GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

4th Edition

ISBN: 9781260087376

Author: M. David Haddock Jr. Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 2CTP

Demetria Davis, the bookkeeper for Home Interiors and Designs Company, has just finished posting the closing entries for the year to the ledger. She is concerned about the following balances:

Davis knows that these amounts should agree and asks for your assistance in reviewing her work.

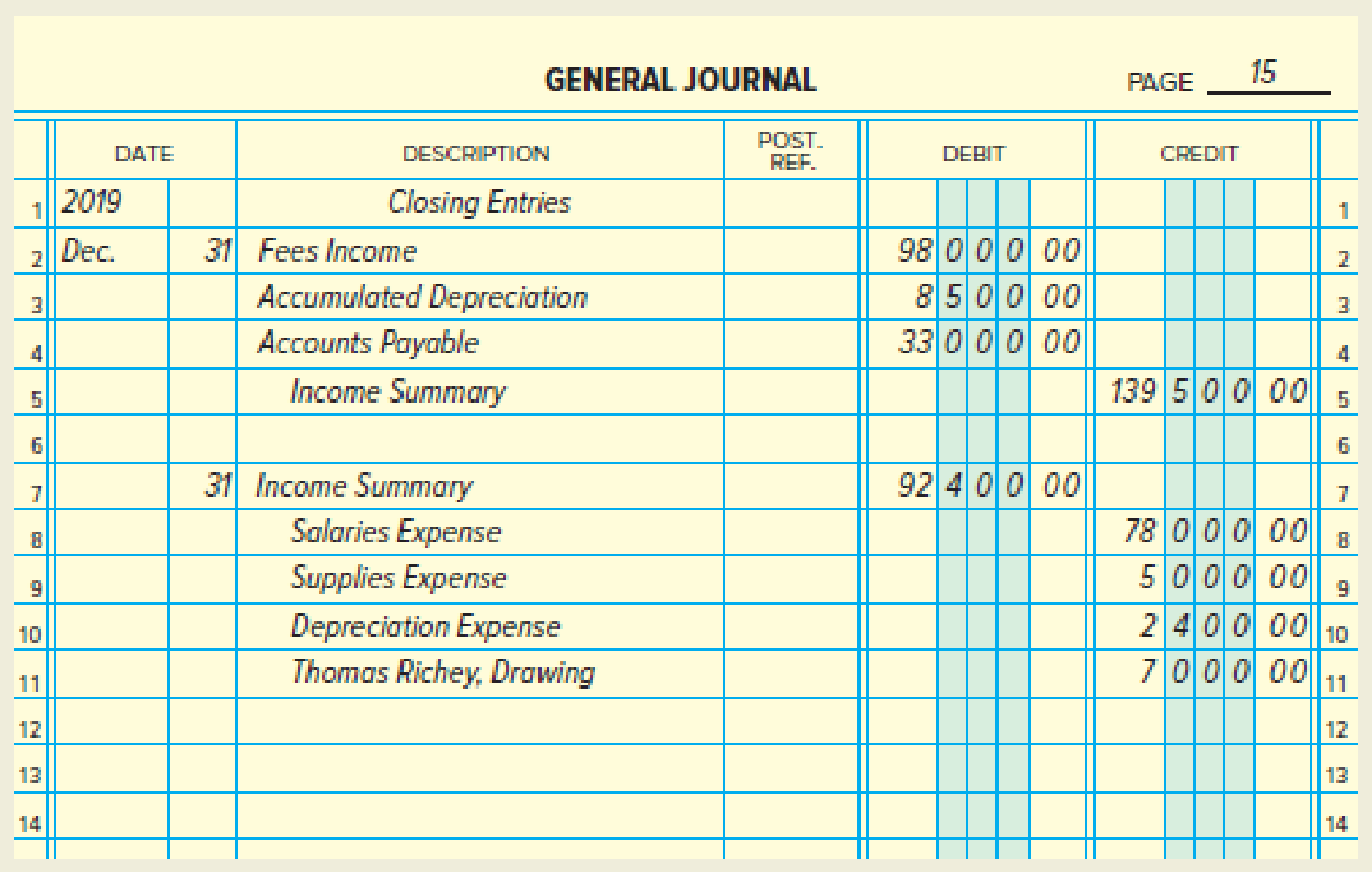

Your review of the general ledger of Home Interiors and Designs Company reveals a beginning capital balance of $50,000. You also review the general journal for the accounting period and find the closing entries shown below.

- 1. What errors did Ms. Davis make in preparing the closing entries for the period?

- 2. Prepare a general

journal entry to correct the errors made. - 3. Explain why the balance of the capital account in the ledger after closing entries have been posted will be the same as the ending capital balance on the statement of owner’s equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Profit 60000 if sales revenue increase by 30000 how much will profit increase?

Answer? ? General Accounting

What is the return on assets ratio

Chapter 6 Solutions

GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

Ch. 6 - What is the journal entry to close the drawing...Ch. 6 - How is the Income Summary account classified?Ch. 6 - Prob. 1.3SRQCh. 6 - Prob. 1.4SRECh. 6 - Prob. 1.5SRECh. 6 - Prob. 1.6SRACh. 6 - Prob. 2.1SRQCh. 6 - Prob. 2.2SRQCh. 6 - What accounts appear on the post-closing trial...Ch. 6 - Prob. 2.4SRE

Ch. 6 - Prob. 2.5SRECh. 6 - On which financial statement would you find the...Ch. 6 - Prob. 1CSRCh. 6 - A firm has the following expenses: Rent Expense,...Ch. 6 - Prob. 3CSRCh. 6 - What is the last step in the accounting cycle?Ch. 6 - Is the following statement true or false? Why? All...Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - What accounts appear on a postclosing trial...Ch. 6 - Prob. 4DQCh. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - How is the Income Summary account used in the...Ch. 6 - Briefly describe the flow of data through a simple...Ch. 6 - Prob. 10DQCh. 6 - Prob. 1ECh. 6 - Accounting cycle. Following are the steps in the...Ch. 6 - Prob. 3ECh. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - Prob. 6ECh. 6 - Prob. 7ECh. 6 - Prob. 8ECh. 6 - Prob. 1PACh. 6 - Prob. 2PACh. 6 - Prob. 3PACh. 6 - Prob. 4PACh. 6 - Prob. 1PBCh. 6 - Prob. 2PBCh. 6 - Prob. 3PBCh. 6 - Prob. 4PBCh. 6 - The Trial Balance section of the worksheet for...Ch. 6 - Demetria Davis, the bookkeeper for Home Interiors...Ch. 6 - Prob. 1MFCh. 6 - Prob. 2MFCh. 6 - Why is it important that a firms financial records...Ch. 6 - Prob. 4MFCh. 6 - Prob. 1EDCh. 6 - Prob. 1ICCh. 6 - Prob. 1MPS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tulsa's gross profit percentage is:arrow_forwardWhat is the correct answer general Accountingarrow_forwardDepartment A had 15,000 units in work in process that were 60% completed as to labor and overhead at the beginning of the period; 45,600 units of direct materials were added during the period; 42,500 units were completed during the period, and 11,000 units were 80% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. The first-in, first-out method is used to cost inventories. The number of equivalent units of production for conversion costs for the period was ____ Units.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License