Practical Management Science, Loose-leaf Version

5th Edition

ISBN: 9781305631540

Author: WINSTON, Wayne L.; Albright, S. Christian

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 6, Problem 39P

Summary Introduction

To determine: The investment that maximizes NPV.

Introduction: The variation between the present value of the

Expert Solution & Answer

Explanation of Solution

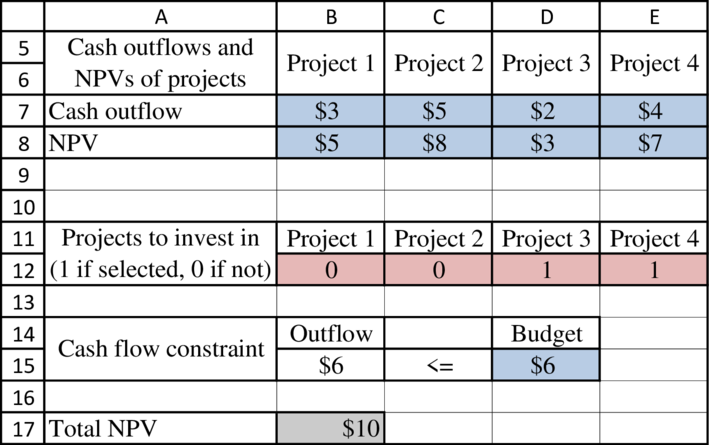

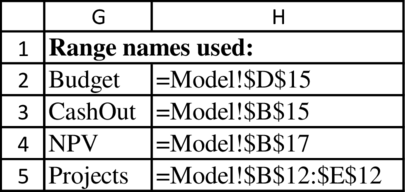

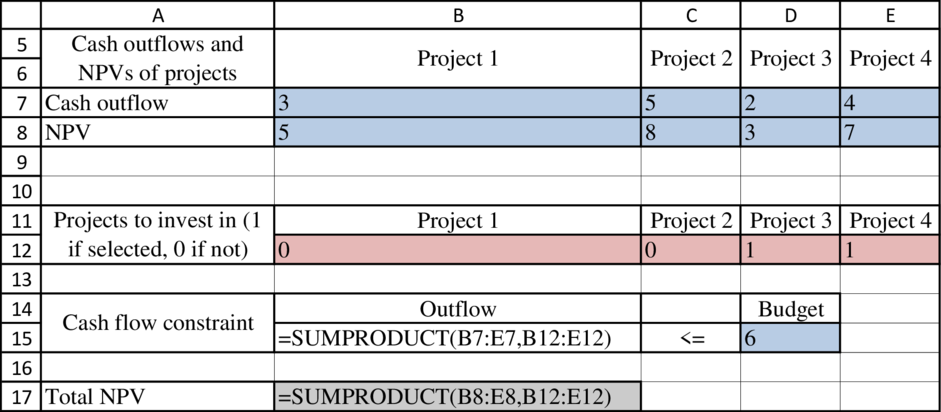

Model:

The values in the above table are in millions.

Formulae to determine the model:

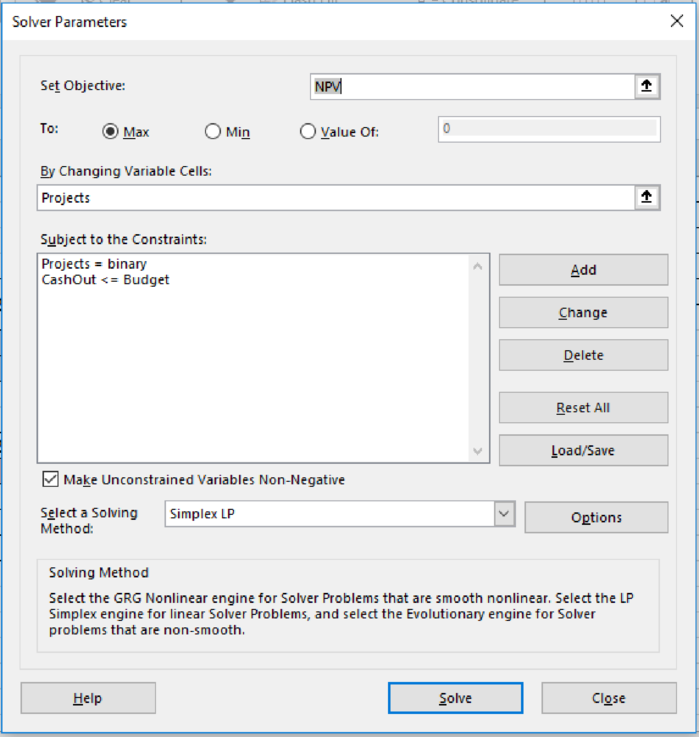

Solver parameter:

Project 4 and Project 3 are the investment plants that would maximize the NPV.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Please and thank you

A local fast-food restaurant processes several customer orders at once. Service clerks’ cross paths, sometimes nearly colliding, while they trace different paths to fill customer orders. If customers order a special combination of toppings on their burgers, they must wait quite some time while the special order is cooked. How would you modify the restaurant’s operations to achieve competitive advantage? Because demand surges at lunchtime, volume flexibility is a competitive priority in the fast-food business. How would you achieve volume flexibility? What are the potential downsides of relying too heavily on automation and standardization in this industry? What data would you want to gather, if any, before making recommendations?

What are 4 key points that are interesting about this video

https://youtu.be/LAoMuvYZ_QM?si=Mognj_KBU9EIOLSP

Chapter 6 Solutions

Practical Management Science, Loose-leaf Version

Ch. 6.3 - Prob. 1PCh. 6.3 - Prob. 2PCh. 6.3 - Solve Problem 1 with the extra assumption that the...Ch. 6.3 - Prob. 4PCh. 6.3 - Prob. 5PCh. 6.3 - Prob. 6PCh. 6.3 - Prob. 7PCh. 6.3 - Prob. 8PCh. 6.3 - Prob. 9PCh. 6.3 - Prob. 10P

Ch. 6.4 - Prob. 11PCh. 6.4 - Prob. 12PCh. 6.4 - Prob. 13PCh. 6.4 - Prob. 14PCh. 6.4 - Prob. 15PCh. 6.4 - Prob. 16PCh. 6.4 - Prob. 17PCh. 6.4 - Prob. 18PCh. 6.4 - Prob. 19PCh. 6.4 - Prob. 20PCh. 6.4 - Prob. 21PCh. 6.4 - Prob. 22PCh. 6.4 - Prob. 23PCh. 6.5 - Prob. 24PCh. 6.5 - Prob. 25PCh. 6.5 - Prob. 26PCh. 6.5 - Prob. 28PCh. 6.5 - Prob. 29PCh. 6.5 - Prob. 30PCh. 6.5 - In the optimal solution to the Green Grass...Ch. 6.5 - Prob. 32PCh. 6.5 - Prob. 33PCh. 6.5 - Prob. 34PCh. 6.5 - Prob. 35PCh. 6.6 - Prob. 36PCh. 6.6 - Prob. 37PCh. 6.6 - Prob. 38PCh. 6 - Prob. 39PCh. 6 - Prob. 40PCh. 6 - Prob. 41PCh. 6 - Prob. 42PCh. 6 - Prob. 43PCh. 6 - Prob. 44PCh. 6 - Prob. 45PCh. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Prob. 54PCh. 6 - Prob. 55PCh. 6 - Prob. 56PCh. 6 - Prob. 57PCh. 6 - Prob. 58PCh. 6 - Prob. 59PCh. 6 - Prob. 60PCh. 6 - Prob. 61PCh. 6 - Prob. 62PCh. 6 - Prob. 63PCh. 6 - Prob. 64PCh. 6 - Prob. 65PCh. 6 - Prob. 66PCh. 6 - Prob. 67PCh. 6 - Prob. 68PCh. 6 - Prob. 69PCh. 6 - Prob. 70PCh. 6 - Prob. 71PCh. 6 - Prob. 72PCh. 6 - Prob. 73PCh. 6 - Prob. 74PCh. 6 - Prob. 75PCh. 6 - Prob. 76PCh. 6 - Prob. 77PCh. 6 - Prob. 78PCh. 6 - Prob. 79PCh. 6 - Prob. 80PCh. 6 - Prob. 81PCh. 6 - Prob. 82PCh. 6 - Prob. 83PCh. 6 - Prob. 84PCh. 6 - Prob. 85PCh. 6 - Prob. 86PCh. 6 - Prob. 87PCh. 6 - Prob. 88PCh. 6 - Prob. 89PCh. 6 - Prob. 90PCh. 6 - Prob. 91PCh. 6 - Prob. 92PCh. 6 - This problem is based on Motorolas online method...Ch. 6 - Prob. 94PCh. 6 - Prob. 95PCh. 6 - Prob. 96PCh. 6 - Prob. 97PCh. 6 - Prob. 98PCh. 6 - Prob. 99PCh. 6 - Prob. 100PCh. 6 - Prob. 1CCh. 6 - Prob. 2CCh. 6 - Prob. 3.1CCh. 6 - Prob. 3.2CCh. 6 - Prob. 3.3CCh. 6 - Prob. 3.4CCh. 6 - Prob. 3.5CCh. 6 - Prob. 3.6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- a) Select all of the correct impacts the maturing of a product might have on OM strategy below. (Check all that apply.) A. Cost cutting is instituted. B. Inventory needs to be revised. C. Labor skills decrease. D. Product design needs to be revised. E. Design compromises are instituted. F. New human resources skills.arrow_forwardPlease help! Multifactor!arrow_forwardKlassen Toy Company, Inc., assembles two parts (parts 1 and 2): Part 1 is first processed at workstation A for 10 minutes per unit and then processed at workstation B for 20 minutes per unit. Part 2 is simultaneously processed at workstation C for 12 minutes per unit. Work stations B and C feed the parts to an assembler at workstation D, where the two parts are assembled. The time at workstation D is 15 minutes. a) The bottleneck of this process is at minutes per unit (enter your response as a whole number).arrow_forward

- Just HELParrow_forwardI need help with C. I'm strugglingarrow_forwardBy signaling their willingness to share information about their interests, but not their BATNA, a negotiator can capitalize on the powerful principle of reciprocity. Which of the following situations best illustrates the reciprocity principle? Group of answer choices A. A car salesman shares information about the town where he grew up, and his custo.mer shares that he also grew up near that town B. A cab driver takes a customer to her hotel and picks up a new customer at the hotel. C. A woman compliments a friend about her purse and the friend says thank you. D. An employee shares information about a project's progress with a coworker who is uncertain.arrow_forward

- What benefits can negotiators get from using the strategy of multiple equivalent simultaneous offers (MESOs)? Give a real life example.arrow_forwardWhat benefits can negotiators get from using the strategy of multiple equivalent simultaneous offers (MESOs)?arrow_forwardWhat is the Perspective on Research? How is the Research from a Biblical perspective conducting Business? What is the connection between Biblical principles and the concepts chosen for conducting Business Research? What is the Perspective on Research? How is the Research from a Biblical perspective conducting Business? What is the connection between Biblical principles and the concepts chosen for conducting Business Research? What is the Perspective on Research? How is the Research from a Biblical perspective conducting Business? What is the connection between Biblical principles and the concepts chosen for conducting Business Research?arrow_forward

- what is the arithmetic average annual return per year?arrow_forwardDescribe a simple sales information system for an online store, including its products, branches, and its appraisal, so that it captures the attention of an average person without a university degree or a particular career, and develop a report about it.arrow_forwardNote: A waiting line model solver computer package is needed to answer these questions. The Kolkmeyer Manufacturing Company uses a group of six identical machines, each of which operates an average of 23 hours between breakdowns. With randomly occurring breakdowns, the Poisson probability distribution is used to describe the machine breakdown arrival process. One person from the maintenance department provides the single-server repair service for the six machines. Management is now considering adding two machines to its manufacturing operation. This addition will bring the number of machines to eight. The president of Kolkmeyer asked for a study of the need to add a second employee to the repair operation. The service rate for each individual assigned to the repair operation is 0.40 machines per hour. (a) Compute the operating characteristics if the company retains the single-employee repair operation. (Round your answers to four decimal places. Report time in hours.) La = L = Wa W = h…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,