Concept explainers

a.

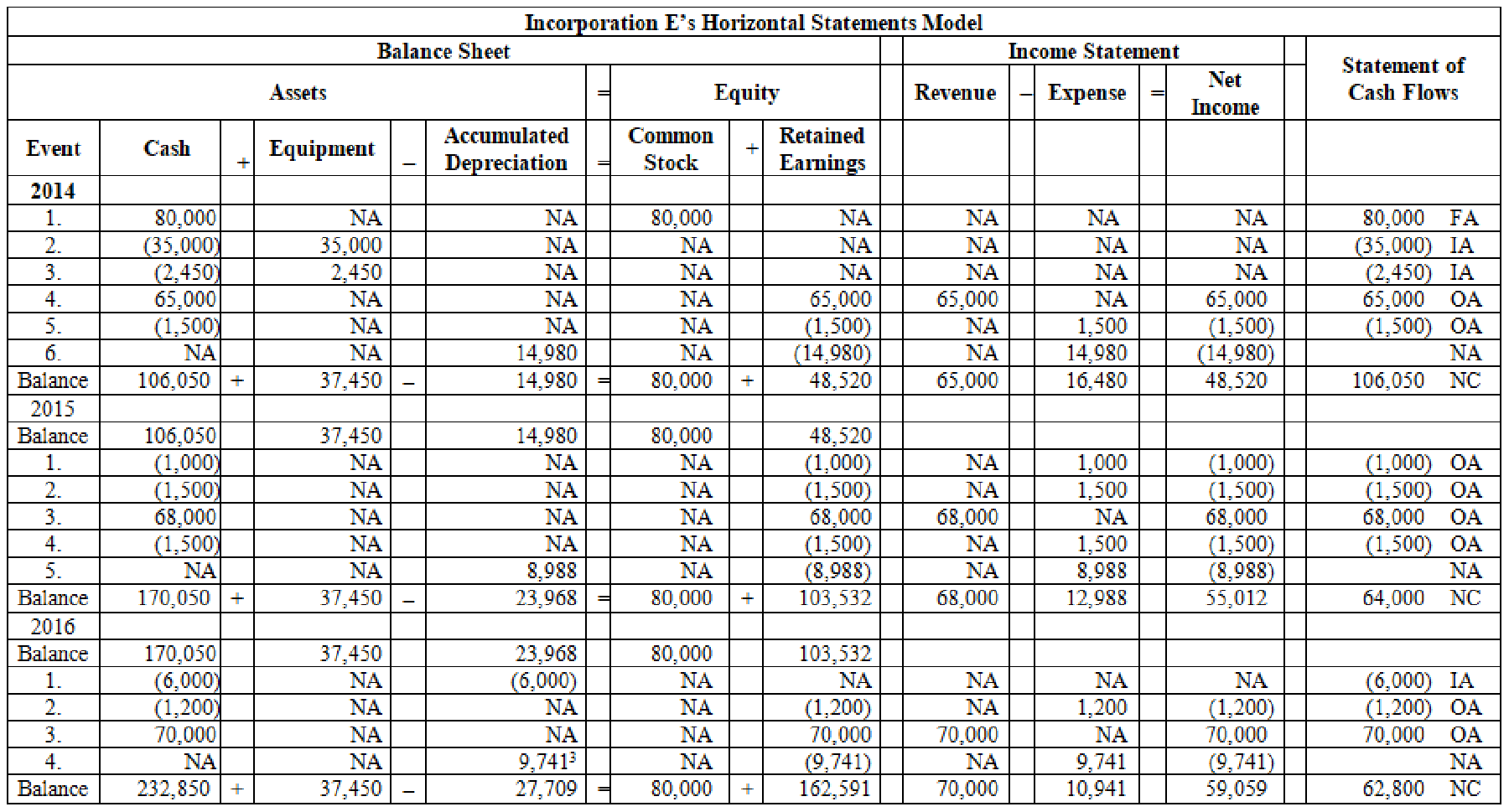

Use a horizontal statements model to show the effect of the transactions on the elements of financial statements.

a.

Explanation of Solution

Financial Statements:

Financial statements are complete record of all the financial transactions that take place in the business during a particular financial year. They report important financial information such as assets, liabilities, revenues and expenses of the company to the internal and external users for taking necessary decision. They help them to know the financial status of the business for a particular period.

Record the transactions in a horizontal statements model:

Table (1)

Working note 1: Determine the

Useful life = 5 years

Working note 2: Calculate the depreciation expense using Double-declining-balance method.

Calculate the depreciation expense for 2014.

Working note 3: Calculate the depreciation expense for 2015.

Working note 4: Calculate the depreciation expense for 2016.

b.

Use a vertical model to present financial statements for 2014, 2015, and 2016.

b.

Explanation of Solution

Income statement:

Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Statement of changes in stockholders' equity:

Statement of changes in stockholders' equity records the changes in the owners’ equity during the end of an accounting period by explaining about the increase or decrease in the capital reserves of shares.

Balance sheet summarizes the assets, the liabilities, and the

Statement of

Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Use a vertical model to present financial statements for 2014, 2015, and 2016 as follows:

| Incorporation E | |||

| Financial Statements | |||

| For the year ended December 31 | |||

| Income Statements | |||

| 2014 | 2015 | 2016 | |

| Service Revenue | $65,000 | $68,000 | $70,000 |

| Expenses: | |||

| Maintenance Expense | 0 | (2,500) | 0 |

| Computer Service Expense | (1,500) | (1,500) | (1,200) |

| Depreciation Expense | (14,980) | (8,988) | (9,741) |

| Total Expenses | (16,480) | (12,988) | (10,941) |

| Net Income | $48,520 | $55,012 | $59,059 |

| Statement of Changes in Stockholder's Equity | |||

| Beginning Common Stock | 0 | $80,000 | $80,000 |

| Add: Stock Issued | 80,000 | 0 | 0 |

| Ending Common Stock | 80,000 | 80,000 | 80,000 |

| Beginning | 0 | 48,520 | 103,532 |

| Add: Net Income | 48,520 | 55,012 | 59,059 |

| Ending Retained Earnings | 48,520 | 103,532 | 162,591 |

| Total Stockholders’ Equity | $128,520 | $183,532 | $242,591 |

Table (2)

| Incorporation E | |||

| Financial Statements | |||

| Balance Sheet as of December 31 | |||

| 2014 | 2015 | 2016 | |

| Assets | |||

| Cash | $106,050 | $170,050 | $232,850 |

| Computer | 37,450 | 37,450 | 37,450 |

| Less: | (14,980) | (23,968) | (27,709) |

| Total Assets | $128,520 | $183,532 | $242,591 |

| Liabilities | $0 | $0 | $0 |

| Stockholders’ Equity | |||

| Common Stock | 80,000 | 80,000 | 80,000 |

| Retained Earnings | 48,520 | 103,532 | 162,591 |

| Total Stockholders’ Equity | $128,520 | $183,532 | $242,591 |

| Total Liabilities and Stockholders' Equity | $128,520 | $183,532 | $242,591 |

Table (3)

| Incorporation E | |||

| Statement of Cash Flows | |||

| For the Year Ended December 31 | |||

| Particulars | 2014 (in $) | 2015 (in $) | 2016 (in $) |

| Cash Flows From Operating Activities: | |||

| Inflow from revenue | 65,000 | 68,000 | 70,000 |

| Outflow for expenses | (1,500) | (4,000) | (1,200) |

| Net Cash Flow from operating activities | 63,500 | 64,000 | 68,800 |

| Cash Flows From Investing Activities: | |||

| Outflow to purchase Computer | (37,450) | 0 | (6,000) |

| Net Cash Flow from investing activities | (37,450) | 0 | (6,000) |

| Cash Flows From Financing Activities: | |||

| Inflow from stock issue | 80,000 | 0 | 0 |

| Net Cash Flow from financing activities | 80,000 | 0 | 0 |

| Net Increase in Cash | 106,050 | 64,000 | 62,800 |

| Add: Beginning Cash Balance | 0 | 106,050 | 170,050 |

| Ending Cash Balance | $106,050 | $170,050 | $232,850 |

(Table 4)

Want to see more full solutions like this?

Chapter 6 Solutions

Survey Of Accounting

- Get correct solution this financial accounting questionarrow_forwardPlease give me correct answer this financial accounting questionarrow_forwardAssume a federal agency has the following events: Receives a warrant from the Treasury notifying the agency of appropriations of $5,350,000. OMB apportions one-fourth of the appropriation for the first quarter of the year. The director of the agency allots $1,202,000 to program units. Program units place orders of $865,000. Supplies ($141,500) and services ($582,500) are received during the first quarter. Supplies of $130,000 were used in the quarter. Accounts payable were paid in full. Required: Prepare a schedule showing the status of the appropriation at the end of the first quarter.arrow_forward

- What is the payable deferral period on these financial accounting question?arrow_forwardEvergreen Corporation (calendar-year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Date Placed in Asset Service Original Basis Machinery October 25 $ 120,000 Computer equipment February 3 47,500 Used delivery truck* August 17 Furniture April 22 60,500 212,500 *The delivery truck is not a luxury automobile. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation and elects out of §179 expense? Depreciation $ 440,500arrow_forwardLina purchased a new car for use in her business during 2024. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including §179 expense unless stated otherwise) for the automobile in 2024 and 2025 (Lina doesn't want to take bonus depreciation for 2024) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1, Table 2, and Exhibit 10-10.) e. The vehicle cost $85,000, and she used it 20 percent for business. Year Depreciation deduction 2024 2025arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education