Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 37P

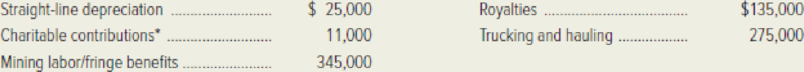

Antioch Extraction, which mines ore in Montana, uses a calendar year for both financial -reporting and tax purposes. The following selected costs were incurred in December, the low point of activity, when 1,500 tons of ore were extracted:

*Incurred only in December.

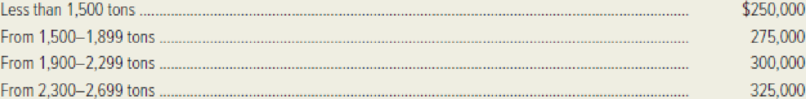

Peak activity of 2,600 tons occurred in June, resulting in mining labor/fringe benefit costs of $598,000, royalties of $201,000, and trucking and hauling outlays of $325,000. The trucking and hauling outlays exhibit the following behavior:

Antioch uses the high-low method to analyze costs.

Required:

- 1. Classify the five costs listed in terms of their behavior: variable, step-variable, committed fixed, discretionary fixed, step-fixed, or semivariable. Show calculations to support your answers for mining labor/

fringe benefits and royalties. - 2. Calculate the total cost for next February when 1,650 tons are expected to be extracted.

- 3. Comment on the cost-effectiveness of hauling 1,500 tons with respect to Antioch’s trucking/hauling cost behavior. Can the company’s effectiveness be improved? How?

- 4. Distinguish between committed and discretionary fixed costs. If Antioch were to experience severe economic difficulties, which of the two types of fixed costs should management try to cut? Why?

- 5. Speculate as to why the company’s charitable contribution cost arises only in December.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ss

Rent on a manufacturing plant donated by the county, where the agreement calls for rent of $100,000 to be reduced by $1 for each direct manufacturing labor-hour worked in excess of 200,000 hours, but a minimum rental fee of $20,000 must be paid.

During its first year of operations, Silverman Company paid $16,360 for direct materials and $10,300 for production workers' wages. Lease payments and utilities on the production facilities amounted to $9,300 while general, selling, and administrative expenses totaled $4,800. The company produced 6,200 units and sold 3,800 units at a price of $8.30 a unit.

What is Silverman's cost of goods sold for the year?

Chapter 6 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 6 - Describe the importance of cost behavior patterns...Ch. 6 - Define the following terms, and explain the...Ch. 6 - Suggest an appropriate activity base (or cost...Ch. 6 - Draw a simple graph of each of the following types...Ch. 6 - Explain the impact of an increase in the level of...Ch. 6 - Explain why a manufacturers cost of supervising...Ch. 6 - Explain the impact of an increase in the level of...Ch. 6 - Prob. 8RQCh. 6 - Indicate which of the following descriptions is...Ch. 6 - Prob. 10RQ

Ch. 6 - What is meant by a learning curve? Explain its...Ch. 6 - Suggest an appropriate independent variable to use...Ch. 6 - What is an outlier? List some possible causes of...Ch. 6 - Explain the cost estimation problem caused by...Ch. 6 - Describe the visual-fit method of cost estimation....Ch. 6 - What is the chief drawback of the high-low method...Ch. 6 - Explain the meaning of the term least squares in...Ch. 6 - Prob. 18RQCh. 6 - Prob. 19RQCh. 6 - List several possible cost drivers that could be...Ch. 6 - Prob. 21RQCh. 6 - Prob. 22ECh. 6 - The behavior of the annual maintenance and repair...Ch. 6 - WMEJ is an independent television station run by a...Ch. 6 - Jonathan Macintosh is a highly successful...Ch. 6 - Jonathan Macintosh is a highly successful...Ch. 6 - The Iowa City Veterinary Laboratory performs a...Ch. 6 - Chillicothe Meat Company produces one of the best...Ch. 6 - Rio Bus Tours has incurred the following bus...Ch. 6 - Prob. 31ECh. 6 - Prob. 32ECh. 6 - Prob. 33ECh. 6 - Gator Beach Marts, a chain of convenience grocery...Ch. 6 - For each of the cost items described below, choose...Ch. 6 - The following selected data were taken from the...Ch. 6 - Antioch Extraction, which mines ore in Montana,...Ch. 6 - Nations Capital Fitness, Inc. operates a chain of...Ch. 6 - The Allegheny School of Music has hired you as a...Ch. 6 - Prob. 40PCh. 6 - (Note: Instructors who wish to cover all three...Ch. 6 - Refer to the original data in the preceding...Ch. 6 - Shortly after being hired as an analyst with...Ch. 6 - The controller of Chittenango Chain Company...Ch. 6 - Dana Rand owns a catering company that prepares...Ch. 6 - Prob. 48PCh. 6 - Earth and Artistry, Inc. provides commercial...Ch. 6 - Prob. 51CCh. 6 - Refer to the data and accompanying information in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Johnson Electrical produces industrial ventilation fans. The company plans to manufacture 87,000 fans evenly over the next quarter at the following costs direct material, $1,740,000, direct labor, $522,000, variable production overhead, $639,450, and fixed production overhead. $960,000. The $960,000 amount includes $84,000 of straight-line depreciation and $105,000 of supervisory salaries Shortly after the conclusion of the quarter's first month, Johnson reported the following costs: Direct material Direct labor $ 554,600 159,300 Variable production overhead Depreciation 220,000 28,000 Supervisory salaries 37,600 Other fixed production overhead Total 252,000 $1,251,500 Dave Kellerman and his crews turned out 25,000 fans during the month a remarkable feat given that the firm's manufacturing plant was closed for several days because of storm damage and flooding Kellerman was especially pleased with the fact that overall financial performance for the period was favorable when compared…arrow_forwardJohnson Electrical produces industrial ventilation fans. The company plans to manufacture 84,000 fans evenly over the next quarter at the following costs: direct material, $1,932,000; direct labor, $588,000; variable production overhead, $659,400; and fixed production overhead, $951,000. The $951,000 amount includes $96,000 of straight-line depreciation and $108,000 of supervisory salaries. Shortly after the conclusion of the quarter’s first month, Johnson reported the following costs: Direct material $ 601,500 Direct labor 187,600 Variable production overhead 225,000 Depreciation 32,000 Supervisory salaries 38,700 Other fixed production overhead 248,000 Total $ 1,332,800 Dave Kellerman and his crews turned out 25,000 fans during the month—a remarkable feat given that the firm’s manufacturing plant was closed for several days because of storm damage and flooding. Kellerman was especially pleased with the fact that overall…arrow_forwardThe Silverman Company spent $14,000 on direct supplies and $19,000 on the salary of production personnel in its first year of business. General, selling, and administrative costs came to $8,000 while lease payments and utilities for the production facilities came to $17,000. At a cost of $15.00 per unit, the company produced 5,000 units, of which 3,000 were sold. When was the year's operating net profit for Silverman? $7,000 $12,000 $28,000 $37,000arrow_forward

- During its first year of operations, Silverman Company paid $14,000 for direct materials and $ 19,000 for production workers' wages. Lease payments and utilities on the production facilities amounted to $17,000 while general, selling, and administrative expenses totaled $8,000. The company produced 5,000 units and sold 3,000 units at a price of $15.00 a unit. What was Silverman's net income for the first year in operation? Multiple Choice $37,000 $12,000 $ 7,000 $28,000arrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 23% each of the last three years. He computed the following cost and revenue estimates for each product: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 310,000 $ 510,000 Annual revenues and costs: Sales revenues $ 360,000 $ 460,000 Variable expenses $ 164,000 $ 214,000 Depreciation expense $ 62,000 $ 102,000 Fixed out-of-pocket operating costs $ 81,000 $ 65,000 The company’s discount rate is 18%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Calculate each product’s payback period. 2. Calculate each product’s net present value. 3. Calculate each product’s internal rate of return. 4. Calculate each…arrow_forwardDuring its first year of operations, Silverman Company paid $9,160 for direct materials and $9,700 for production workers' wages. Lease payments and utilities on the production facilities amounted to $8,700 while general, selling, and administrative expenses totaled $4,200. The company produced 5,300 units and sold 3,200 units at a price of $7.70 a unit. What is Silverman's cost of goods sold for the year? Multiple Choice O $27,560 $13,923 $16,640 $23,060arrow_forward

- During its first year of operations, Silverman Company paid $14,000 for direct materials and $19,000 for production workers' wages. Lease payments and utilities on the production facilities amounted to $17,000 while general, selling, and administrative expenses totaled $8,000. The company produced 5,000 units and sold 3,000 units at a price of $15.00 a unit. What was Silverman's net income for the first year in operation? Group of answer choices $7,000 $12,000 $28,000 $37,000arrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 22% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product AProduct BInitial investment: Cost of equipment (zero salvage value)$ 340,000$ 540,000Annual revenues and costs: Sales revenues$ 380,000$ 460,000Variable expenses$ 170,000$ 206,000Depreciation expense$ 68,000$ 108,000Fixed out-of-pocket operating costs$ 86,000$ 66,000 The company’s discount rate is 20%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product. 4. Calculate the profitability index for…arrow_forwardDayton, Inc. manufactured 15,000 units of product last month and identified the following costs associated with the manufacturing activity. Variable costs: Direct materials used Direct labor $1,100,000 2,060,000 236, 000 213,000 Indirect materials and supplies Power to run plant equipment Fixed costs: Supervisory salaries Plant utilities (other than power to run plant equipment) Depreciation on plant and equipeent (straight-line, tine basis) Property taxes on building 906,000 287,000 141,000 199, e00 Required: Unit variable costs and total fixed costs are expected to remain unchanged next month Calculate the unit cost and the total cost if 21,000 units are produced next month. (Round "Unit costs" to 2 decimal places.) Total variable costs Total fixed costs Total costs Unit costsarrow_forward

- Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 19% each of the last three years. He computed the following cost and revenue estimates for each product: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 190,000 $ 400,000 Annual revenues and costs: Sales revenues $ 270,000 $ 370,000 Variable expenses $ 128,000 $ 178,000 Depreciation expense $ 38,000 $ 80,000 Fixed out-of-pocket operating costs $ 72,000 $ 52,000 The company's discount rate is 17%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Calculate each product's payback period. 2. Calculate each product's net present value. 3. Calculate each product's internal rate of return. 4. Calculate each product's profitability index. 5.…arrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 23% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 390,000 $ 585,000 Annual revenues and costs: Sales revenues $ 420,000 $ 500,000 Variable expenses $ 185,000 $ 222,000 Depreciation expense $ 78,000 $ 117,000 Fixed out-of-pocket operating costs $ 90,000 $ 70,000 The company’s discount rate is 21%. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product. 4. Calculate the profitability index for each product. 5. Calculate the simple rate of return for each…arrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 17% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 176,600 $ 390,000 Annual revenues and costs: Sales revenues $ 260,000 $ 360,000 Variable expenses $ 124,000 $ 174,000 Depreciation expense $ 36,000 $ 78,000 Fixed out-of-pocket operating costs $ 71,000 $ 50,000 The company’s discount rate is 15%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Accounting for Derivatives_1.mp4; Author: DVRamanaXIMB;https://www.youtube.com/watch?v=kZky1jIiCN0;License: Standard Youtube License

Depreciation|(Concept and Methods); Author: easyCBSE commerce lectures;https://www.youtube.com/watch?v=w4lScJke6CA;License: Standard YouTube License, CC-BY