(Capital Outlay; Inventory–Consumption Method) (a) Record the following transactions in the General Fund General Ledger of Benford Township using the consumption method (periodic inventory system) to account for materials, supplies, and prepayments. Record both the budgetary and actual entries. (b) Compute the amount of expenditures to be reported in the school district General Fund statement of revenues, expenditures, and changes in fund balance. (c) Compute the amount of nonspendable fund balance to be reported at year end. Materials and supplies costing $90,000 were on hand at the beginning of the year.

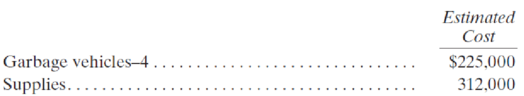

1. The town ordered the following:

2. The town received the garbage vehicles. The actual cost of $222,000 was vouchered for payment.

3. The town received most of the supplies ordered (estimated cost $302,000). The actual cost was $301,800.

4. The town paid $523,800 of vouchers payable.

5. At year end, the town had supplies on hand costing $102,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Pearson eText for Governmental and Nonprofit Accounting -- Instant Access (Pearson+)

- Acorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your answer to the nearest whole dollar amount. Acorn provided you with the following information: Asset Placed in Service Basis New equipment and tools August 20 $ 3,800,000 Used light-duty trucks October 17 2,000,000 Used machinery November 6 1,525,000 Total $ 7,325,000 The used assets had been contributed to the business by its owner in a tax-deferred transaction two years ago. a. What is Acorn's maximum cost recovery deduction in the current year?arrow_forwardGeneral accountingarrow_forwardQuick answer of this accounting questionsarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education