.

- b) Calvin’s AGI is $100,000 but the State Museum told Calvin that it plans to sell the painting.

- c) Calvin’s AGI is $50,000.

- d) Calvin’s AGI is $100,000 and Hobbs is a private nonoperating foundation.

- e) Calvin’s AGI is $100,000 but the painting is worth $10,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

GEN COMBO LL MCGRAW-HILLS TAXATION INDIVIDUALS & BUSINESS ENTITIES; CONNECT AC

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Cariman Company is a manufacturer with two production departments (Machining and Assembly) as well as two support departments (Human Resources and Information Services).For the last quarter of 2020, Cariman’s cost records indicate the following:SUPPORT PRODUCTIONHuman Resources (HR)Information Services(IS)MachiningAssemblyTotalBudgeted overhead costs before any inter-department cost allocations$400,000$2,000,000$10,912,000$14,916,000$28,228,000Support work supplied by HR (Number of employees)025%40%35%100%Support work supplied by IS (Processing costs)10%030%60%100%Required:1. Allocate the two support departments’ costs to the two operating departments using the following methods:a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.2. Compare and explain differences in the support-department costs allocated to each production department. 3. What approaches might be used to decide the sequence in which to allocate…arrow_forwardQuick answer of this accounting questionsarrow_forwardGet correct answer this financial accounting question without use Aiarrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT