INTEREST RATE DETERMINATION Maria Juarez is a professional tennis player, and your firm manages her money. She has asked you to give her information about what determines the level of various interest rates.

Your boss has prepared some questions for you to consider.

- a. What are the four most fundamental factors that affect the cost of money, or the general level of interest rates, in the economy?

- b. What is the real risk-free rate of interest (r″) and the nominal risk-free rate (rRF)? How are these two rates measured?

- c. Define the terms inflation premium (IP), default risk premium (DRP), liquidity premium (LP), and maturity risk premium (MRP). Which of these premiums is included in determining the interest rate on (1) short-term U.S. Treasury securities, (2) long-term U.S. Treasury securities, (3) short-term corporate securities, and (4) long-term corporate securities? Explain how the premiums would vary over time and among the different securities listed.

- d. What is the term structure of interest rates? What is a yield curve?

- e. Suppose most investors expect the inflation rate to be 5% next year, 6% the following year, and 8% thereafter. The real risk-free rate is 3%. The maturity risk premium is zero for bonds that mature in 1 year or less and 0.1% for 2-year bonds; then the MRP increases by 0.1% per year thereafter for 20 years, after which it is stable. What is the interest rate on 1-, 10-, and 20-year Treasury bonds? Draw a yield curve with these data. What factors can explain why this constructed yield curve is upward sloping?

- f. At any given time, how would the yield curve facing a AAA-rated company compare with the yield curve for U.S. Treasury securities? At any given time, how would the yield curve facing a BB-rated company compare with the yield curve for U.S. Treasury securities? Draw a graph to illustrate your answer.

- g. What is the pure expectations theory? What does the pure expectations theory imply about the term structure of interest rates?

- h. Suppose you observe the following term structure for Treasury securities:

| Maturity | Yield |

| 1 year | 6.0% |

| 2 years | 6.2 |

| 3 years | 6.4 |

| 4 years | 6.5 |

| 5 years | 6.5 |

Assume that the pure expectations theory of the term structure is correct. (This implies that you can use the yield curve provided to “back out” the market’s expectations about future interest rates.) What does the market expect will be the interest rate on 1-year securities 1 year from now? What does the market expect will be the interest rate on 3-year securities 2 years from now? Calculate these yields using geometric averages.

- i. Describe how

macroeconomic factors affect the level of interest rates. How do these factors explain why interest rates have been lower in recent years?

a.

To identify: The factors which affect the cost of money or general level interest rate.

Interest Rate:

A rate at which a borrower is ready to pay and the depositor is ready to receive the money is known as the interest rate.

Answer to Problem 21IC

The factors that affects the general level of interest rate or the cost of money are as follows:

- Production opportunities

- Time preferences

- Risk

- Inflation

Explanation of Solution

- Production opportunities for a company are the main factor, which affects the cost of money as it leads to the higher production.

- The consumption of the product by the customer in the duration of a period, affect the cost of money.

- The concept of higher risk lead to higher return and lower risk leads to lower return mainly affects the interest rate. Hence, is also a factor which affects the interest rate.

- Inflation refers to the rise in price in the market. Due to increase in the price of products the money supply also increase which refers that the inflation is the main factor that affects the cost of money.

Hence, there are various factors such as production opportunities, time preferences, risk and inflation which affect the cost of money and interest rate.

b.

To explain: The real risk-free rate and nominal risk-free rate and their measurement.

Answer to Problem 21IC

Real Risk-Free Rate:

A rate of minimum return that is required by an investor is known as real risk-free return rate.

The measurement of real risk-free rate is difficult as it is measured withthe help of Treasury bond index.

Nominal Risk-Free Rate:

A combination of real risk-free rate and inflation premium is the nominal risk-free rate.

A formula is used for the measurement of nominal risk-free rate,

Where,

- r is the nominal risk-free rate.

- r* is the real risk-free rate.

- IP is inflation premium.

Explanation of Solution

- The real risk-free rate is the interest rate which is mainly attached to the short-term Treasury securities.

- The real risk-free rate is the rate which is lowest interest rate and is expected by the investors on their investments.

- The real risk-free rate and inflation premium combined are known as nominal risk-free rate. The inflation premium refers the compensation by the issuer for the inflation risk.

Hence, the real risk-free rate is the interest rate which is the at least interest expected by the investors and the nominal risk-free rate is the combination of real risk-free rate and the compensation of inflation risk.

c.

To explain: The inflation premium, default risk premium, liquidity premium and maturity risk premium.

Interest Rate:

A rate at which a borrower is ready to pay and the depositor is ready to receive the money is known as the interest rate.

Answer to Problem 21IC

Inflation Premium:

Inflation refers a financial term which indicates the generally raised price level of goods and services in the market and currency’s decreased level of purchasing power and issued company compensates that risk of inflation through inflation premium.

Default Risk Premium:

A premium which is paid by the borrower to its lender in the form of compensation of lender’s money in the regards of default risk is known as default risk premium.

Liquidity Premium:

A premium which is paid by the borrower to its lender in the form of compensation of short-term or long-term liquidation of investment is known as maturity risk premium.

Maturity Risk Premium:

A premium which is paid by the borrower to its lender in the form of compensation of interest rate uncertainty in the regards of maturity risk is known as maturity risk premium.

The premium which is required for the calculation of interest rates on:

(1) Short-term U.S. Treasury Securities:

There is no as such risk in U.S. Treasury securities. The interest rate which is offered on the securities is real risk-free rate which is measured with the help of Treasury index.

(2) Long-term U.S. Treasury Securities:

The inflation risk is the main risk which is there on the long-term Treasury securities. The inflation premium is included with the interest rate of long-term Treasury securities.

(3)Short-term Corporate Securities:

The inflation premium, default risk premium and liquidity premiums are included in the interest rates of short-term corporate securities.

(4)Long-term Corporate Securities:

The inflation premium, default risk premium, liquidity premium and maturity risk premium is included in the interest rates of long-term corporate securities.

Explanation of Solution

- The inflation premium is an average inflation over a period of investment and it is connected with the interest rates of Long-term U.S. Treasury securities and both the type of corporate securities as the inflation risk is there with these securities.

- Default risk premium refers the expected default that can happen because of investment. The Treasury securities have no default risk. Hence, the default risk premium is connected with the interest rates of corporate securities.

- The liquidity premium is the premium which refers the conversion of investment into cash at a shorter period. The short-term and long-term corporate securities include the liquidity premium as there is a liquidity risk with it.

- The maturity risk premium was the consideration of price at the time of maturity of the securities. The long-term corporate securities have the maturity risk premium in their interest rates as the maturity payment risk or less payment risk is there.

Hence, the different securities have the different premium requirements according to their risk availability.

d.

To explain: The term structure of interest rate and the yield curve.

Yield:

Yield is the percentage of the securities at which the return is provided by the company to its investors. Yield can be used in the form of dividend and interest.

Answer to Problem 21IC

Term Structure of Interest Rate:

The term structure represents the connection between the interest rates at the different time period.

Yield Curve:

The graphical representation of expected which return, provided by the company to its investors during the years is known as the yield curve.

Explanation of Solution

- The term structure helps in the presentation of the volatility of the curve.

- To make the various investment-related decisions, the term structure of interest rate and yield curve helps.

Hence, the term structure of interest rate and yield curve are the representation of the relationship between the interest rates and term.

e.

To identify: The interest rate of securities: 1-year, 10-year, and 20-year Treasury bond and draw a curve to identify whether it is upward-sloping or not.

Explanation of Solution

The items required for the calculation of interest rates on Treasury bonds are risk-free rate, inflation premium, and market risk premium.

Compute the interest rate on 1-year:

Given,

The real risk-free rate is 3%.

The inflation premium is 5%.

The formula to calculate the interest rate,

- Wherer is the interest rate.

- r* is the real risk-free rate.

- IP is inflation premium.

Substitute 3% for r* 5% for IP.

The interest rate on 1-year Treasury security is 8%.

Compute the interest rate on 10-year:

Given,

The real risk-free rate is 3%.

The average inflation premium is 7.5%.

The maturity risk premium is 0.14%.

The formula to calculate the interest rate,

- Wherer is the interest rate.

- r* is the real risk-free rate.

- IP is inflation premium.

- MRP is maturity risk premium.

Substitute 3% for r*, 7.5% for IP and 0.14 for MRP.

The interest rate on 10-years Treasury security is 10.64%.

Compute the interest rate on 20-year:

Given,

The real risk-free rate is 3%.

The average inflation premium is 7.75%.

The maturity risk premium is 0.26%.

The formula to calculate the interest rate,

Where,

- r is the interest rate.

- r* is the real risk-free rate.

- IP is inflation premium.

- MRP is maturity risk premium.

Substitute 3% for r*, 7.75% for IP and 0.26 for MRP.

The interest rate on 20-years Treasury security is 11.01%.

Working note:

Computation of average inflation premium at 10-year Treasury securities,

The inflation premium is 7.5%.

Compute the maturity risk premium at 10-year Treasury securities.

| Year | Workings |

Maturity Risk Premium (%) |

| 1 | 0 | |

| 2 | 0.10 | |

| 3 |

| 0.11 |

| 4 |

| 0.121 |

| 5 |

| 0.1331 |

| 6 |

| 0.14641 |

| 7 |

| 0.161051 |

| 8 |

| 0.1772 |

| 9 |

| 0.195 |

| 10 |

| 0.2145 |

| Total | 1.358261 | |

| Average Maturity Risk Premium |

| 0.136 or 0.14 |

Table (1)

The average maturity risk premium is 0.14%.

Computation of average inflation premium at 20-year Treasury securities,

The inflation premium is 7.75%.

Compute the maturity risk premium at 20-year treasury securities.

| Year | Workings |

Maturity Risk Premium (%) |

| 1 | 0 | |

| 2 | 0.10 | |

| 3 |

| 0.11 |

| 4 |

| 0.121 |

| 5 |

| 0.1331 |

| 6 |

| 0.14641 |

| 7 |

| 0.161051 |

| 8 |

| 0.1772 |

| 9 |

| 0.195 |

| 10 |

| 0.2145 |

| 11 |

| 0.2359 |

| 12 |

| 0.2595 |

| 13 |

| 0.2855 |

| 14 |

| 0.3141 |

| 15 |

| 0.3456 |

| 16 |

| 0.3801 |

| 17 |

| 0.4182 |

| 18 |

| 0.4600 |

| 19 |

| 0.506 |

| 20 |

| 0.557 |

| Total | 5.120616 | |

| Average Maturity Risk Premium |

| 0.26 |

Table (2)

The average maturity risk premium is 0.26%.

Statement to show the interest rates:

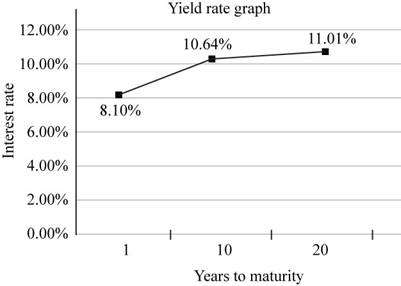

Fig 1

- Thex-axis represents the maturity years.

- They-axis represents the interest rate with the respective maturity years.

- The yield curve is upward sloping.

Hence, the interest rate at 1-year maturity is 8%, at 10-year maturity is 10.64% and at 20-year maturity, 11.01% and the curve which represent with the help of interest rates is upward sloping.

f.

To explain: The performance of U.S. Treasury securities, AAA-rated securities, and BB-rated securities.

Answer to Problem 21IC

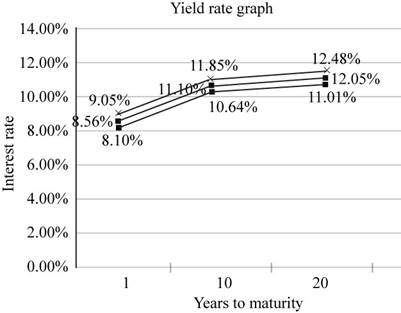

Statement to show the interest rates of the securities at a particular maturity,

| Years to Maturity |

U.S. Treasury Yield Rates (%) |

AAA-rated Yield Rates (%) |

BB-rated Yield Rates (%) |

| 1 | 8 | 8.56 | 9.05 |

| 10 | 10.64 | 11.10 | 11.85 |

| 20 | 11.01 | 12.05 | 12.48 |

Table (3)

Fig 2

- The lower curve shows the yields of U.S. Treasury securities, middle curve shows the yields of AAA-rated securities and higher curve shows the yields of SS-rated securities.

- The U.S. Treasury curve is the lowest as it doesn’t include the liquidity and default premium.

- AAA-rated securities include a lower rate of liquidity premium and default risk premium.

- BB-rated securities include the higher rate of liquidity premium than AAA-rated securities.

Explanation of Solution

- The interest rate of securities which includes the risk-free rate and inflation premium only is the treasury security bonds.

- The interest rates which includes the risk-free rate, inflation premium, liquidity premium, maturity risk premium and default risk premium has the higher interest rate and the curveis also higher than other securities.

Hence, the U.S. Treasury securities curve is lower, AAA-rated is medium and BB- rated curve is higher.

g.

To describe: The pure expectation theory and its implication in the regards of the term structure.

Answer to Problem 21IC

Expectation Theory: Expectation theory estimates the future interest without taking into consideration of maturity risk.

The maturity risk doesn’t consider in that case. The interest rate on long-term securities is calculated without considering the maturity risk.

Explanation of Solution

- According to the expectation theory, the yield curve of investment totally depends upon the future expectation of investors.

- The short-term securities have not defaulted risk premium and interest on long-term securities is the weighted average of securities.

Hence, the interest is calculated without taking into consideration default risk premium.

h.

To identify: The interest rate on 1-year securities after 1 year and interest rate on 3-year securities after 2 years from now with the use of the geometric average method.

Explanation of Solution

Compute the interest rate on 1-years securities after 1 year.

Given,

The yield for 2 years is 6.20%.

The yield for 1 year is 6%.

The formula to compute the rate,

Substitute 0.062 for yield for year 2, 0.060 for yield for year 1, 1 for a number of years and 1 for years from now.

The rate is 6.40%.

Compute the interest rate on 3-years securities after 2years.

Given,

The yield for 5 years is 6.50%.

The yield for 2years is 6.2%.

The formula to compute the rate,

Substitute 0.065 for yield for year 5, 0.062 for yield for year 2, 3 for a number of years and 2 for years from now.

Simplify the above equation,

The rate is 6.70%.

Hence, the interest rate on1-years securities after 1 year is 6.40% and at 3-years securities after 2 years is 6.70%.

i.

To explain: The effect of macroeconomic factors on interest rate and the reason of securities have the low-interestrate.

Answer to Problem 21IC

- The Federal Reserve policy mainly affects the interest rate on short-term and long-term securities. The federal trade the short-term securities which would result in the increment of the money supply.

- Federal budget deficits and surplus increase the interest rate to balance the budget, the government would issue the investment securities and increase the interest on that and interest rates would increase.

- The corporations require fund for their business and increase the demand for the product. The increase in demand of the product leads to increase in nominal interest rate.

Explanation of Solution

- The increase in money supply results to increase in inflation and high inflation is not good for the economy.

- To attract the outside borrowers it is necessary not to fix the less interest rate which increases the investments.

Hence, the international factors, businesses, Federal Reserve policies and federal budget deficits are the main factors of macroeconomics which directly affect the interest rate.

Want to see more full solutions like this?

Chapter 6 Solutions

Bundle: Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition 6-Month Printed Access Card), 8th + Aplia Printed Access Card

- Unite Assissment 02 : New City Band Part 02: Base & Flexible Budget Base Budget Flexible Budget Fixed or Variable Revenue City Contributions Fixed Annual Contribution F Per Concert Contributions V Public Contributions V Endowment Earnings F Total Revenue Expenses Conductors Stipend F Musicians Stipend V Insurance Fixed Insurance Premium F Per-Concert Insurance Premium V Music Costs Music Acquisitions F Performance Rights V Total Expenses Surplus/(Deficit)arrow_forwardSonja Jensen is considering the purchase of a fast-food franchise. Sonja will be operating on a lot that is to be converted into a parking lot in six years, but that may be rented in the interim for $700 per month. The franchise and necessary equipment will have a total initial cost of $68,000 and a salvage value of $9,000 (in today's dollars) after six years. Sonja is told that the future annual general inflation rate will be 5%. The projected operating revenues and expenses (in actual dollars) other than rent and depreciation for the business are given in the table below. Assume that the initial investment will be depreciated under the five-year MACRS and that Sonja's tax rate will be 30%. Sonja can invest her money at a rate of at least 14% in other investment activities during this inflation-ridden period. Click the icon to view the projected operating revenues and expenses. Click the icon to view the MACRS depreciation schedules. (a) Determine the cash flows associated with the…arrow_forwardSonja Jensen is considering the purchase of a fast-food franchise. Sonja will be operating on a lot that is to be converted into a parking lot in six years, but that may be rented in the interim for $700 per month. The franchise and necessary equipment will have a total initial cost of $68,000 and a salvage value of $9,000 (in today's dollars) after six years. Sonja is told that the future annual general inflation rate will be 5%. The projected operating revenues and expenses (in actual dollars) other than rent and depreciation for the business are given in the table below. Assume that the initial investment will be depreciated under the five-year MACRS and that Sonja's tax rate will be 30%. Sonja can invest her money at a rate of at least 14% in other investment activities during this inflation-ridden period. Click the icon to view the projected operating revenues and expenses. Click the icon to view the MACRS depreciation schedules. (a) Determine the cash flows associated with the…arrow_forward

- Unit 02 Part 3: New City BandAs the volunteer business manager for the New City Band (City Band), you are responsible for preparing the operating budget for the organization’s upcoming summer concert season. Each year, City Band presents up to 20 weekend performances, depending on weather conditions. The concerts are free to the public,but the band hangs a pot from the bandstand and people leave small donations in it. On average, City Band gets $100 in donations at each of its performances. In addition to donations, New City pays the band $3,000 per season plus $125 for each performance.City Band also has a small endowment of $100,000 on which it expects to earn 3.5 percent in the coming fiscal year. City Band’s trustees have decided to use that money to pay for operating expenses if they need to.City Band pays its conductor $3,000 for the summer season and has aninsurance policy to protect it against any loss of equipment or damage to the bandstand. That policy costs the band…arrow_forwardhow to solvearrow_forwardHow much working capital does Airbnb have for the year 2024? Discuss the components of working capital and calculations. What is the amount of the total assets that Airbnb reported for the year 2024? List the assets included. What is the amount of the total liabilities that tAirbnb reported for the year 2024? List the liabilities included.arrow_forward

- How much working capital does Airbnb have for the year 2024? State the components of working capital and calculations. What is the amount of the total assets that Airbnb reported for the year of 2024 and list the assets?arrow_forwardWhat is an account that requires present value calculations. State both the account name and the amount for the account you select. What inventory method does Airbnb employ and explain how this method works? Calculate Airbnb inventory turnover for the year 2024. What does inventory turnover tells an investor?arrow_forwardWhat was the free cash flow for the year 2024 for Airbnb and formula used for their calculations? Explain the importance of free cash flow.arrow_forward

- What is the useful lives for the various types of property, plant, and equipment owned by Airbnb?arrow_forwardWhat depreciation method does Airbnb employ and how does this depreciation method works? Does Airbnb have any impaired assets?arrow_forwardNew City BandAs the volunteer business manager for the New City Band (City Band), you are responsible for preparing the operating budget for the organization’s upcoming summer concert season. Each year, City Band presents up to 20 weekend performances, depending on weather conditions. The concerts are free to the public,but the band hangs a pot from the bandstand and people leave small donations in it. On average, City Band gets $100 in donations at each of its performances. In addition to donations, New City pays the band $3,000 per season plus $125 for each performance.City Band also has a small endowment of $100,000 on which it expects to earn 3.5 percent in the coming fiscal year. City Band’s trustees have decided to use that money to pay for operating expenses if they need to.City Band pays its conductor $3,000 for the summer season and has aninsurance policy to protect it against any loss of equipment or damage to the bandstand. That policy costs the band $500 for the summer plus…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning