a.

Prepare all general journal entries for the given transactions.

a.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare journal entries:

| Event | Account Titles and Explanation | Debit ($) | Credit($) |

| 1. | Petty Cash | 250 | |

| Cash | 250 | ||

| ( To record the establishment of fund) | |||

| 2. | No Entry | ||

| 3. | Meals Expense | 120 | |

| Postage Expense | 21 | ||

| Delivery Expense | 93 | ||

| Cash Short and Over | 3 | ||

| Cash (1) | 237 | ||

| (To record the recognition of expenses) |

Table (1)

To record the establishment of fund:

- Petty cash is an asset account and it is increased. Therefore debit petty cash fund by $250.

- Cash is an asset and it is decreased. Therefore, credit cash account by $250.

To record the recognition of expenses:

- Meals expense of $120, postage expense of $ 21, Delivery expense of $93, cash short and over of $3 are a component of

stockholders’ equity and it is decreased. Therefore debit it by $ 237. - Cash is an asset and it is decreased. Therefore, credit cash account by $237.

Note:

Working note:

Calculate the amount of cash:

Note: Event 2 (reimbursement of employees) is not affected because, these are the expenses paid by the employer on behalf of the employee and Event 3 (Replenishment of fund) is also not affected by any of the transaction because, it is the constant fund that remains in the petty cash box to meet minor business expenses and it has to be periodically replenished to ensure sufficient availability of fund.

b.

Explain the way in which the cash short and over account will affect the income statement.

b.

Explanation of Solution

The cash short will be stated as miscellaneous expense on the income statement.

c.

Identify the type of event depicted in each journal entry.

c.

Explanation of Solution

Assets exchange transaction:

Transaction that has two asset accounts is called as assets exchange transaction. Assets exchange transaction increases the value of one asset account, and decreases the value of another asset account. The increased asset account is recorded with the debit entry, and decreased asset account is recorded with the credit entry.

Assets use transaction:

Transaction that reduces the value of assets account is called as assets use transaction. Asset use transaction decreases the value of assets account and also decreases the corresponding liabilities and stockholder’s equity account. The decreased asset account is recorded with credit entry.

Three Events are identified as follows:

| Event Number | Type of Event |

| 1. | Asset Exchange Transaction |

| 2. | No Effect |

| 3. | Asset Use Transaction |

Table (2)

- In event number 1, the company established petty cash fund by issuing check of $250. It is an Asset exchange transaction as it decreases the cash (asset account) by $250 and increases the petty cash (asset account) by $ 250. Asset exchange transaction affects only the composition of assets and the total amount of assets remains unaffected.

- In event number 3, Company has recognised expenses by decreasing the cash account. It is an Asset use transaction as it decreases the total amount of assets (cash) by $237 and increases the expenses account by $237.

Note: Event 2 (reimbursement of employees) is not affected because, these are the expenses paid by the employer on behalf of the employee and Event 3(Replenishment of fund) is also not affected by any of the transaction because, it is the constant fund that remains in the petty cash box to meet minor business expenses and it has to be periodically replenished to ensure sufficient availability of fund.

d.

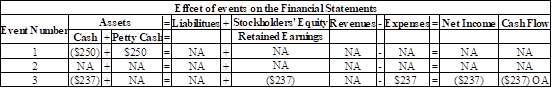

Show the effects of the events on the financial statements and indicate whether item is an operating activity (OA), Investing activity (IA), financing activity (FA) or use NA to show that the account is not affected by the event.

d.

Explanation of Solution

Financial statements:

Financial statements are condensed summary of transactions communicated in the form of reports for the purpose of decision making. The financial statements reports, and shows the financial status of the business. The financial statements consist of the

Three events are recorded as follows:

Figure (1)

Note: Event 2 (reimbursement of employees) is not affected because, these are the expenses paid by the employer on behalf of the employee and Event 3 (Replenishment of fund) is not recorded on the financial statements because, it is the constant fund that remains in the petty cash box to meet minor business expenses and it has to be periodically replenished to ensure sufficient availability of fund.

Want to see more full solutions like this?

Chapter 6 Solutions

Loose-Leaf Fundamental Financial Accounting Concepts

- I need help with this solution and general accounting questionarrow_forwardCozy Retreats currently sells 420 Standard hot tubs, 580 Luxury hot tubs, and 190 Premium model hot tubs each year. The firm is considering adding a Comfort model hot tub and expects that, if it does, it can sell 340 of them. However, if the new hot tub is added, standard sales are expected to decline to 290 units while Luxury sales are expected to decline to 310. The sales of the Premium model will not be affected. Standard hot tubs sell for an average of $8,900 each. Luxury hot tubs are priced at $14,500 and the Premium model sells for $22,000 each. The new Comfort model will sell for $12,300. What is the value of erosion?arrow_forwardSalma Production uses direct labor cost as the allocation base for applying MOH to WIP. The budgeted direct labor cost for the year was $850,000. The budgeted manufacturing overhead was $722,500. The actual direct labor cost for the year was $910,000. The actual manufacturing overhead was $745,000. A. What was Salma's predetermined manufacturing overhead rate per direct labor dollars? B. How much MOH was applied to WIP during the year?arrow_forward

- Hello tutor solve this question and accountingarrow_forwardThe total factory overhead for Leicester Manufacturing is budgeted for the year at $756,000. Leicester manufactures two product lines: standard lamps and premium lamps. These products each require 4 direct labor hours to manufacture. Each product is budgeted for 8,000 units of production for the year. Determine the factory overhead allocated per unit for premium lamps using the single plantwide factory overhead rate.arrow_forwardI need help with this solution and accounting questionarrow_forward

- https://investor.exxonmobil.com/sec-filings/annual-reports/content/0000034088-25-000010/0000034088-25-000010.pdf Use link to help me answer my question please in picturearrow_forwardHello tutor solve this question and accountingarrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardStarbucks Corporation wants to make a profit of $32,000. It has variable costs of $65 per unit and fixed costs of $18,000. How much must it charge per unit if 5,000 units are sold?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education